- United States

- /

- Capital Markets

- /

- NYSE:BRDG

Positive Sentiment Still Eludes Bridge Investment Group Holdings Inc. (NYSE:BRDG) Following 27% Share Price Slump

Bridge Investment Group Holdings Inc. (NYSE:BRDG) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

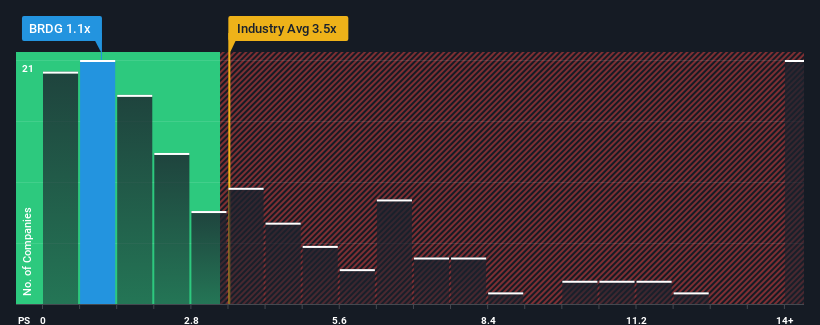

After such a large drop in price, Bridge Investment Group Holdings' price-to-sales (or "P/S") ratio of 1.1x might make it look like a strong buy right now compared to the wider Capital Markets industry in the United States, where around half of the companies have P/S ratios above 3.5x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Bridge Investment Group Holdings

What Does Bridge Investment Group Holdings' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Bridge Investment Group Holdings' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bridge Investment Group Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Bridge Investment Group Holdings' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 23% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 35% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.1% per year, which is noticeably less attractive.

In light of this, it's peculiar that Bridge Investment Group Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Having almost fallen off a cliff, Bridge Investment Group Holdings' share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Bridge Investment Group Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Bridge Investment Group Holdings that we have uncovered.

If these risks are making you reconsider your opinion on Bridge Investment Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bridge Investment Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BRDG

Bridge Investment Group Holdings

Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager..

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives