- United States

- /

- Consumer Finance

- /

- NYSE:BFH

How Bread Financial’s (BFH) $500 Million Debt Refinancing May Reshape Its Investment Outlook

Reviewed by Sasha Jovanovic

- In October 2025, Bread Financial Holdings completed a US$500 million private offering of 6.750% senior notes due 2031, with the proceeds and US$275 million in cash earmarked to redeem all outstanding 9.750% senior notes due 2029. This refinancing effort is accompanied by guarantees from the company's domestic subsidiaries and aims to lower future interest expenses while reshaping the company’s capital structure.

- Bread Financial’s move to reduce debt costs comes as the company also reported stronger third quarter results and continued expansion of its digital-focused payment solutions, reflecting management’s focus on operational efficiency and disciplined balance sheet management.

- We'll examine how this refinancing effort, targeting lower borrowing costs and enhanced debt structure, impacts Bread Financial's investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bread Financial Holdings Investment Narrative Recap

To be a shareholder in Bread Financial Holdings, you need to believe in the company’s ability to balance digital innovation with prudent credit management, and to keep earnings resilient even as credit costs and competitive pressures remain elevated. The recent US$500 million refinancing of senior notes is aimed at lowering interest expense, but does not materially change the short-term catalyst, which is management’s effort to maintain stable earnings through controlled credit risk and disciplined lending, amid a flat loan growth outlook and ongoing macro uncertainty. The biggest risk is that shifting towards higher-quality customers and co-brand partnerships could pressure long-term revenue growth and margins if loan yields decline, with new debt only partially offsetting these structural challenges.

Among recent announcements, the updated 2025 earnings guidance, which called for flat revenue and a net loss rate in the 7.8% to 7.9% range, stands out as directly relevant to this refinancing news. Elevated net loss rates highlight the ongoing credit risk environment, reinforcing why Bread Financial’s lower debt costs and capital structure moves matter for earnings stability and for navigating potential credit normalization. By improving its debt profile now, Bread Financial lays the groundwork for cost management while credit quality pressures remain an important watch point for investors.

Yet, despite more efficient funding, investors should closely watch for any signs that loan growth remains...

Read the full narrative on Bread Financial Holdings (it's free!)

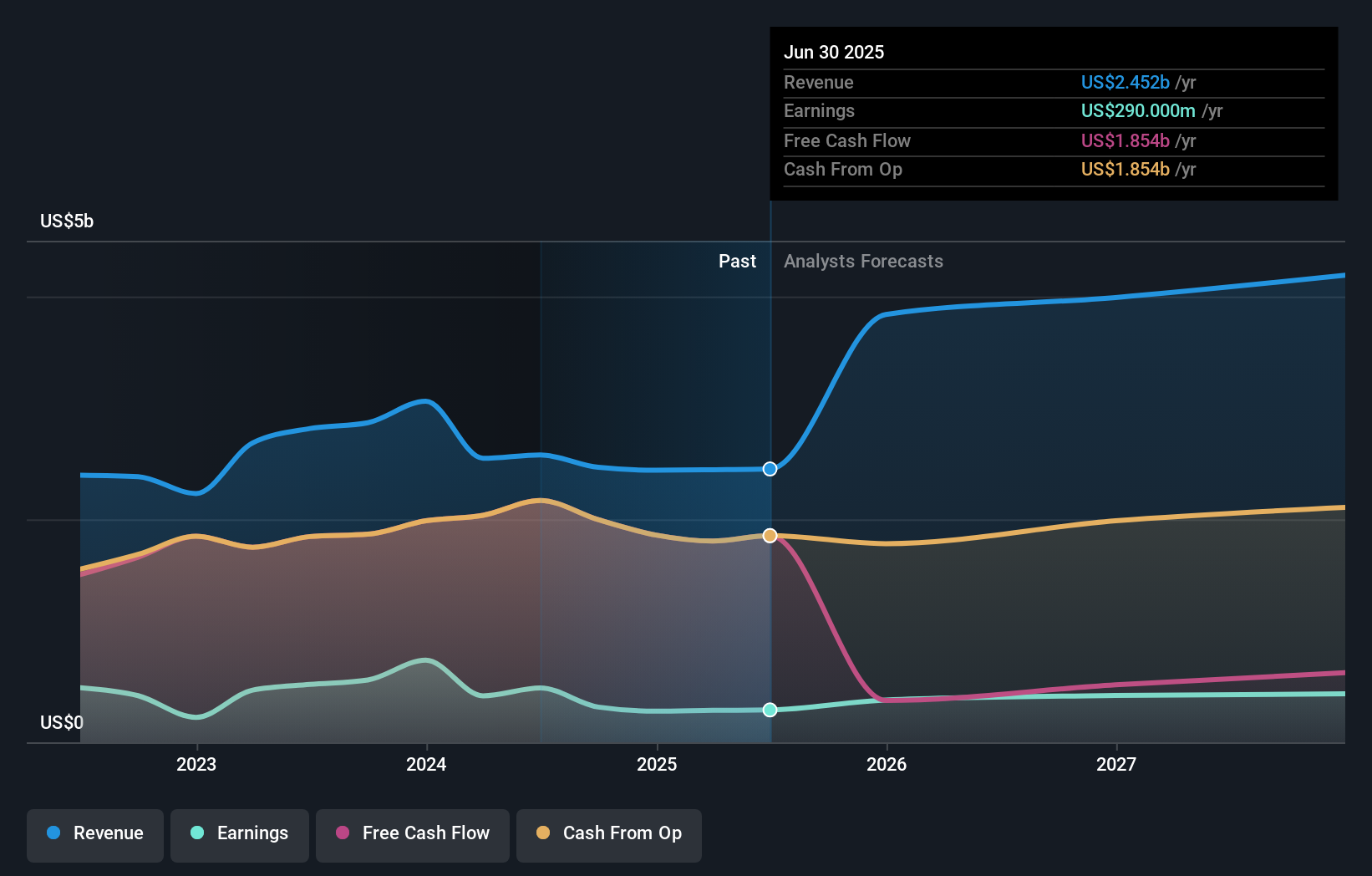

Bread Financial Holdings' outlook anticipates $4.3 billion in revenue and $379.5 million in earnings by 2028. This projection rests on a 20.3% annual revenue growth rate and an $89.5 million earnings increase from the current $290.0 million.

Uncover how Bread Financial Holdings' forecasts yield a $70.20 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided just one fair value estimate for Bread Financial at US$70.20 per share. With credit risk and modest loan growth still shaping the outlook, you can review a range of alternative viewpoints from our community.

Explore another fair value estimate on Bread Financial Holdings - why the stock might be worth just $70.20!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bread Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFH

Bread Financial Holdings

Provides tech-forward payment and lending solutions to customers and consumer-based industries in North America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives