- United States

- /

- Capital Markets

- /

- NYSE:ARES

What Ares Management (ARES)'s Strong Earnings and Systematic Credit Expansion Mean For Shareholders

Reviewed by Sasha Jovanovic

- Ares Management Corporation recently reported strong third-quarter results, with revenue reaching US$1.66 billion and net income at US$288.88 million, both showing significant year-over-year growth.

- The company's outperformance was accompanied by an affirmation of its quarterly dividend and an acquisition announcement set to expand its capabilities in systematic credit solutions.

- We'll now explore how this robust earnings growth sharpens Ares Management's investment narrative and influences its future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ares Management Investment Narrative Recap

For shareholders in Ares Management, the core investment case rests on faith in the company’s ability to drive strong fee-based revenue and earnings growth by expanding its leadership in private credit, alternative assets, and global fundraising channels. While the impressive third-quarter results reinforce confidence in near-term profitability, they do not materially lessen the immediate risk of future fee pressure and margin compression, as competition in private credit continues to intensify and peers adjust their pricing to attract capital.

The affirmation of the US$1.12 quarterly dividend alongside rapid revenue and net income growth stands out as a signal of balance sheet resilience and cash flow health, even as management confronts industrywide margin headwinds. These actions underscore Ares’ focus on delivering shareholder returns while navigating heightened sector competition and evolving client preferences for alternative assets in the short term.

However, investors should be aware that, in contrast to headline earnings strength, future management fee growth remains exposed if ...

Read the full narrative on Ares Management (it's free!)

Ares Management's outlook anticipates $7.1 billion in revenue and $2.2 billion in earnings by 2028. This forecast is based on a 13.7% annual revenue growth rate and a $1.83 billion increase in earnings from the current $369.5 million.

Uncover how Ares Management's forecasts yield a $180.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

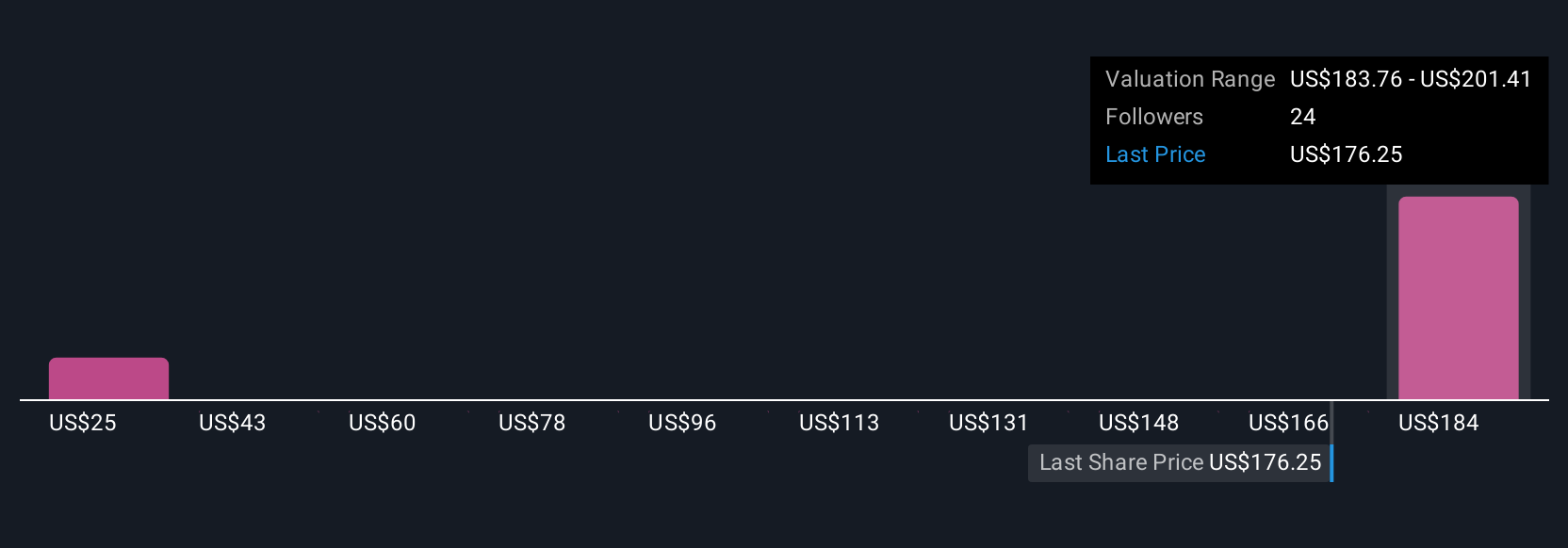

Three estimates from the Simply Wall St Community put Ares Management’s fair value anywhere from US$31 to US$201 per share. While investor views on valuation vary widely, intensifying competition and the potential for lower management fees remain factors that could shape performance in coming quarters, explore these perspectives for a fuller picture.

Explore 3 other fair value estimates on Ares Management - why the stock might be worth as much as 32% more than the current price!

Build Your Own Ares Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ares Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ares Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ares Management's overall financial health at a glance.

No Opportunity In Ares Management?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives