- United States

- /

- Capital Markets

- /

- NYSE:BX

Assessing Blackstone After a 15% Drop and Fresh Investments in 2025

Reviewed by Bailey Pemberton

- Wondering if Blackstone is truly a bargain right now or priced for perfection? Let’s break down what’s driving the debate about the company’s value.

- After an impressive 197.3% return over five years, Blackstone has cooled off lately, falling -15.2% in the past month and -17.8% year-to-date. This has raised questions about whether market sentiment or fundamentals have shifted.

- Recent headlines highlight Blackstone’s continued deal-making and activity in alternative assets, with fresh investments in infrastructure and real estate making waves. This has kept the spotlight on how the company is navigating shifting market conditions and potential opportunities for future growth.

- When it comes to traditional valuation checks, Blackstone scores just 1 out of 6 for being undervalued, but as we’ll see, these methods only tell part of the story. There is a smarter way to gauge fair value coming up later.

Blackstone scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Blackstone Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively a company uses its equity to generate returns above its cost of capital. Instead of just considering profits, this model examines the company’s ability to produce value above what investors would demand for taking on risk, which is especially relevant for financial businesses like Blackstone.

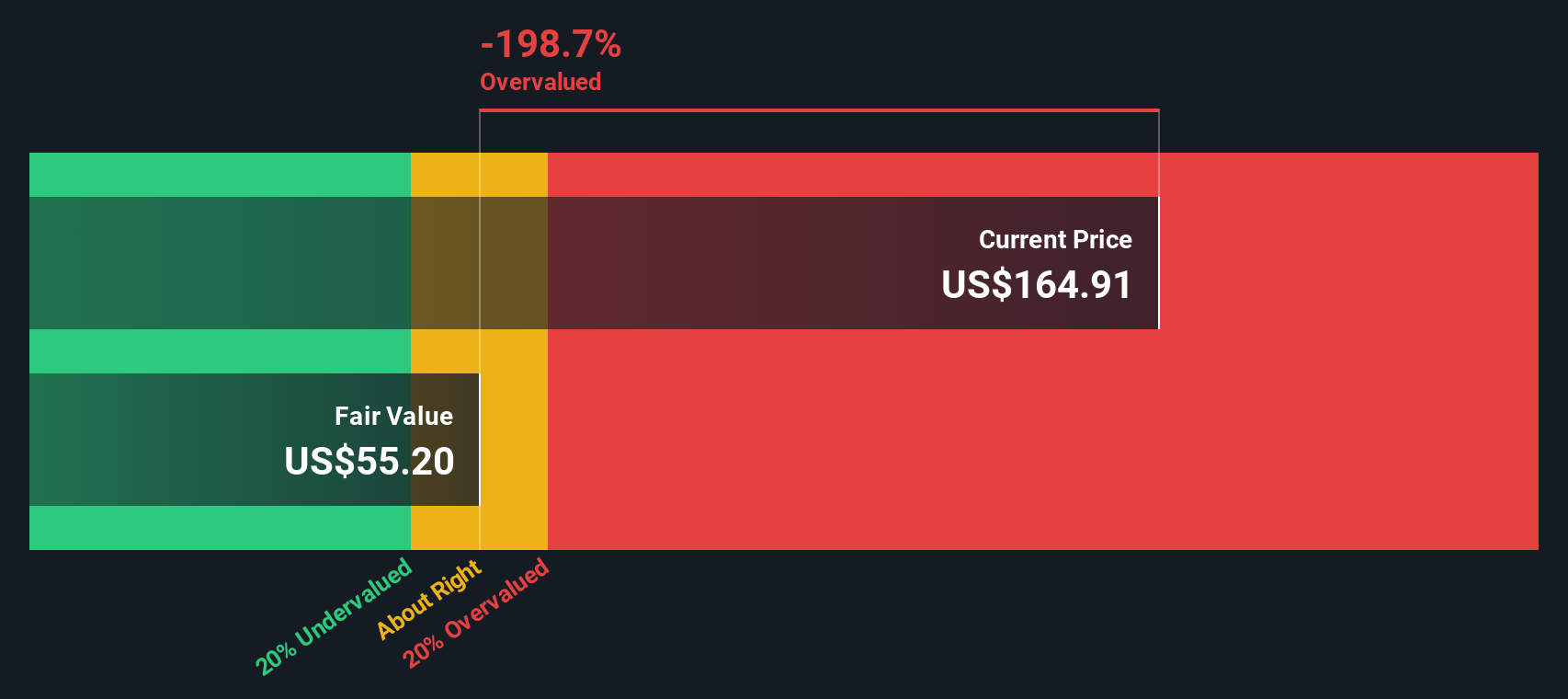

For Blackstone, the key figures are telling. The company’s Book Value stands at $10.72 per share, while the Stable Earnings Per Share (EPS) is $2.80, as estimated by a consensus of six analysts. The Cost of Equity is $0.50 per share. This gives Blackstone an Excess Return of $2.31 per share, meaning the returns on its invested equity far exceed what shareholders require. Notably, the company’s average Return on Equity is a striking 46.20%, and its Stable Book Value is forecast at $6.07 per share.

According to the Excess Returns model, the resulting intrinsic value suggests that Blackstone’s current price is 179.1% above its fair value. Despite strong profitability and efficient capital usage, at today’s levels, the stock appears significantly overvalued compared to its measured worth using this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Blackstone may be overvalued by 179.1%. Discover 841 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Blackstone Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies because it focuses on how much investors are willing to pay for each dollar of earnings. It is particularly useful for comparing companies with steady profits, like Blackstone, as it reflects both current performance and future growth expectations.

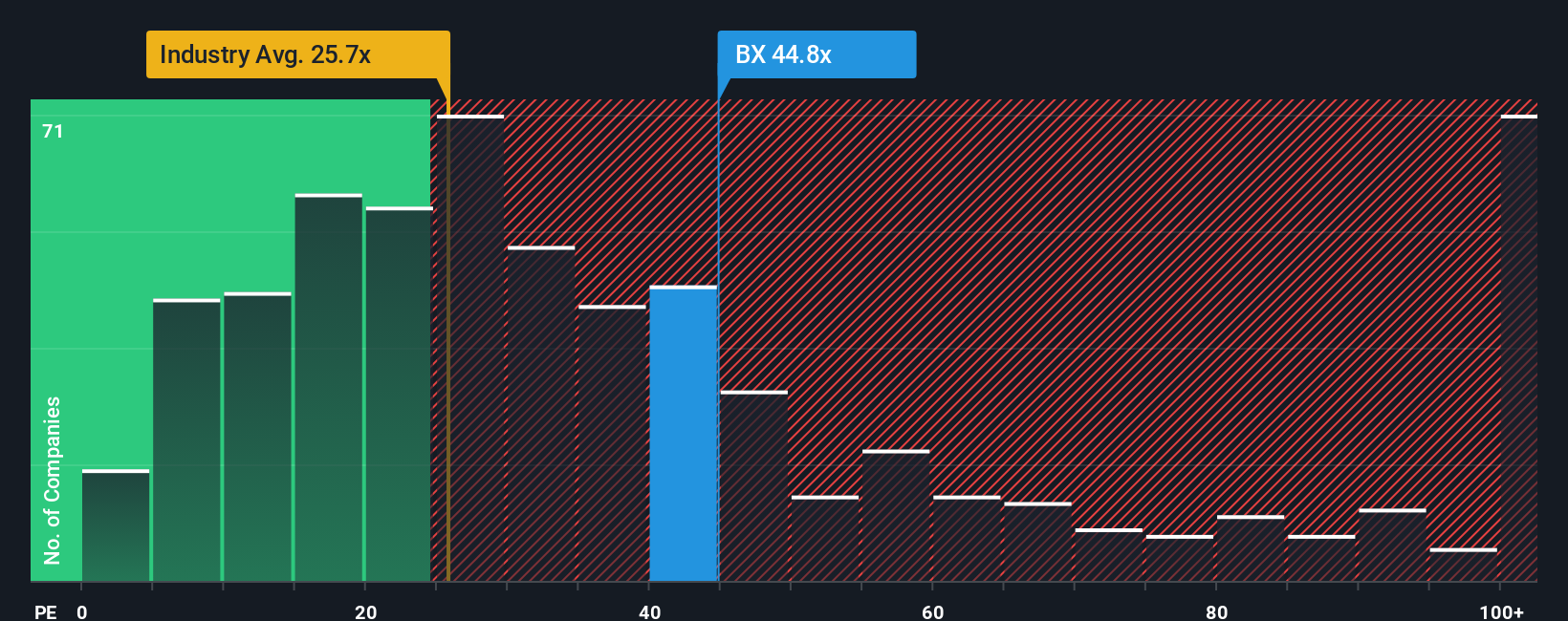

Growth potential and risk play a big part in what a “normal” or “fair” PE ratio should be. Higher anticipated earnings growth or lower perceived risk typically support a higher PE, while lower growth or added risk justifies a smaller multiple. In this context, Blackstone’s current PE stands at 41.3x. For comparison, the Capital Markets industry as a whole trades at an average PE ratio of 23.7x, and Blackstone’s key peers average 36.5x.

Simply Wall St’s proprietary Fair Ratio for Blackstone is 25.6x. This figure is more useful than just looking at industry and peer benchmarks because it takes into account Blackstone’s unique combination of earnings growth, risk profile, profit margin, size, and other sector-specific factors. This holistic approach offers a fairer perspective on what investors should be willing to pay for the stock right now.

Since Blackstone’s actual PE of 41.3x is noticeably higher than its Fair Ratio of 25.6x, this suggests that, even allowing for its strengths, the stock is priced above a level considered reasonable for its business outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Blackstone Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, personalized story that connects your view on a company’s business outlook—where its revenue, earnings, and margins are headed—with your assumptions about its underlying value. Instead of just crunching numbers, Narratives help you express your perspective on what you believe will drive the company's future, and show how those beliefs translate into a fair value for the stock.

On Simply Wall St's platform, Narratives are an easy and intuitive tool found in the Community page, used by millions of investors to bring their investment thinking to life. Narratives don’t just tell a story, they link that story to a detailed financial forecast and a calculated fair value, making it simple to decide if it makes sense to buy, hold, or sell by comparing your Fair Value to the current market price. Because Narratives update dynamically when new information such as company earnings or breaking headlines emerges, your view stays relevant and adaptive.

For example, some investors see Blackstone as poised for substantial future growth, supporting a fair value of up to $202, while others focus on risks and set their fair value closer to $124. The right Narrative depends on your unique expectations for the business and gives you a smarter, more dynamic way to invest.

For Blackstone, we will make it really easy for you with previews of two leading Blackstone Narratives:

Fair Value: $178.79

Current price is approximately 20.1% below fair value.

Expected revenue growth: 19.7%

- Blackstone is positioned for strong future growth, with record inflows and substantial capital ready for investment in undervalued opportunities.

- Innovations and partnerships in private credit and wealth management are expected to boost revenues and expand market reach.

- Analysts see potential risks from tariffs and economic uncertainty, but believe consensus price targets reflect a fair outlook if forecasts are achieved.

Fair Value: $124.55

Current price is approximately 14.7% above fair value.

Expected revenue growth: 15.9%

- Rapid expansion in infrastructure and private wealth may introduce operational inefficiencies and strain future earnings.

- Dependence on large-scale deployments and fast technological changes could make revenues and profits less predictable going forward.

- Bears see the current price as too high given ongoing market and margin pressures, even with improving fundamentals.

Do you think there's more to the story for Blackstone? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives