- United States

- /

- Diversified Financial

- /

- NYSE:BRK.B

Berkshire Hathaway (BRK.B): Exploring the Stock’s Valuation After Its 10% Year-to-Date Climb

Reviewed by Kshitija Bhandaru

Berkshire Hathaway (BRK.B) continues to hold investor attention, as its stock performance reflects both its longstanding track record and the company’s recent moves. Shares are up nearly 10% so far this year, outpacing much of the broader market.

See our latest analysis for Berkshire Hathaway.

Momentum is clearly building for Berkshire Hathaway, with its share price up nearly 10% year-to-date and the latest close at $495.92 reflecting strong investor sentiment. This follows a series of solid quarterly results and strategic moves by the company. In summary, the stock has achieved consistent growth in the short term, while its three-year total shareholder return of almost 80% highlights the impact of long-term compounding.

If you’re interested in uncovering what else the market’s top performers have in common, now’s the perfect moment to discover fast growing stocks with high insider ownership

Yet with performance this strong, some investors might wonder whether Berkshire Hathaway’s current valuation leaves further room to run, or if expectations for future growth are already reflected in the price. Is there still a buying opportunity here, or is everything priced in?

Price-to-Earnings of 17x: Is it justified?

Berkshire Hathaway is currently trading at a Price-to-Earnings (P/E) ratio of 17x, which is lower than the peer group average but slightly above the industry standard. With a recent close at $495.92, the stock appears attractively priced compared to its historical valuation relative to earnings.

The P/E ratio measures what investors are willing to pay today for a dollar of earnings. For Berkshire Hathaway, this metric is especially relevant because of its diversified earnings base and reputation for disciplined capital allocation. A lower P/E relative to peers could indicate a more favorable entry point for long-term investors. It is important to consider trends in historical and expected earnings when evaluating this ratio.

Looking at peer benchmarks, Berkshire’s P/E of 17x is well below the peer average of 28x. However, it is marginally higher than the US Diversified Financial industry average of 16.5x. When comparing its P/E to an estimated fair P/E of 19.8x, Berkshire appears to trade at a discount. The market could move towards this level if company fundamentals remain robust.

Explore the SWS fair ratio for Berkshire Hathaway

Result: Price-to-Earnings of 17x (UNDERVALUED)

However, softer annual net income and potential shifts in revenue growth could challenge the current optimism around Berkshire Hathaway’s valuation in the future.

Find out about the key risks to this Berkshire Hathaway narrative.

Another View: What Does Our DCF Model Say?

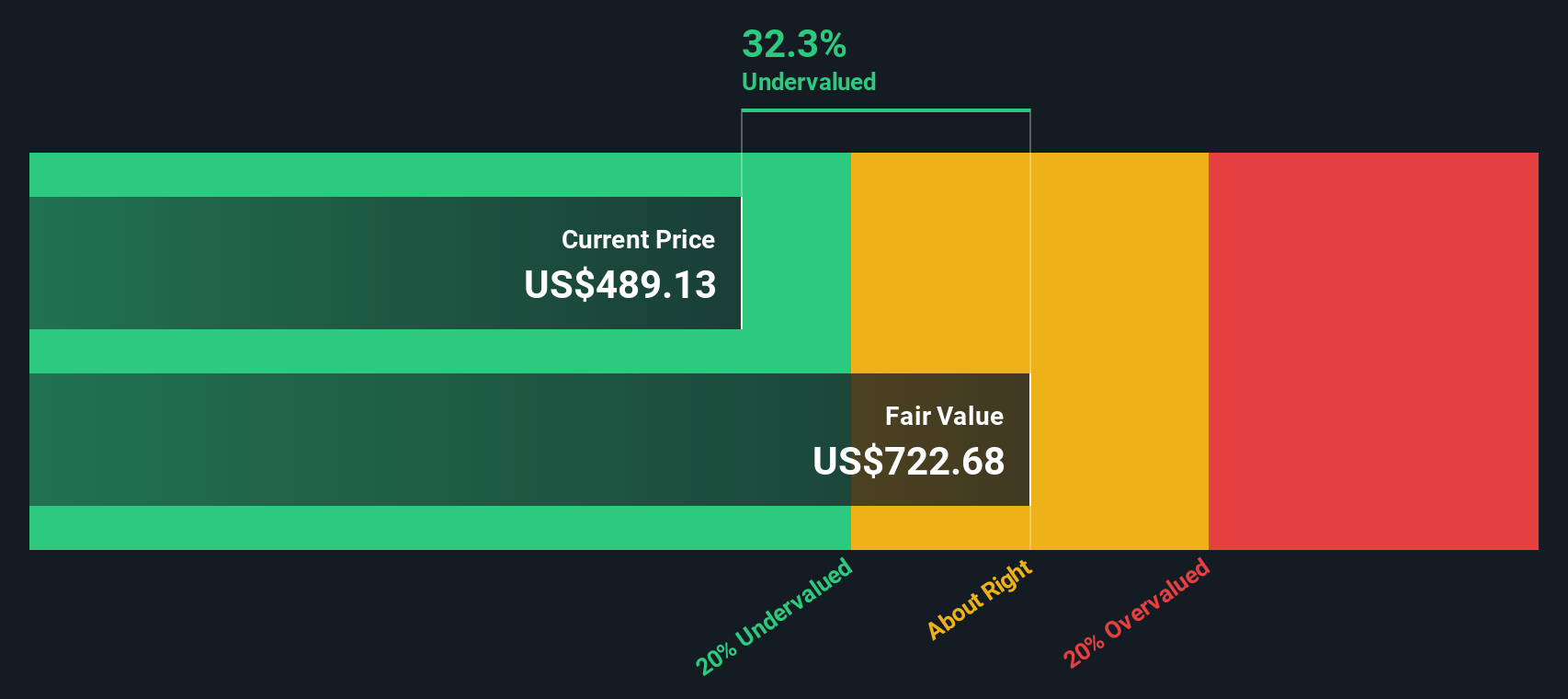

Looking at Berkshire Hathaway through the lens of our DCF model paints a different picture. The SWS DCF model suggests the shares are trading at a 31% discount to our fair value estimate of $723.31, which is significantly below the current share price. This points to an even larger valuation gap than what multiples alone reveal. But does this signal a clear opportunity, or could the model’s assumptions be too optimistic for today’s market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Berkshire Hathaway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Berkshire Hathaway Narrative

If you want to dig into the numbers yourself or have a different perspective, you can easily develop your own story in just a few minutes. Use our tools to Do it your way.

A great starting point for your Berkshire Hathaway research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always have their eyes open for new opportunities. Don’t let the next big winner slip past you. Gain an edge by focusing on these top strategies:

- Grow your portfolio faster by targeting these 904 undervalued stocks based on cash flows that the market might be overlooking. Look for strong cash flow potential.

- Boost your income stream by uncovering these 19 dividend stocks with yields > 3% with reliable yields above 3%, helping your money work harder for you.

- Stay ahead of the curve by analyzing these 78 cryptocurrency and blockchain stocks to gain exposure to innovative blockchain and digital currency themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRK.B

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives