- United States

- /

- Capital Markets

- /

- NYSE:BLSH

Is Ark Invest’s BLSH Bet a Sign of Lasting Institutional Conviction or Just a Passing Phase?

Reviewed by Sasha Jovanovic

- Earlier this month, Bullish reported an October trading volume of US$80.5 billion and projected third-quarter revenue from subscriptions, services, and partnerships of US$43.5 million to US$48 million.

- Ark Invest’s cumulative US$10 million purchase of Bullish shares across its ETFs underscores growing investor attention ahead of the company's anticipated Q3 results and evolving partnerships.

- We'll explore how Ark Invest’s recent acquisition highlights the growing role of institutional interest in shaping Bullish's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Bullish's Investment Narrative?

Taking a seat as a Bullish shareholder means believing in a digital asset trading platform still forging its way through high growth and industry volatility. The recent update, where October trading volume reached US$80.5 billion and Q3 revenue is projected up to US$48 million, shows the company’s continued ability to draw transaction flow even after a period of considerable share price weakness (33.84% decline over the past month). Ark Invest’s US$10 million share accumulation across ETFs right before results spotlights growing institutional focus, which could add support if short-term catalysts around new product launches (like crypto options and US spot trading) pay off. Still, price declines expose investor worries about high valuation multiples and persistent unprofitability, variables that could re-emerge quickly if the expected revenue acceleration does not materialize. The balance between regulatory wins, new partnerships, and pressure to turn a profit faster has arguably become even more pronounced after these results, shifting the most important short-term catalyst to actual topline and earnings delivery amid ongoing uncertainty. But sharp price swings could still be a sign that risks are front and center for this name.

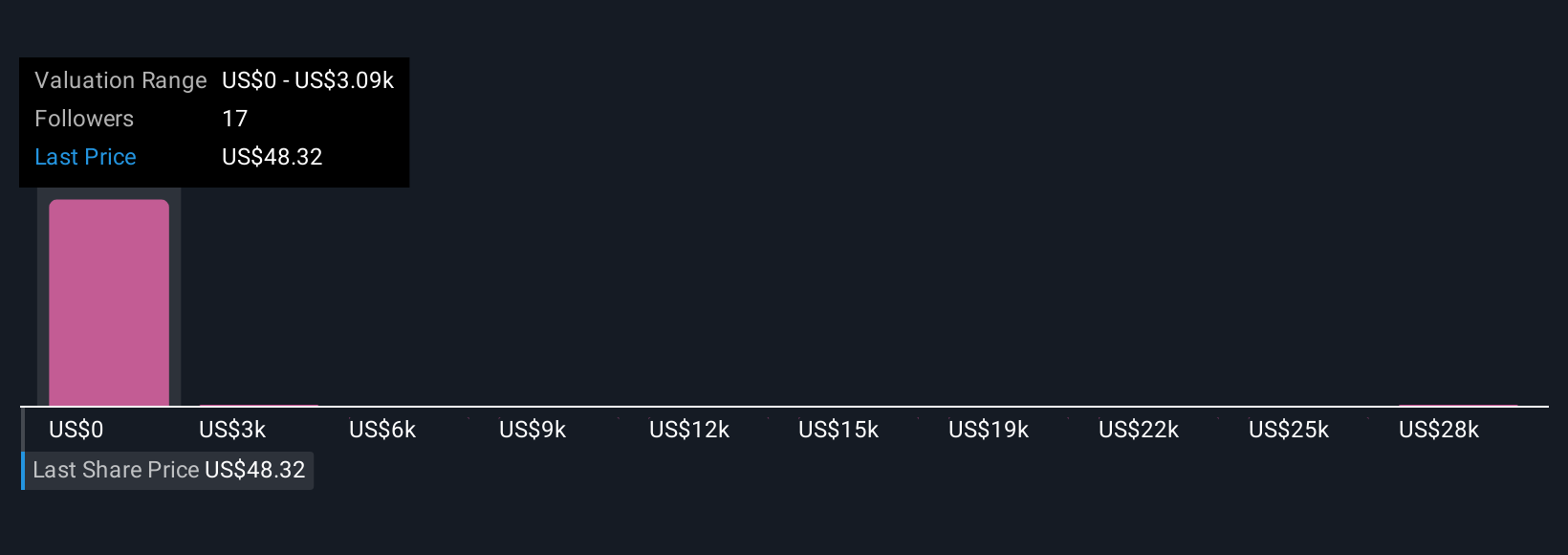

Our expertly prepared valuation report on Bullish implies its share price may be too high.Exploring Other Perspectives

Explore 6 other fair value estimates on Bullish - why the stock might be worth just $3088!

Build Your Own Bullish Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bullish research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bullish research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bullish's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bullish might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLSH

Bullish

Provides market infrastructure and information services in United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives