- United States

- /

- Capital Markets

- /

- NYSE:BLK

What Does Recent ETF Launch Activity Mean for BlackRock's 2025 Share Price?

Reviewed by Bailey Pemberton

- Wondering if BlackRock's lofty share price can still deliver value, or if the best days are behind it? You are not the only one eyeing this market heavyweight for clues about what is next.

- Despite some recent choppiness with the stock down 4.7% over the past week and 5.1% in the last month, BlackRock is still up 6.4% year to date and has gained an impressive 12.2% over the past year.

- Headlines have recently focused on BlackRock's role in major ETF launches and its leadership in sustainable investment initiatives. These strategic moves have kept the market's attention and could explain the renewed volatility and opportunity in the share price.

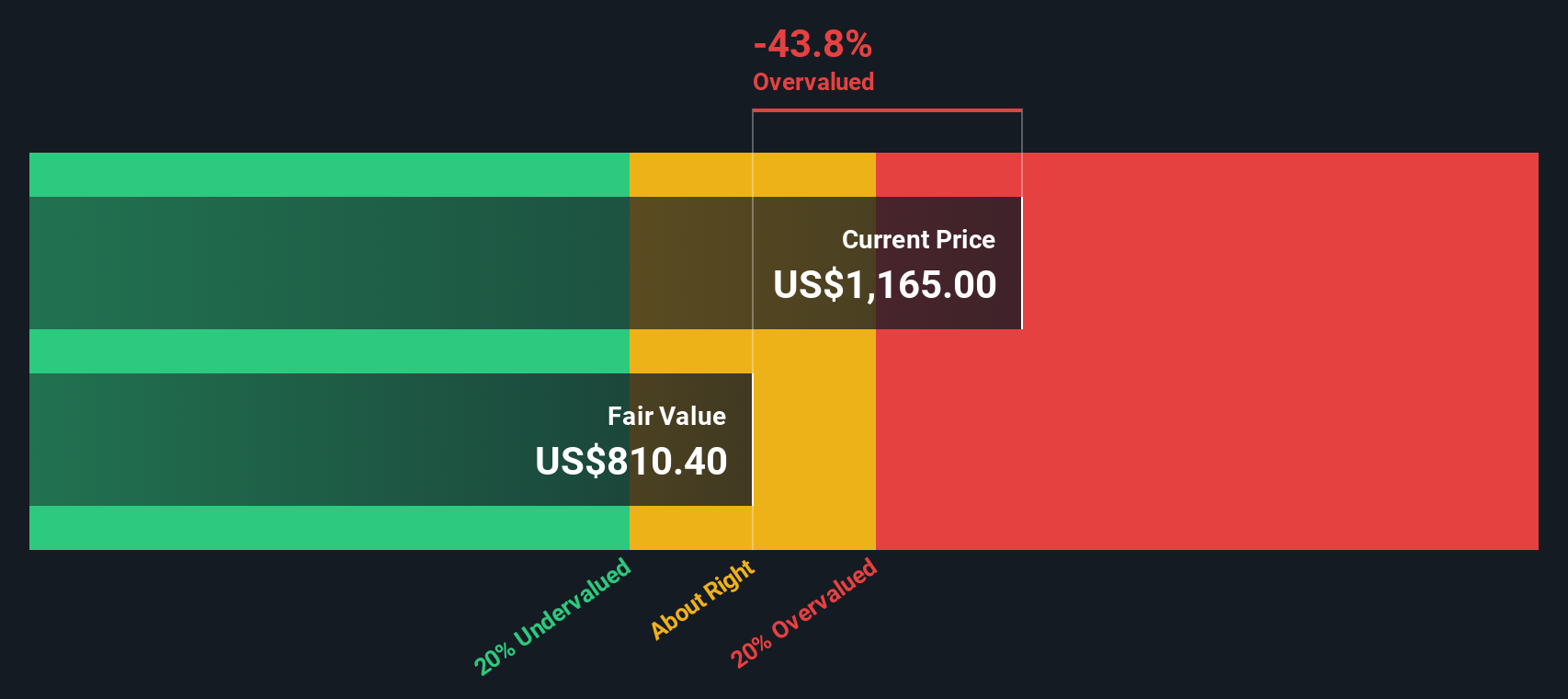

- According to our valuation checks, BlackRock scores just 2/6 for attractiveness right now, but as we dig into different ways to value the stock, we will reveal why the best insights come from going beyond the standard checklist.

BlackRock scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BlackRock Excess Returns Analysis

The Excess Returns valuation model looks at a company’s ability to generate returns on invested capital that exceed its cost of equity. This method focuses on how much value BlackRock creates for shareholders above what could be earned by just investing elsewhere at similar risk.

Based on the latest data, BlackRock boasts a Book Value of $317.55 per share and a Stable EPS (Earnings Per Share) estimate of $50.04. These estimates come from five analysts who have projected future Return on Equity. The company’s Cost of Equity is measured at $24.75 per share, with an Excess Return of $25.29 per share. This means BlackRock consistently generates surplus returns above its baseline cost. The average Return on Equity sits at a robust 16.61%. Analysts estimate a Stable Book Value of $301.21 per share, derived from projections provided by three different analysts.

Using this model, the calculated intrinsic value for BlackRock comes in at $793.59 per share. However, with the current share price significantly above this figure, the model suggests BlackRock is trading at a 36.4% premium.

Result: OVERVALUED

Our Excess Returns analysis suggests BlackRock may be overvalued by 36.4%. Discover 833 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BlackRock Price vs Earnings

For companies like BlackRock that consistently deliver strong profits, the Price-to-Earnings (PE) ratio is often the go-to metric for investors. The PE ratio offers a clear snapshot of how much the market is willing to pay for each dollar of earnings. This is especially useful when a business has a stable earnings track record.

However, what counts as a “normal” or “fair” PE ratio depends largely on growth prospects and risk. Higher growth expectations or lower perceived risk can justify a higher multiple. In contrast, slower growth or higher risks tend to pull these figures down toward the industry average.

BlackRock currently trades at a PE ratio of 27.55x. For context, the industry average in Capital Markets stands at 25.09x, while similar peers are priced even higher at 49.61x. Simple comparisons, however, do not always tell the whole story.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. In BlackRock’s case, the Fair Ratio is 21.79x. Unlike traditional benchmarks, the Fair Ratio takes into account not only the company’s earnings growth but also key factors like profit margin, specific risks, industry dynamics, and market capitalization. This broader perspective makes it a more holistic gauge of value than relying solely on industry or peer group averages.

Since BlackRock’s actual PE ratio of 27.55x is noticeably above the Fair Ratio of 21.79x, it suggests the stock is priced on the expensive side relative to its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BlackRock Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you tell about why BlackRock’s future could unfold in a particular way. It is your view about how future revenue, profit margins, and growth drivers might play out, and what you believe is a fair value for the stock based on those forecasts.

By connecting BlackRock’s business story directly to future financials, Narratives help you move beyond checklists and ratios. They let you put your perspective front and center, tie it to real numbers, and see exactly what would have to change for the stock to look like a bargain or a risk. Narratives are easy to use and available for every stock on Simply Wall St’s Community page, so you can quickly compare your outlook with those of millions of other investors.

Narratives make it clear when to consider buying or selling by comparing your estimated Fair Value to the current Price. Even better, they dynamically update whenever new news or earnings emerge, so your investment story always reflects the latest developments.

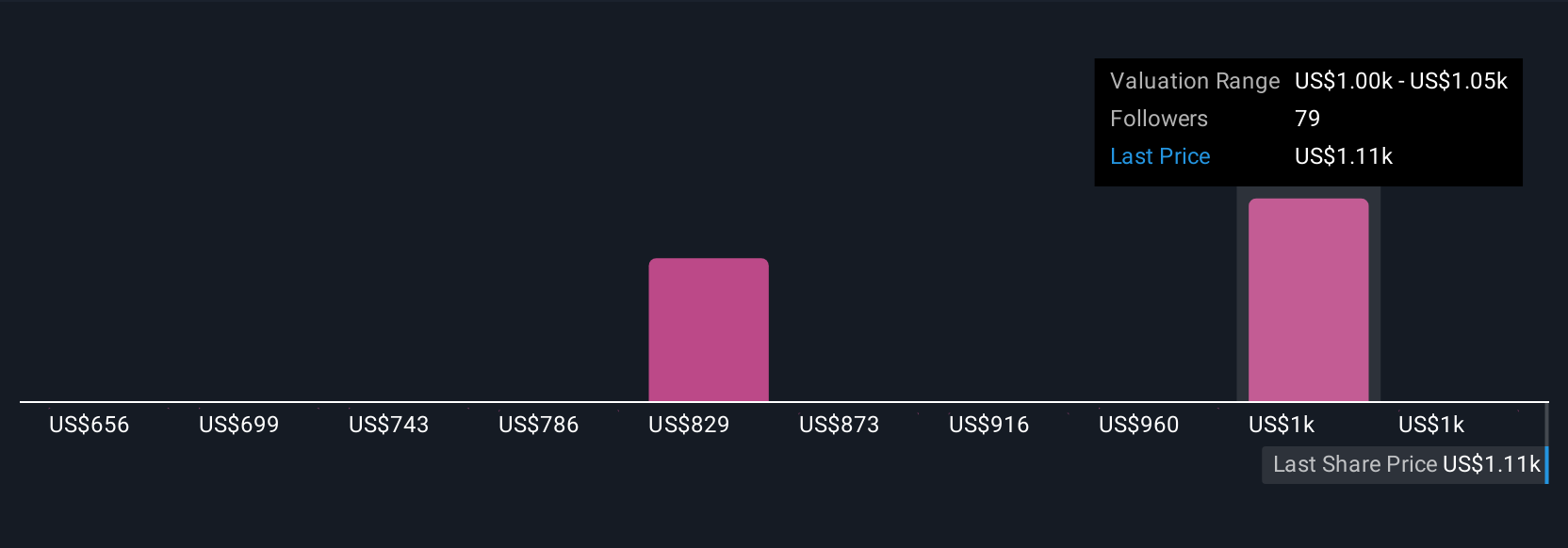

For example, on BlackRock, some investors see significant upside and set price targets as high as $1,334, while others are more cautious with targets closer to $1,000. This highlights how different views on the same company can lead to very different valuations.

Do you think there's more to the story for BlackRock? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives