- United States

- /

- Diversified Financial

- /

- NYSE:BRK.B

Is Berkshire Hathaway’s Recent 4.5% Rally a Signal for More Upside in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Berkshire Hathaway is still a smart buy, or if the stock’s reputation has already priced in all the upside? You're not alone, and today's valuation could surprise you.

- The stock has been on the move, climbing 4.5% in the last week and up 10.6% year-to-date. However, it has only managed a modest 7.7% rise over the past year, which hints at both opportunity and evolving market sentiment.

- Recent headlines have spotlighted Berkshire Hathaway’s notable investments and capital allocation decisions. Some investors see this as steady hands steering the ship through a tricky market. News of Warren Buffett’s latest portfolio changes and significant moves in sectors such as energy and insurance have kept Berkshire’s strategy in focus and added new interest for market watchers.

- With a valuation score of 4 out of 6, Berkshire Hathaway is showing signs of value across several metrics. There is more than one way to evaluate a stock’s worth, and we’ll examine both traditional methods and a more insightful approach for long-term investors by the end of this piece.

Approach 1: Berkshire Hathaway Excess Returns Analysis

The Excess Returns model looks beyond basic earnings to assess how efficiently Berkshire Hathaway puts its equity capital to work, measuring the spread between the company's return on equity and its cost of equity. This tells us how much value the business creates for shareholders above their required rate of return.

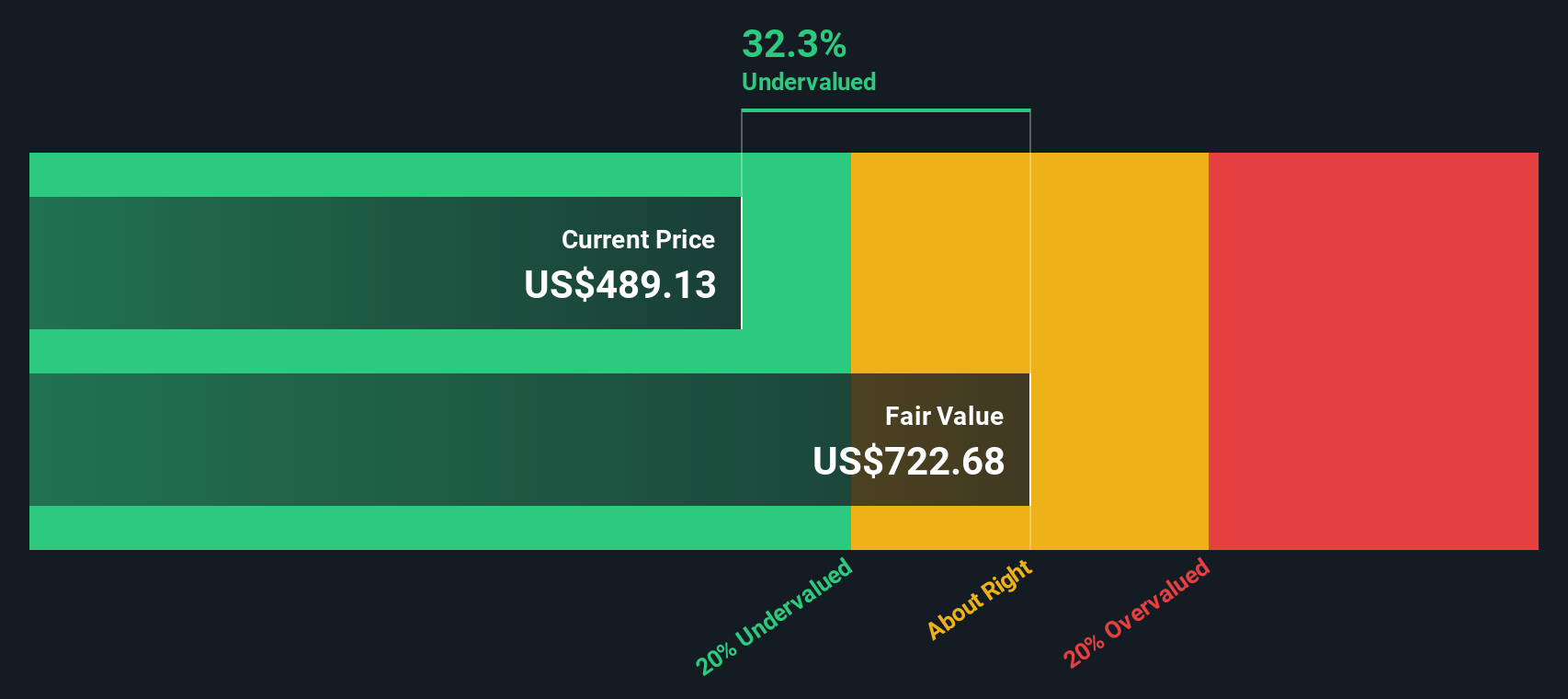

Berkshire Hathaway currently boasts a substantial Book Value of $485,274.36 per share, paired with a Stable Earnings Per Share (EPS) of $66,154.88, based on the median return on equity from the past five years. With a Cost of Equity at $39,029.48 per share, Berkshire delivers Excess Returns of $27,125.40 per share. Notably, the company’s average return on equity over this period sits at 12.85%, indicating a robust record of efficient capital usage. The projected Stable Book Value going forward is $514,986.06 per share, which is based on future analyst estimates.

By considering these factors, the model arrives at an intrinsic value that suggests Berkshire Hathaway is 34.5% undervalued compared to its current price. This valuation points to meaningful upside potential, implying that the current stock price does not fully reflect Berkshire’s ability to compound value for shareholders.

Result: UNDERVALUED

Our Excess Returns analysis suggests Berkshire Hathaway is undervalued by 34.5%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Berkshire Hathaway Price vs Earnings

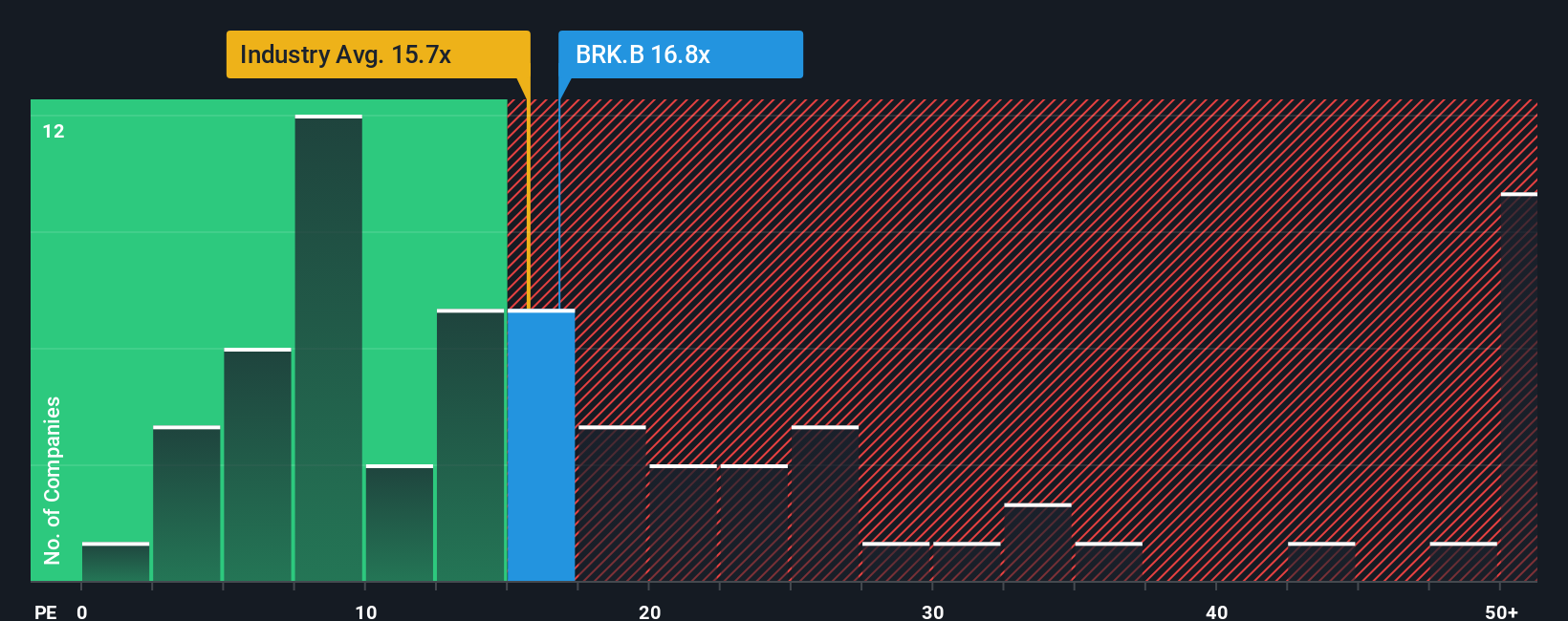

The Price-to-Earnings (PE) ratio is a widely accepted valuation tool for profitable companies like Berkshire Hathaway because it balances a company's current share price with its underlying earnings power. A lower PE can suggest a stock is undervalued, while a higher one may indicate market optimism about future growth.

What constitutes a "fair" PE ratio depends on various factors, particularly a company's growth outlook and perceived risk. Higher growth companies usually command higher PEs as investors anticipate bigger earnings ahead, while riskier or slow-growth firms generally trade at lower PEs to compensate for uncertainty.

Berkshire Hathaway currently trades at a PE of 16x. This is slightly above the Diversified Financial industry average of 13.1x, but well below the peer average of 27x. To help investors cut through these noisy benchmarks, Simply Wall St calculates a "Fair Ratio" for Berkshire. That fair PE sits at 17x. Unlike blunt peer or industry averages, the Fair Ratio blends Berkshire’s size, profitability, growth prospects, risks, and its industry conditions, offering a more comprehensive valuation benchmark.

Comparing Berkshire’s actual PE of 16x with its Fair Ratio of 17x, the stock appears to be priced about right based on its earnings profile and underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Berkshire Hathaway Narrative

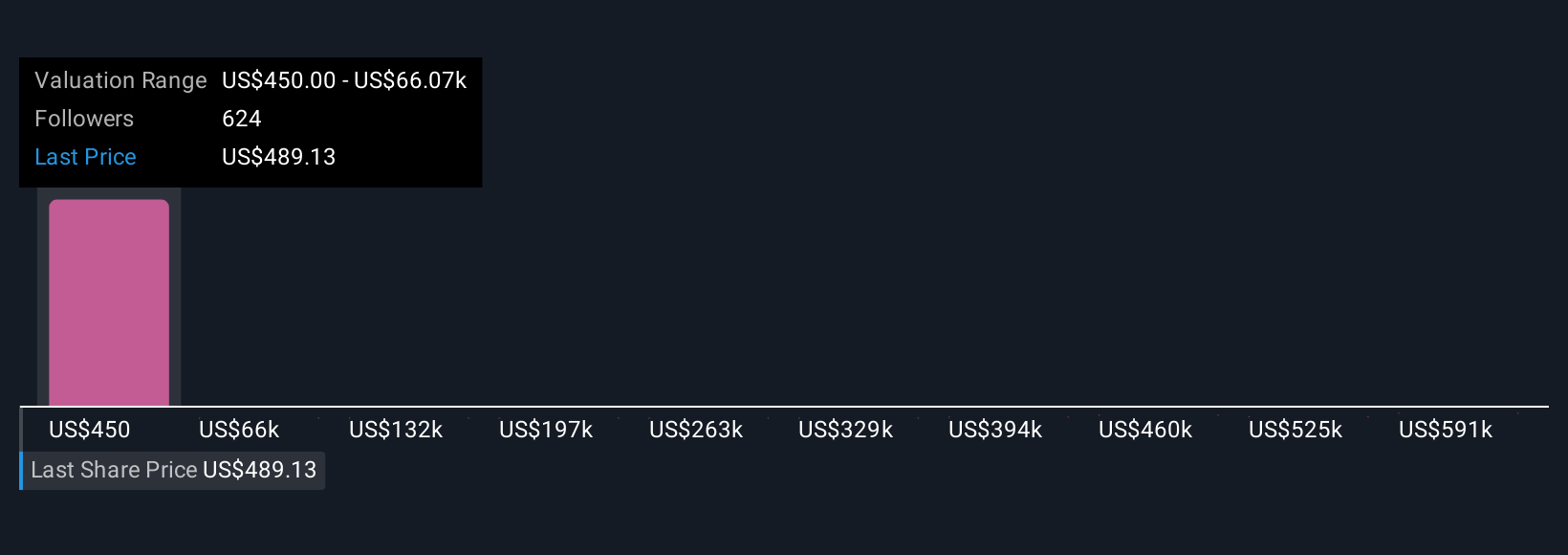

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind the numbers, where you use your own assumptions about Berkshire Hathaway’s future revenue, profits, and margins to estimate a fair value for the stock. Narratives directly connect your view of the company’s journey to a detailed financial forecast and a calculated fair value, giving you a clear picture of what you believe the stock is really worth.

Available on Simply Wall St’s Community page, Narratives are an easy and powerful tool used by millions of investors to make smarter, more personalized decisions. You can quickly see whether you think Berkshire is undervalued or overvalued by comparing your Narrative's Fair Value to the current market price. Because Narratives update automatically whenever fresh news or earnings come in, your conclusions remain relevant and timely.

For example, some investors may see Berkshire’s Fair Value as much higher than the market price if they expect strong future growth, while others, with more cautious forecasts, may see the opposite. Narratives let you turn your perspective into action, helping you decide when to buy, hold, or sell, all based on your unique view.

Do you think there's more to the story for Berkshire Hathaway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.B

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives