- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Blackstone Mortgage Trust (BXMT): Valuation Insights After Profitable Quarter and Share Buyback Completion

Reviewed by Simply Wall St

Blackstone Mortgage Trust delivered a strong turnaround in the third quarter, swinging back into profit after last year’s losses. The company also wrapped up a sizable share buyback program, which reinforces its commitment to shareholders.

See our latest analysis for Blackstone Mortgage Trust.

Blackstone Mortgage Trust’s notable swing to profitability and decisive share buyback appear to have boosted investor confidence, with the stock delivering a 7.2% total shareholder return over the past year. Despite some short-term volatility, momentum seems to be picking up as the company rebuilds following last year’s challenges.

If you’re curious to see what else the market has to offer, now is a perfect time to expand your scope and discover fast growing stocks with high insider ownership

The improved earnings and buyback may reflect a positive outlook. However, with shares trading close to their analyst price target, investors must ask if this is a compelling value entry or if the stock’s upside is already accounted for.

Most Popular Narrative: 10.2% Undervalued

With the most popular narrative placing Blackstone Mortgage Trust’s fair value at $20.50 per share, that is a solid premium over the last close price of $18.40. The narrative points to a path of transformative growth as the driver for that valuation target.

The company is focusing on portfolio turnover through repayments and redeployment into high-quality new credit opportunities, which is expected to enhance future earnings by improving the overall credit composition and potentially increasing revenue from new investments. Resolution of impaired loans is expected to be a catalyst for future growth by reducing the non-performing assets and allowing the company to recapture earnings potential, thereby potentially increasing net margins as capital is redeployed into more productive investments.

Want to know the secret behind this bullish stance? The fair value hinges on rapid shifts in earnings quality and a bold vision for margin expansion. The numbers baked into this narrative may surprise you. Tap in to see what dramatic financial transformation analysts are betting on for Blackstone Mortgage Trust.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent impaired loans and macroeconomic uncertainty could still challenge Blackstone Mortgage Trust’s path to higher margins and steady growth.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

Another View: What Do Market Ratios Say?

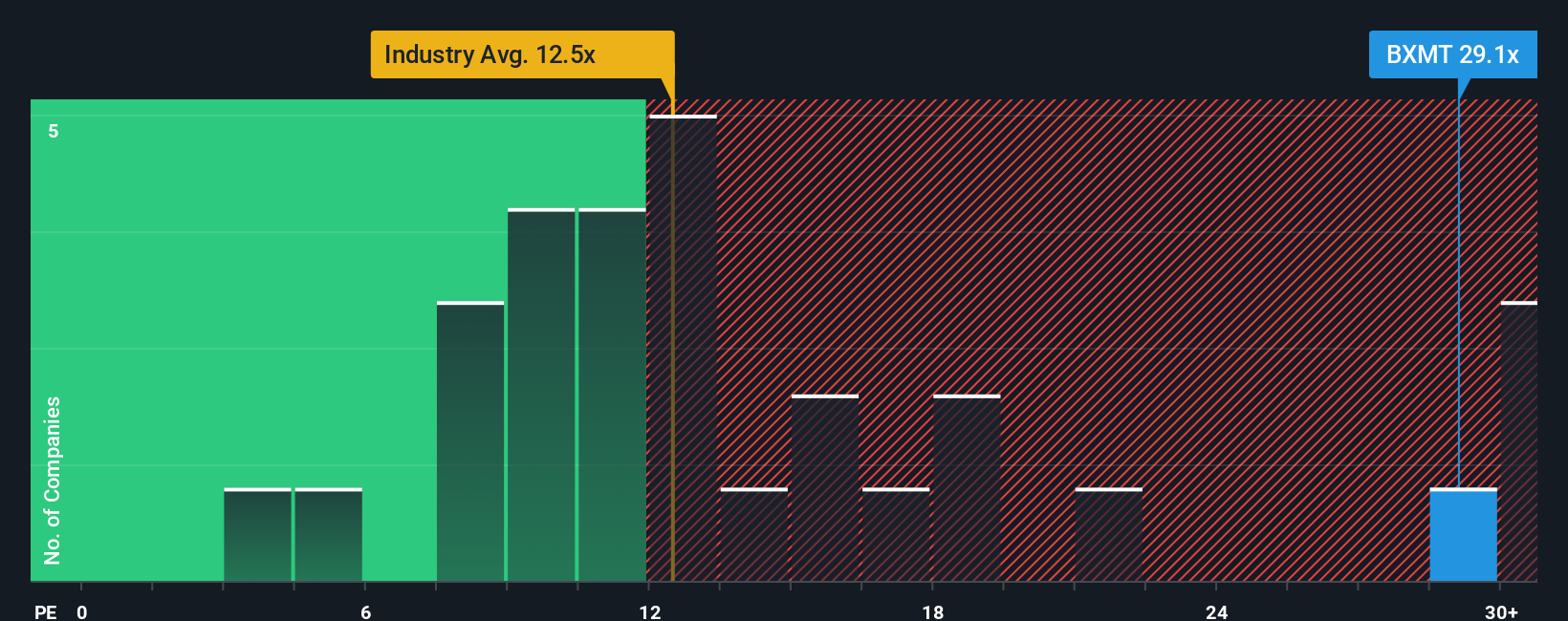

While analyst forecasts point to upside, current valuation tells a different story. Blackstone Mortgage Trust trades at a price-to-earnings ratio of 29.1 times, which is over double the Mortgage REITs industry average of 12.6 times and significantly above the fair ratio of 18.8. This premium suggests investors are paying a hefty price based on expectations. Could this set the stage for disappointment, or does it signal confidence in a strong turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own valuation story in just a few minutes. Do it your way

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Stock Picks?

Take your strategy up a notch and get ahead of the crowd. These handpicked ideas can help you spot the next big winner before others catch on.

- Unlock steady streams of income by checking out these 16 dividend stocks with yields > 3%, offering reliable yields above 3% for consistent returns.

- Ride the future of medicine and technology by searching these 32 healthcare AI stocks, which are pioneering AI innovations in healthcare.

- Fuel your portfolio with high potential by scanning these 878 undervalued stocks based on cash flows, trading below their fair value according to rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives