- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (BX): Exploring the Valuation Behind Recent Share Price Declines

Reviewed by Simply Wall St

See our latest analysis for Blackstone.

Blackstone’s share price has lost momentum in recent months, with a 1-month share price return of -12.95% and a year-to-date slide of -15.60%. This reflects heightened market caution. Still, long-term total shareholder returns remain impressive, up more than 210% over five years. This highlights the stock’s enduring appeal amid short-term noise.

If shifting market sentiment has you rethinking your approach, it could be the ideal chance to uncover new ideas through fast growing stocks with high insider ownership.

With recent declines despite robust long-term growth, the question for investors is clear: is Blackstone’s current weakness a signal that the stock is undervalued, or has the market already factored in its future prospects?

Most Popular Narrative: 18% Undervalued

Despite its recent slide, the most widely followed narrative points to a fair value of $178.79 for Blackstone, compared to a last close of $146.64. This gap is driving bullish debate on what is behind the upside.

Blackstone has raised $62 billion of inflows in Q1 2025, marking the highest level in three years, which boosts assets under management (AUM) and gives the company a strong foundation for future revenue growth. The firm is well-positioned to benefit from market dislocation with $177 billion of dry powder available for opportunistic investments, potentially increasing future earnings as capital is deployed in undervalued assets.

Want to know what powers this valuation boost? The narrative hints at ambitious growth targets and a profit outlook reminiscent of the market’s top-tier performers. What is fueling these bold projections, and does the story have legs? Click through to uncover the details hiding behind this headline number.

Result: Fair Value of $178.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and rising construction costs could dampen Blackstone’s returns. These factors may challenge the growth story that currently underpins bullish forecasts.

Find out about the key risks to this Blackstone narrative.

Another View: Multiples Don’t Tell the Same Story

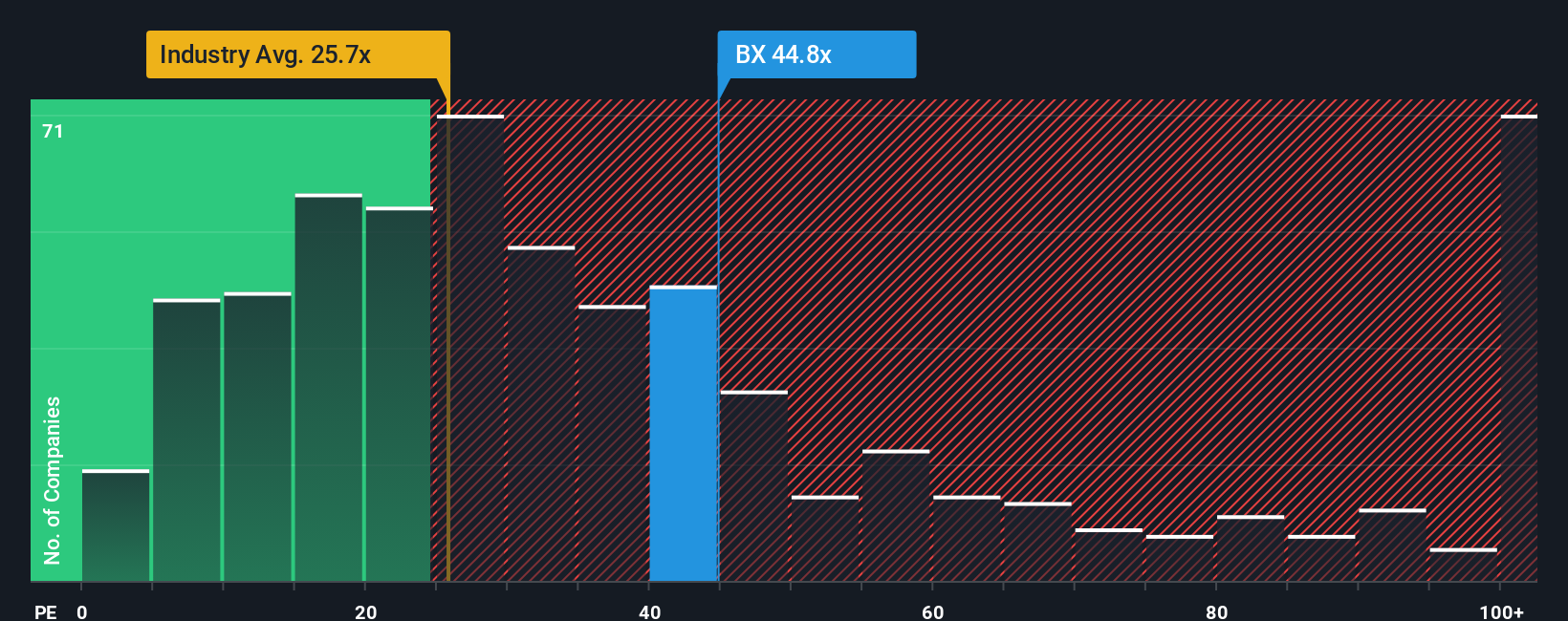

While the most common narrative points to Blackstone being undervalued, a closer look at the price-to-earnings ratio paints a less optimistic picture. Blackstone trades at 42.4x earnings, which is significantly higher than both the US Capital Markets industry average (24x) and its peer group (41.4x). The fair ratio, our estimate of a value the market might move toward, is 25.7x.

This gap means investors are paying a premium compared to the sector and what history suggests is reasonable. Does this premium reflect future growth potential, or could it set the stage for disappointment if expectations aren’t met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If you think the numbers tell a different story or want to dig into the fundamentals yourself, you can easily craft your own perspective in just a few minutes, Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by tapping into investment opportunities others may overlook. Let Simply Wall St help you expand your horizons and find your next potential winner.

- Boost your passive income with strong yields by checking out these 22 dividend stocks with yields > 3%, which consistently deliver returns above 3%.

- Ride the transformative wave in healthcare innovation by investigating these 33 healthcare AI stocks, which is spearheading breakthroughs in medical technology and AI-driven care.

- Capture ground-floor growth by targeting these 3589 penny stocks with strong financials, which combine robust financials with high upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives