- United States

- /

- Capital Markets

- /

- NYSE:ARES

Ares Management (ARES): Evaluating Valuation as Shares Cool from Recent Highs

Reviewed by Simply Wall St

See our latest analysis for Ares Management.

This latest dip in Ares Management’s share price comes after a volatile stretch, with the stock down over 19% in the last three months. The company still boasts an impressive 94% total shareholder return over three years. Momentum has faded lately, but long-term performance remains strong and continues to signal the company’s enduring growth story.

If you’re curious where else rapid growth and insider conviction are shaping markets, now’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares now trading below both recent highs and some analyst targets, investors are left to weigh whether Ares Management is undervalued at these levels or if the market has already accounted for future growth.

Most Popular Narrative: 16% Undervalued

Ares Management's widely followed narrative presents a fair value of $180 per share, notably above its last close of $151.26. This suggests that the narrative sees significant upside potential and sets the stage for ambitious performance expectations.

Expansion into multiple asset classes (infrastructure, real estate, sports/media, secondaries), with recent successes such as the GCP acquisition and the scaling of data center asset management, is expected to deliver higher management and development fees. This supports long-term revenue and FRE growth. Robust international fundraising, particularly in Europe and Asia-Pacific, along with ongoing success in deepening distribution partnerships, is broadening Ares' addressable markets, increasing global deal flow, and positioning the company for sustained earnings growth.

Curious which ambitious growth numbers are fueling this valuation? The narrative points to management’s bold expansion bets and high-multiple expectations. But the specific assumptions behind this upside — would you have guessed them? Tap in to see what really drives this fair value.

Result: Fair Value of $180 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and potential fee pressure could unsettle Ares Management's outlook, especially if rivals cut fees aggressively to gain market share.

Find out about the key risks to this Ares Management narrative.

Another View: Market Ratios Signal Caution

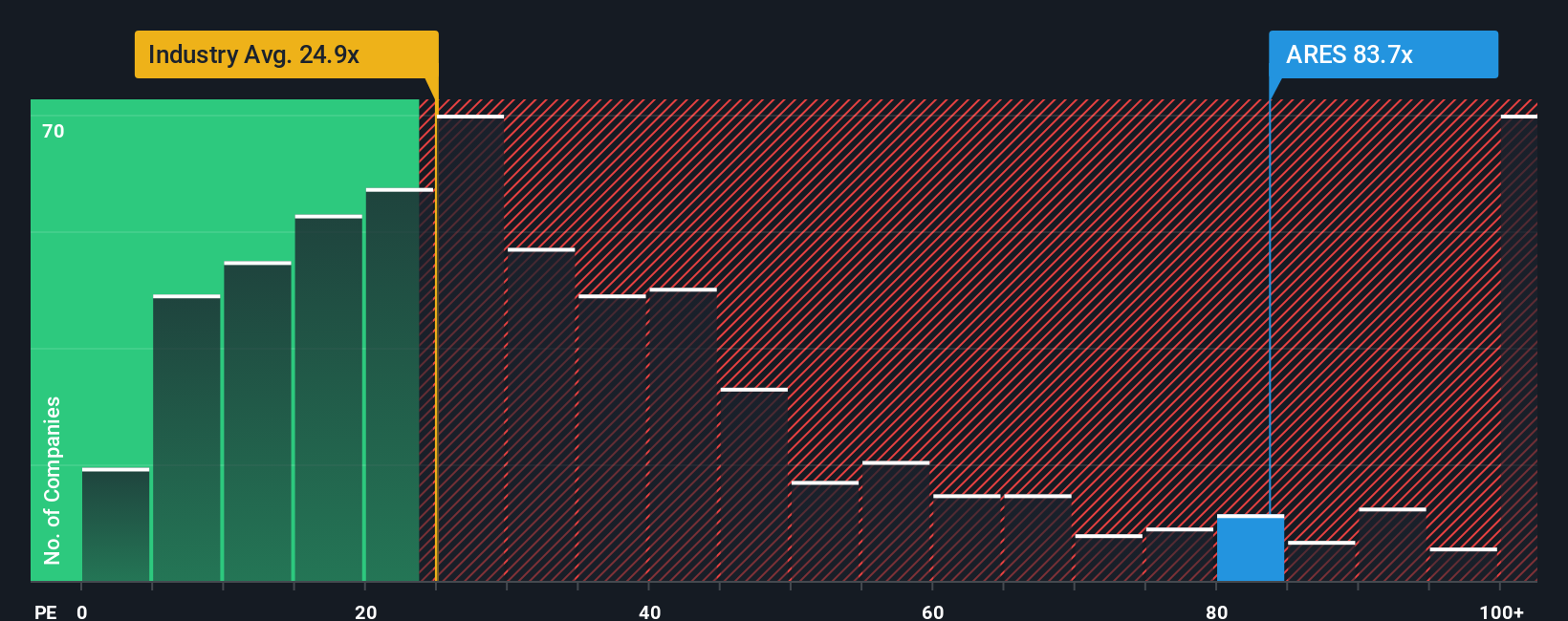

Looking through the lens of price-to-earnings, Ares Management appears expensive. Its 63.7x ratio is far above the US Capital Markets average of 23.8x, its peer average of 13.3x, and even the market's fair ratio of 26.1x. That kind of premium suggests higher valuation risk if growth stumbles or expectations shift. Could the story be too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

Not seeing your story reflected here, or want to dig into the numbers personally? Take a hands-on approach by creating your own take in just minutes. Do it your way

A great starting point for your Ares Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at Ares Management. Seize the next big opportunity by reviewing high-potential companies handpicked with proven metrics on Simply Wall Street’s powerful Screener.

- Grow your portfolio’s income stream by locking in these 18 dividend stocks with yields > 3% offering strong yields and resilient fundamentals.

- Spot tomorrow’s disruptors by examining these 25 AI penny stocks pushing boundaries in artificial intelligence and rapid tech innovation.

- Uncover value gems poised for a rebound by researching these 845 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives