- United States

- /

- Capital Markets

- /

- NYSE:BK

Did Landing WisdomTree Prime Make BNY Mellon (BK) a Core Player in Digital Asset Infrastructure?

Reviewed by Sasha Jovanovic

- On October 28, 2025, WisdomTree Inc. announced it had appointed The Bank of New York Mellon Corporation as the core banking-as-a-service provider for WisdomTree Prime®, enabling retail access to tokenized assets and cryptocurrencies in the U.S. through new stablecoin and blockchain functionalities.

- This engagement marks BNY Mellon’s first major retail digital assets platform client and highlights the growing intersection between traditional banking infrastructure and digital asset innovation.

- We’ll explore how BNY Mellon’s new role as a core digital asset infrastructure provider could shape its long-term investment thesis.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Bank of New York Mellon Investment Narrative Recap

To see value in BNY Mellon as a shareholder, you’d need to believe that the firm’s scale, diversified fee-based model, and continued investment in digital infrastructure can offset risks from industry fee compression and client outflows while capturing new revenue pools. The WisdomTree Prime partnership is the first major sign of traction in BNY Mellon’s push into blockchain-powered retail finance, supporting the digital assets catalyst but without material short-term impact on the core near-term driver, sustained net inflows and fee growth in institutional solutions. Short-term, the biggest risk remains continued asset management outflows and lingering revenue pressure from the shift toward passive strategies, which this announcement doesn’t address directly.

Elsewhere, the TIAA Wealth Management partnership announced last month also reinforces BNY Mellon’s strength in platform-based servicing, echoing recent catalysts but targeting a different core, wealth management rather than digital assets. Taken together, these announcements reflect a multi-track effort to broaden the firm’s addressable market but highlight how execution risk remains central, as efficiency gains from recent technology investments are still early-stage.

But investors also need to be aware that, in contrast, the rise of tokenized assets could introduce fee and competitive pressures far faster than...

Read the full narrative on Bank of New York Mellon (it's free!)

Bank of New York Mellon's outlook projects $21.3 billion in revenue and $5.8 billion in earnings by 2028. This is based on a 3.4% annual revenue growth rate and a $1.0 billion increase in earnings from the current $4.8 billion.

Uncover how Bank of New York Mellon's forecasts yield a $118.07 fair value, a 9% upside to its current price.

Exploring Other Perspectives

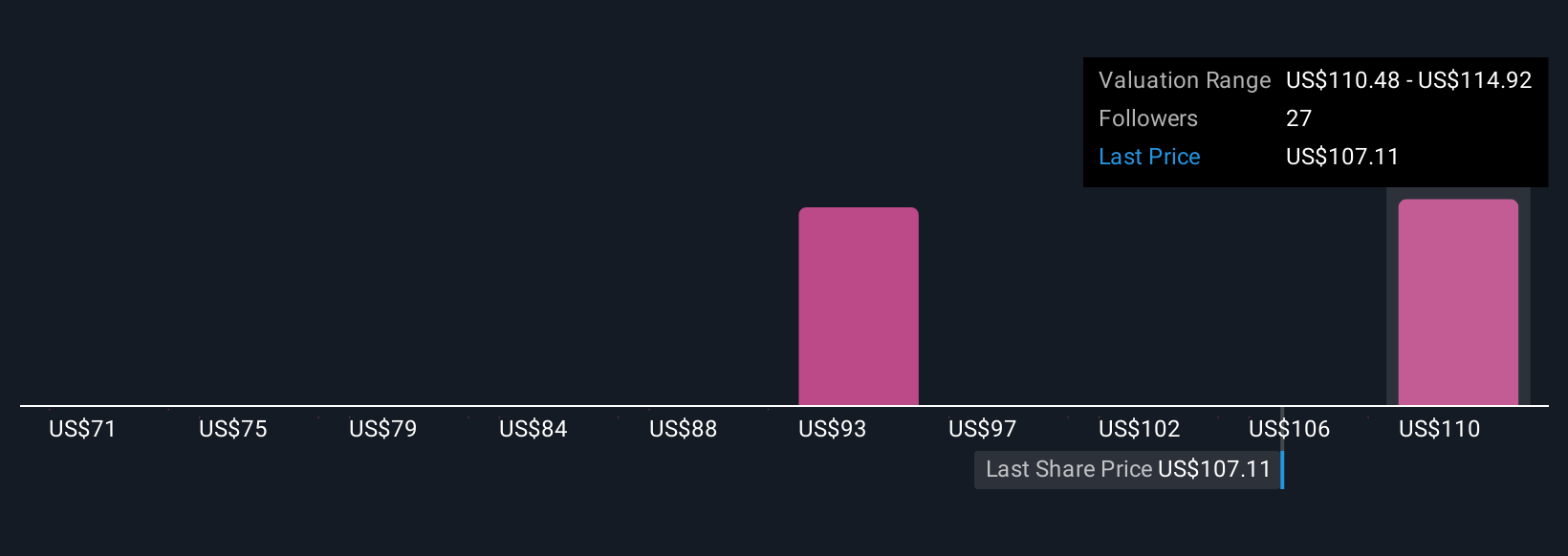

Five private investors in the Simply Wall St Community see fair value for BNY Mellon spanning from US$70.50 to US$119.40 per share. While some see significant upside, others are more cautious, reflecting ongoing questions about whether long-term digital asset initiatives can offset short-term risks in fee trends and net inflows.

Explore 5 other fair value estimates on Bank of New York Mellon - why the stock might be worth as much as 10% more than the current price!

Build Your Own Bank of New York Mellon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Bank of New York Mellon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of New York Mellon's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives