- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (APO): Fresh Valuation Perspective Following Multi-Billion Dollar 8VC Partnership Announcement

Reviewed by Simply Wall St

Apollo Global Management (APO) has teamed up with 8VC in a multi-billion dollar partnership targeting advanced manufacturing, infrastructure, and transformative technology sectors. This collaboration signals Apollo’s intent to support large-scale and high-growth businesses that are reshaping the U.S. economy.

See our latest analysis for Apollo Global Management.

Fresh off news of its multi-billion dollar partnership with 8VC, Apollo Global Management has seen its share price remain under pressure, down 25% year-to-date, as the broader firm juggles major portfolio moves and new leadership appointments. While short-term returns have lagged, Apollo’s three- and five-year total shareholder returns of 110% and 237% highlight how long-term holders have still been rewarded, even as recent momentum has faded.

If Apollo’s shifting strategy has you interested in new opportunities, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and long-term performance outpacing recent results, investors are left wondering: Is Apollo actually undervalued at these levels, or is the market already pricing in its future growth?

Most Popular Narrative: 21% Undervalued

With the most followed narrative estimating Apollo Global Management’s fair value at $158.22, the last close of $124.31 points to a major gap between market price and consensus value. The narrative’s optimism stands in sharp contrast to the recent market pullback, inviting questions about what is fueling such a bullish outlook.

The company’s strategic focus on the global industrial renaissance, particularly in areas like energy and infrastructure, is anticipated to significantly boost origination volumes, enhancing both revenue and earnings. Apollo’s expansion into retirement solutions and evolving products for guaranteed income, alongside legislative prospects, could stimulate strong growth in retirement inflows, positively impacting net margins.

Want to know what is behind this bullish price? The narrative builds on projections of explosive profit growth, a dramatic shift in product mix, and a game-changing margin story. Discovery of the specific forecasts and the bold assumptions in analyst consensus will surprise you. Find out what could be driving such a high fair value.

Result: Fair Value of $158.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or intensifying competition in the insurance space could challenge Apollo’s optimistic forecasts and put future earnings at greater risk.

Find out about the key risks to this Apollo Global Management narrative.

Another View: What Do the Market Ratios Say?

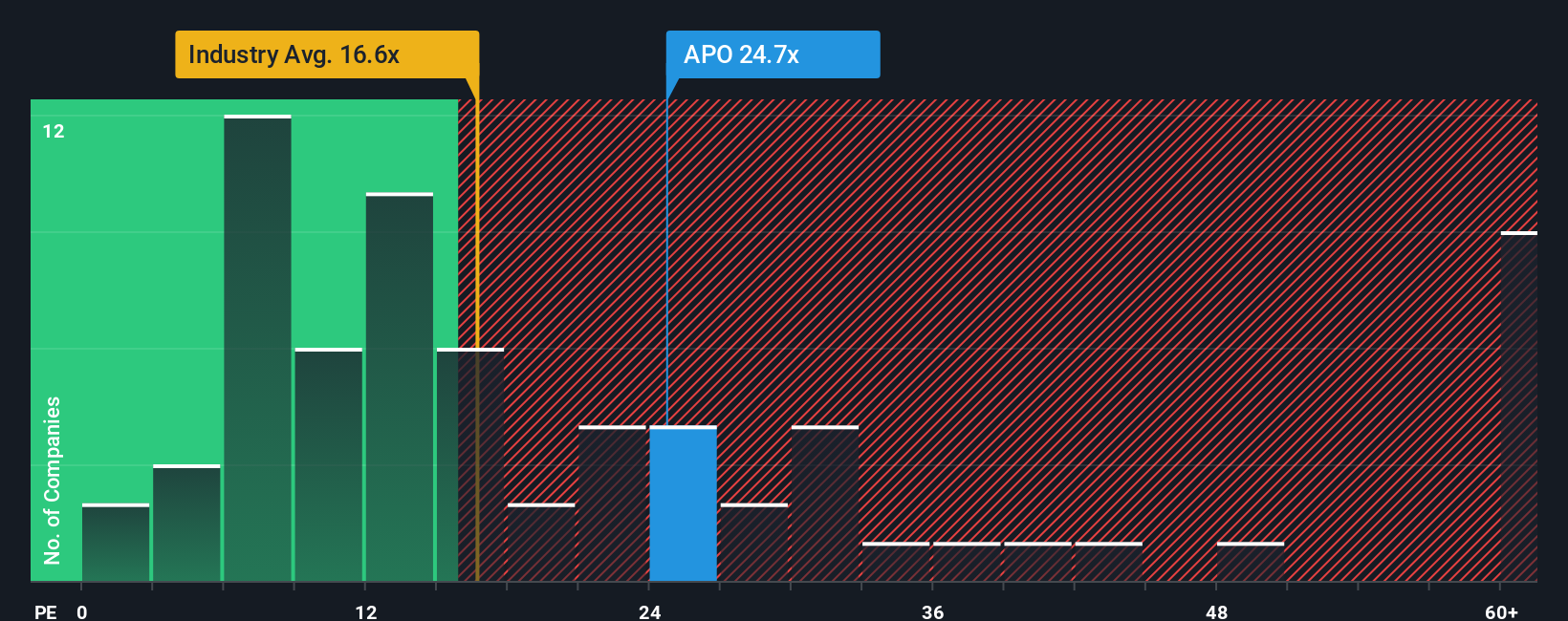

While the analyst consensus points to Apollo being undervalued, looking at the price-to-earnings ratio paints a more cautious picture. Apollo trades at 22.5x earnings, which is higher than both its peer average of 19.5x and the US Diversified Financials industry average of 15.1x. The fair ratio, based on regression analysis, is 24.9x. This means Apollo is still priced below where the market could move, but carries more risk if multiples revert.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Apollo Global Management Narrative

If you have a different take or want to dig into the numbers yourself, you can craft your own narrative for Apollo Global Management in just a few minutes, and Do it your way

A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not settle for just one opportunity when you could be building a portfolio of smart choices. The best strategies come from acting early and following the data.

- Capture reliable cash flows and set yourself up for long-term income by checking out these 22 dividend stocks with yields > 3%, which offers yields above 3%.

- Fuel your watchlist with unmatched growth by hunting for powerhouses among these 3588 penny stocks with strong financials that combine strong finances with high potential.

- Tap into the future of medicine by researching these 33 healthcare AI stocks at the intersection of artificial intelligence and healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives