- United States

- /

- Capital Markets

- /

- NYSE:BLSH

Will Bullish's (BLSH) New BitLicense Approval Change Institutional Perceptions of Its Regulatory Edge?

Reviewed by Sasha Jovanovic

- Bullish recently secured approval for a New York BitLicense, a development that enhances its regulatory standing and enables further institutional access.

- This milestone signals growing recognition of Bullish within regulatory circles, which may lead to broader adoption by institutional partners.

- We'll explore how regulatory clarity from the BitLicense approval could shape investor perceptions of Bullish's long-term potential.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Bullish's Investment Narrative?

Bullish’s newly granted New York BitLicense points to a step forward in mainstream acceptance, reflecting mounting regulatory trust and unlocking pathways for deeper institutional involvement. This comes at a pivotal moment: the company has fast-growing revenues, new partnerships bolstering liquidity and reach, and a stream of tech launches aimed at the lucrative institutional crypto market. Before this news, many saw regulatory uncertainty and limited access to US markets as top hurdles, potentially capping short-term momentum despite ambitious growth forecasts and industry partnerships. The BitLicense directly addresses these issues, which could accelerate product adoption and help bolster market confidence in Bullish's model. However, the sharp increase in regulatory scrutiny can introduce additional compliance costs and operational complexities, even as it opens up new opportunities. That tension remains a top consideration for shareholders, given the company's current unprofitability and rich valuation multiples relative to peers. But, some risks around profitability and compliance costs may become more visible as US operations expand.

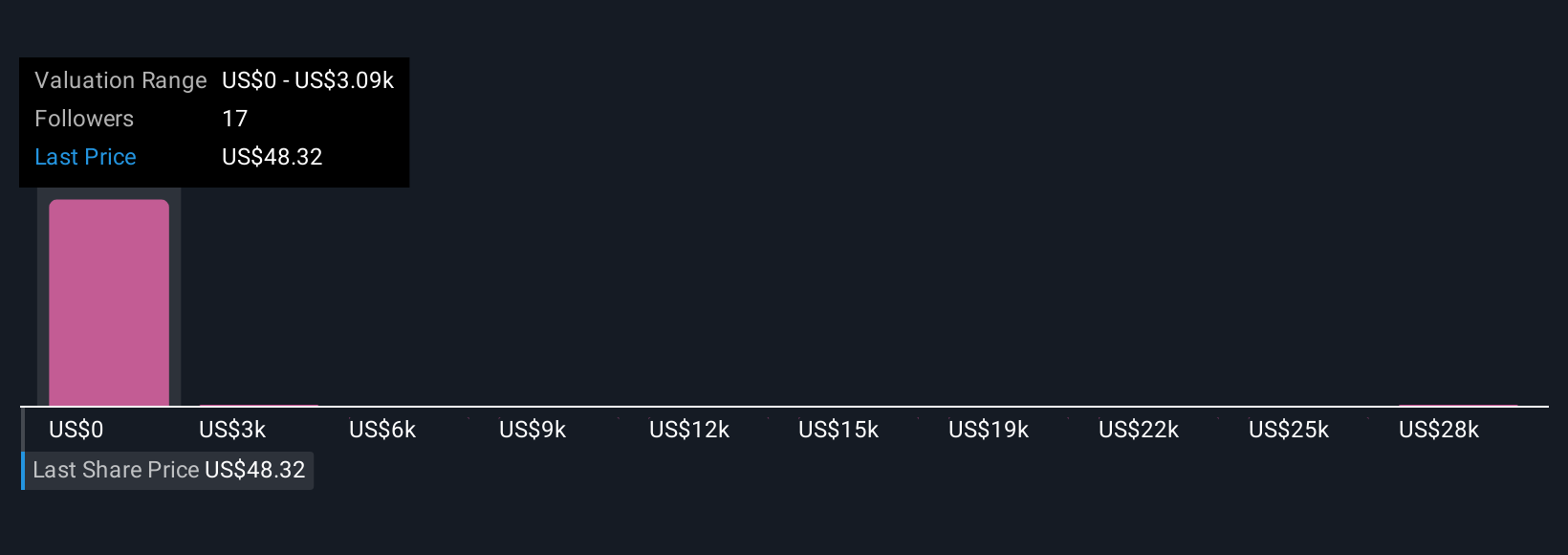

Our valuation report unveils the possibility Bullish's shares may be trading at a premium.Exploring Other Perspectives

Explore 6 other fair value estimates on Bullish - why the stock might be a potential multi-bagger!

Build Your Own Bullish Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bullish research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Bullish research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bullish's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bullish might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLSH

Bullish

Provides market infrastructure and information services in United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives