- United States

- /

- Capital Markets

- /

- NYSE:AMG

Alternative Credit Expansion and Brown Brothers Harriman Deal Might Change The Case For Investing In AMG

Reviewed by Sasha Jovanovic

- Affiliated Managers Group recently broadened its presence in private markets and liquid alternatives through four new partnerships and a key collaboration with Brown Brothers Harriman aimed at expanding alternative credit in the U.S. wealth sector.

- This shift toward growth areas supported strong client interest in alternatives, enabling AMG to counter softness in traditional asset categories and strengthen its earnings diversification.

- We will examine how this expansion into alternative credit, highlighted by the Brown Brothers Harriman partnership, shapes AMG’s investment narrative and growth prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Affiliated Managers Group Investment Narrative Recap

To be a shareholder in Affiliated Managers Group, you need to believe that alternative assets will play an increasingly important role in the investment world, helping the company offset pressure on traditional active equity products. The recent expansion into private markets, particularly through the Brown Brothers Harriman collaboration, reinforces this narrative and may influence near-term inflows, but does not fully address reliance on a handful of key affiliates, which remains a risk to earnings stability.

The headline partnership with Brown Brothers Harriman stands out for its potential to open up new revenue streams in alternative credit for AMG, which could support continued organic growth. However, while this aligns with short-term catalysts centered on surging client demand for private and structured credit, investors should keep a close watch on how successfully these new initiatives are integrated and scaled.

In contrast, ongoing earnings concentration among a few major boutiques points to a risk that investors should be aware of if...

Read the full narrative on Affiliated Managers Group (it's free!)

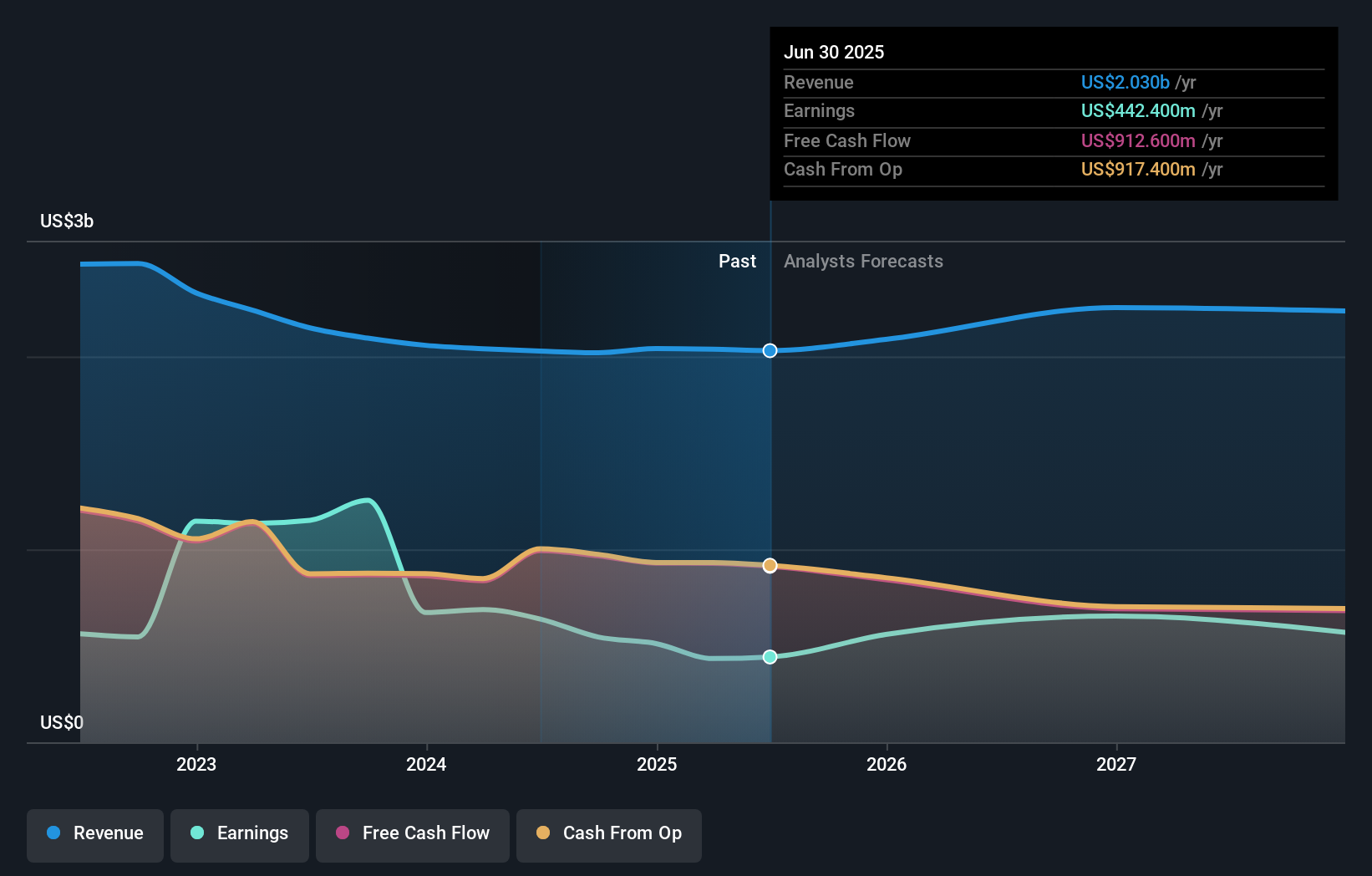

Affiliated Managers Group's narrative projects $2.2 billion revenue and $594.9 million earnings by 2028. This requires 2.7% yearly revenue growth and a $152.5 million earnings increase from $442.4 million.

Uncover how Affiliated Managers Group's forecasts yield a $308.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Two private investors in the Simply Wall St Community assigned fair values for AMG ranging from US$298.27 to US$308 per share. Activity around alternative assets is drawing fresh attention to AMG's future revenue mix, but you can find a wide array of opinions that reflect different views on the company's long-term resilience.

Explore 2 other fair value estimates on Affiliated Managers Group - why the stock might be worth just $298.27!

Build Your Own Affiliated Managers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affiliated Managers Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Affiliated Managers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affiliated Managers Group's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives