- United States

- /

- Diversified Financial

- /

- NYSE:APO

Is Apollo Global Management a Bargain After Latest 25% Pullback in 2025?

Reviewed by Bailey Pemberton

- Wondering if Apollo Global Management stock is a hidden bargain or just riding the market’s ups and downs? Let’s take a closer look at what’s really driving its value.

- Despite impressive long-term gains of 217.9% over five years and 107.1% over three years, the stock is down 25.3% year-to-date and 9.9% over the last twelve months, showing a recent dip that’s caught some investors’ attention.

- Recent headlines have spotlighted Apollo’s growing influence in the alternative asset management space, with significant new deals and expanded partnerships grabbing Wall Street’s interest. These moves offer important context behind the rapid price swings and shifting investor sentiment we’ve seen lately.

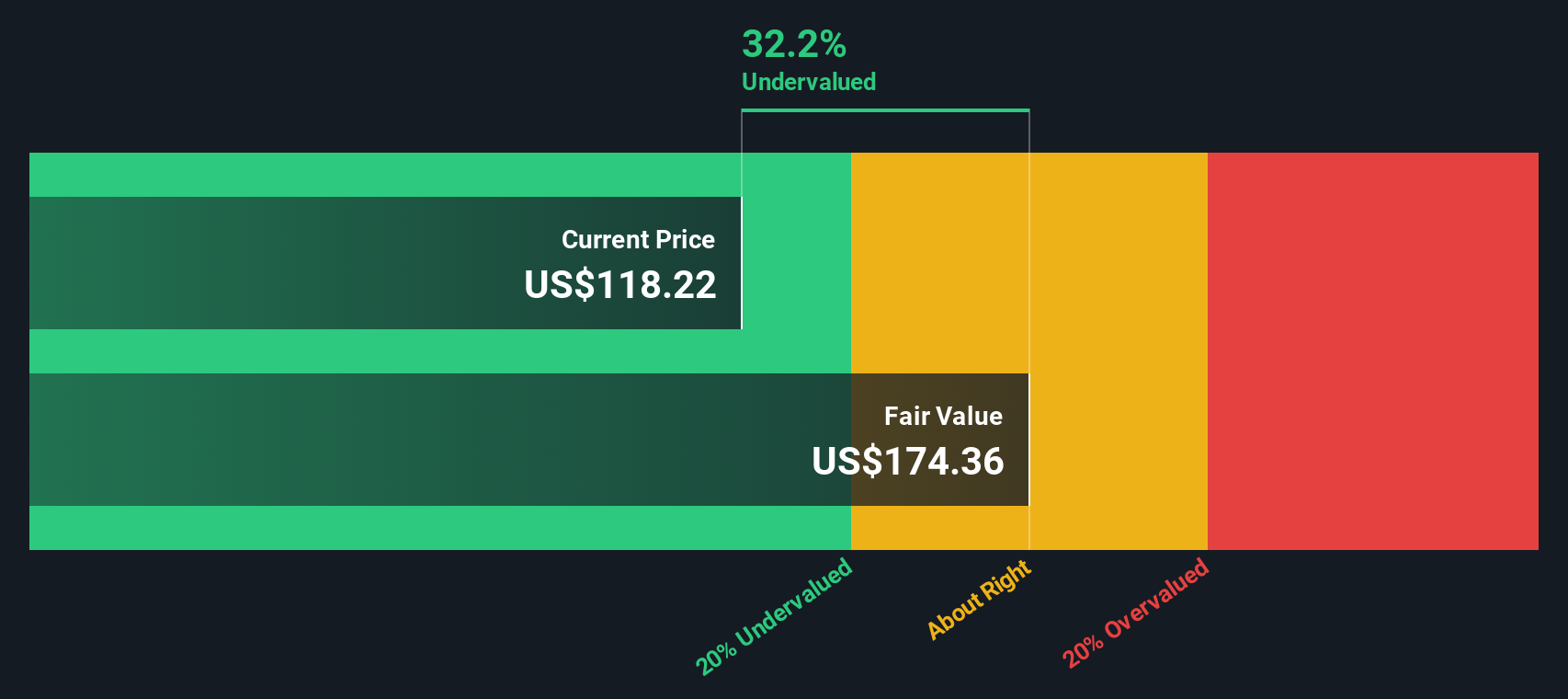

- Apollo Global Management earns a 4 out of 6 on our valuation checks, signaling the company looks undervalued in several key areas. Next, we’ll break down how different approaches stack up, and reveal a deeper, more insightful way to think about value later in the article.

Find out why Apollo Global Management's -9.9% return over the last year is lagging behind its peers.

Approach 1: Apollo Global Management Excess Returns Analysis

The Excess Returns valuation model examines how effectively Apollo Global Management generates profits above its cost of equity. By comparing sustainable earnings potential versus the capital required, this method focuses on whether the company is producing meaningful value for shareholders over time.

According to analyst forecasts, Apollo’s stable earnings per share are projected at $10.58, while its stable book value sits at $51.89 per share. The average future return on equity stands at an impressive 20.40%, with a cost of equity at $4.37 per share. This results in an excess return of $6.21 per share, suggesting Apollo continues to deliver significant value on invested capital. These figures are based on weighted estimates from multiple analysts, adding confidence to the model.

The resulting intrinsic value estimated under the Excess Returns approach is $168.26 per share. Since the current market price is approximately 26.3% lower than this valuation, the stock appears notably undervalued by this metric.

Result: UNDERVALUED

Our Excess Returns analysis suggests Apollo Global Management is undervalued by 26.3%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

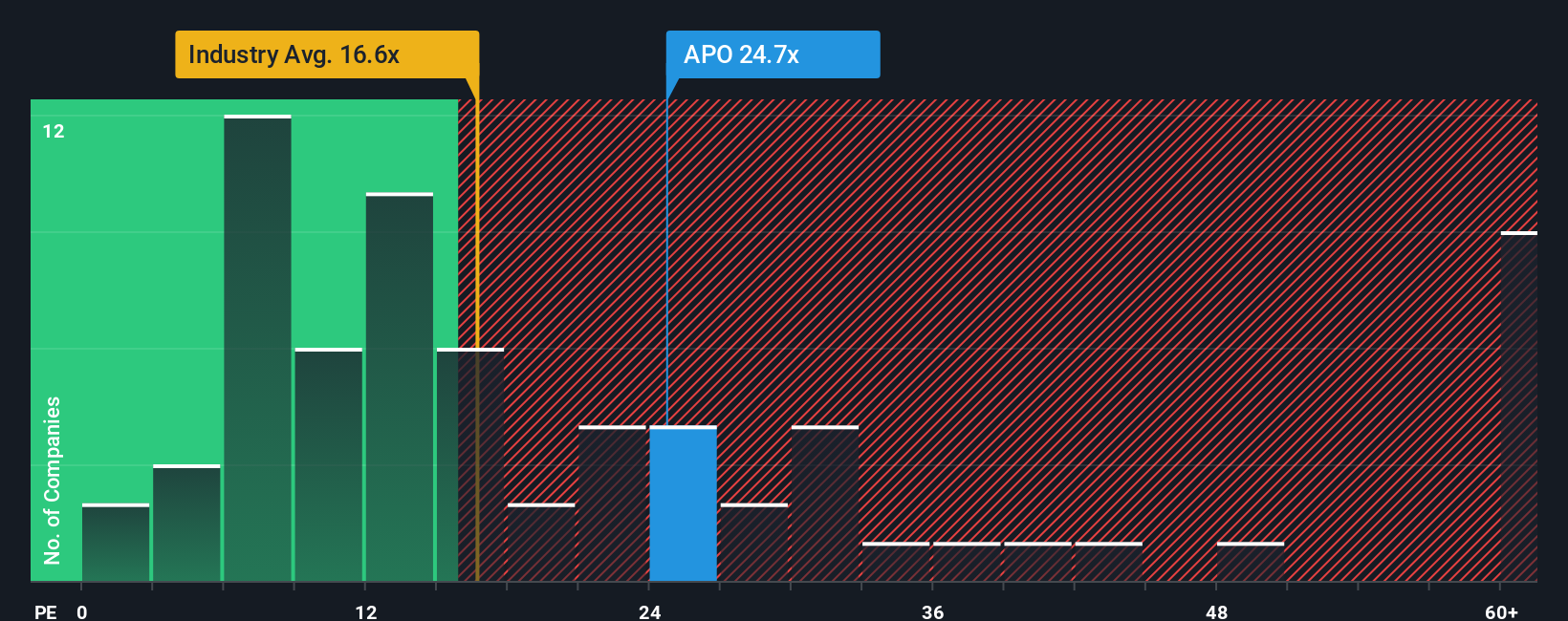

Approach 2: Apollo Global Management Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Apollo Global Management because it directly relates a company's share price to its earnings. This makes it a quick way for investors to gauge whether a stock is expensive or cheap relative to its profit generation.

However, a “normal” or “fair” PE ratio is not the same for every company. Higher expected growth justifies a higher PE, while greater risks typically require a lower one. Market comparisons help set context but can oversimplify what is fair for an individual stock.

Apollo currently trades at a PE ratio of 22.4x. For context, this sits well above the Diversified Financial industry average of 14.8x, and is also higher than the peer group average of 19.2x. Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark, estimating that Apollo deserves a PE of 24.9x based on its strong earnings growth, profit margins, risk, industry standing and market size. This nuanced figure often gives a clearer picture than basic peer comparisons alone, since it factors in what truly drives company value for this specific business.

Comparing Apollo’s actual PE (22.4x) with its Fair Ratio (24.9x), the stock appears undervalued according to this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

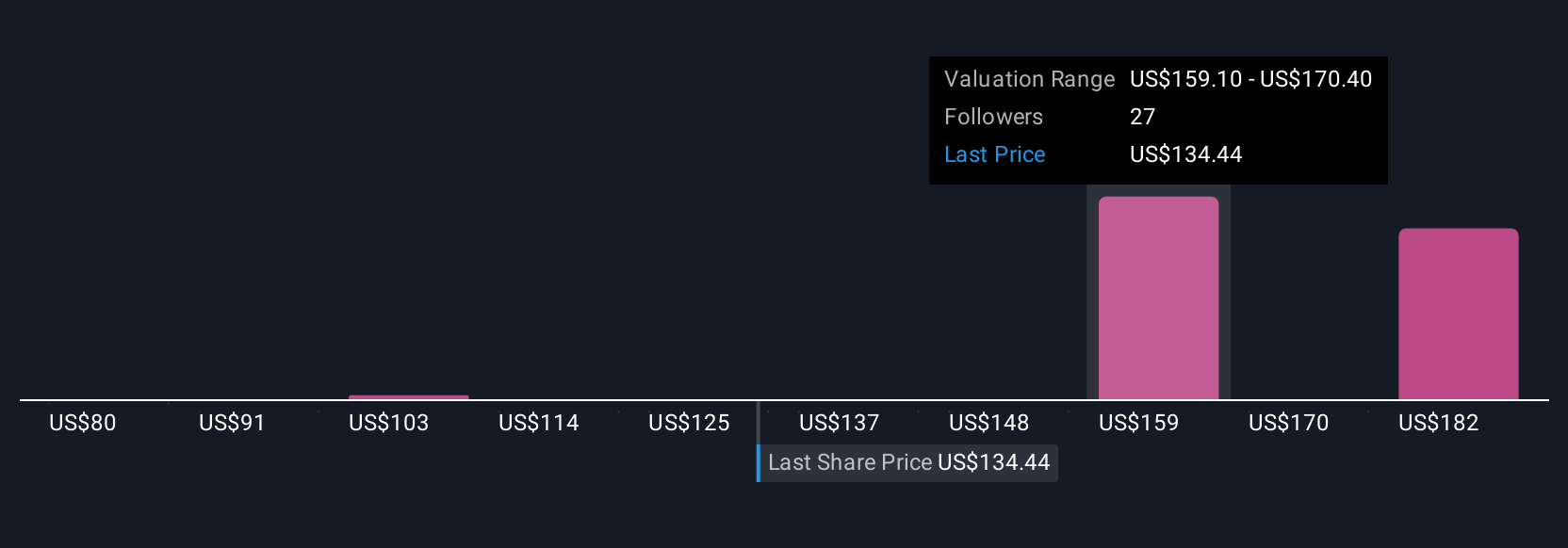

Upgrade Your Decision Making: Choose your Apollo Global Management Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about Apollo Global Management, shaped by your perspective on the company’s future and what you think its fair value should be, determined by your expectations for future revenue, earnings, and profit margins.

Narratives connect the dots between what’s happening in Apollo’s business and your financial forecast, giving you a personalized fair value that reflects your beliefs about where the company is headed. Unlike static models, Narratives are dynamic. When news or earnings come out, your scenario automatically updates, making it easy to stay current.

This approach is now simple and accessible on Simply Wall St’s Community page, used by millions of investors. Narratives show you how your fair value compares to the current share price, giving clear signals on how the company aligns with your view, rather than just the market’s mood.

For example, some investors see Apollo’s S&P 500 inclusion and global reach as a reason to target a bullish $178 fair value. Others, concerned about growth rates or industry risks, may estimate a fair value closer to $117. This shows that Narratives let you shape your investment strategy around your unique outlook.

Do you think there's more to the story for Apollo Global Management? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives