- United States

- /

- Capital Markets

- /

- NYSE:AMG

Do AMG's Recent Affiliate Moves Reveal a Shift in Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Affiliated Managers Group recently announced it will report its third-quarter 2025 financial results on November 3, 2025, with leadership hosting a conference call to discuss performance and future expectations.

- In addition to scheduled earnings, AMG has made headlines through the announced sale of its interest in Comvest Partners’ private credit business and the acquisition of a minority stake in France-based Montefiore Investment, signaling shifts in its business portfolio.

- We'll examine how AMG's recent affiliate transactions and analyst optimism impact the company's investment narrative and future expectations.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Affiliated Managers Group Investment Narrative Recap

Owning Affiliated Managers Group shares means believing in AMG’s ability to balance growing its alternatives platform alongside continued headwinds in traditional active equity strategies. The upcoming third-quarter earnings release is likely to serve as the most important short-term catalyst; the recently announced affiliate transactions are interesting but are not expected to materially change the immediate risk of ongoing equity outflows and industry fee pressure.

Among recent developments, AMG’s decision to sell its interest in Comvest Partners’ private credit business stands out, as it directly refines the firm’s exposure to the alternative asset segment. While the move contributes to AMG’s strategic portfolio evolution, the core focus remains on whether alternative inflows and new affiliate growth can meaningfully offset equity outflows and margin compression in the short term.

However, investors should also keep in mind that persistent outflows from AMG’s traditional equity affiliates could quickly impact overall asset levels if...

Read the full narrative on Affiliated Managers Group (it's free!)

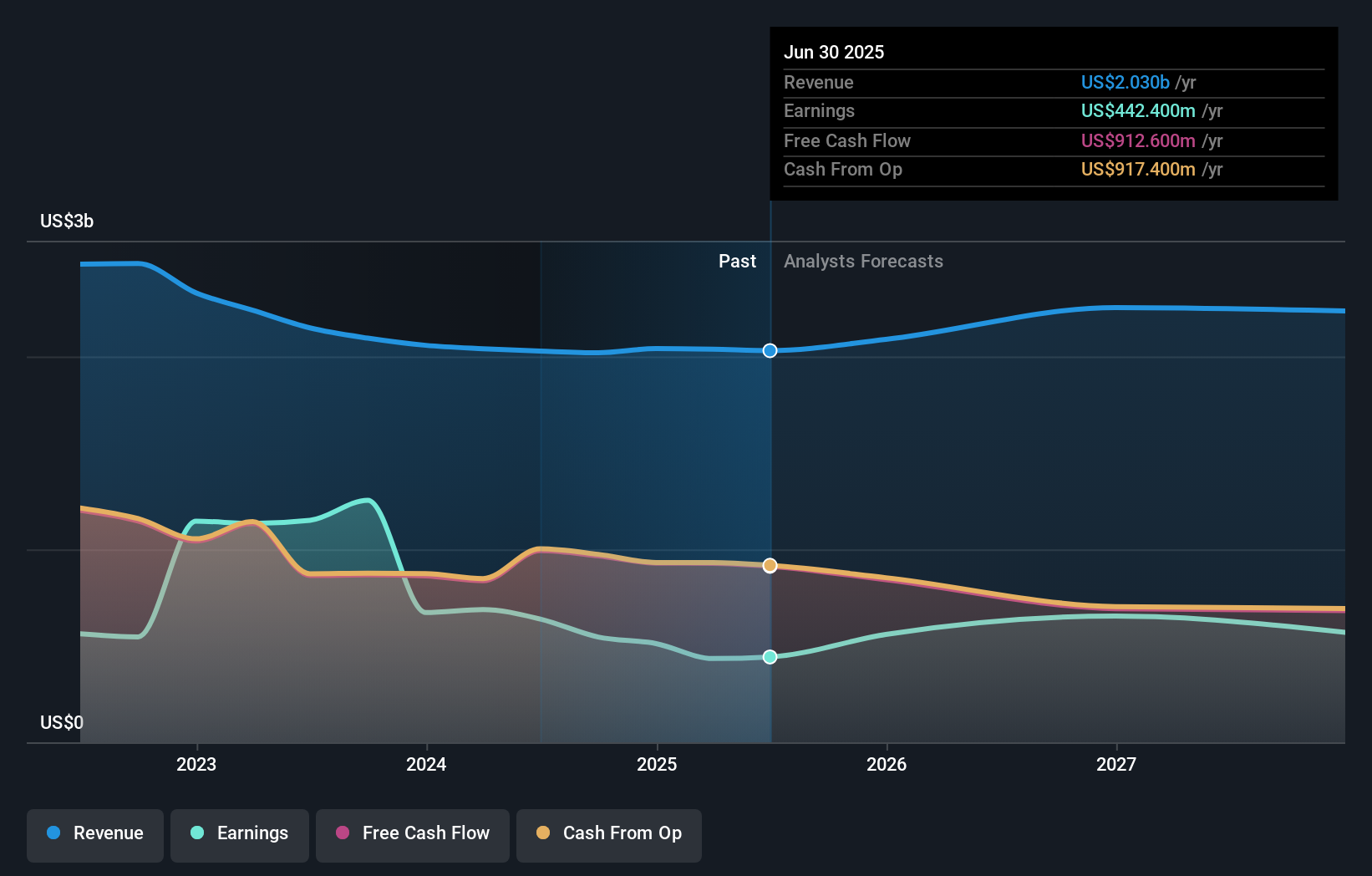

Affiliated Managers Group's narrative projects $2.2 billion revenue and $594.9 million earnings by 2028. This requires 2.7% yearly revenue growth and a $152.5 million earnings increase from the current $442.4 million.

Uncover how Affiliated Managers Group's forecasts yield a $288.71 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate AMG’s fair value between US$265.07 and US$288.71, with two detailed perspectives included. While many see solid value and future growth in alternatives, ongoing equity outflows highlight why views on AMG’s outlook differ widely, see more community insights for a broader view of possible company outcomes.

Explore 2 other fair value estimates on Affiliated Managers Group - why the stock might be worth as much as 21% more than the current price!

Build Your Own Affiliated Managers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affiliated Managers Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Affiliated Managers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affiliated Managers Group's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives