- United States

- /

- Capital Markets

- /

- NYSE:AMG

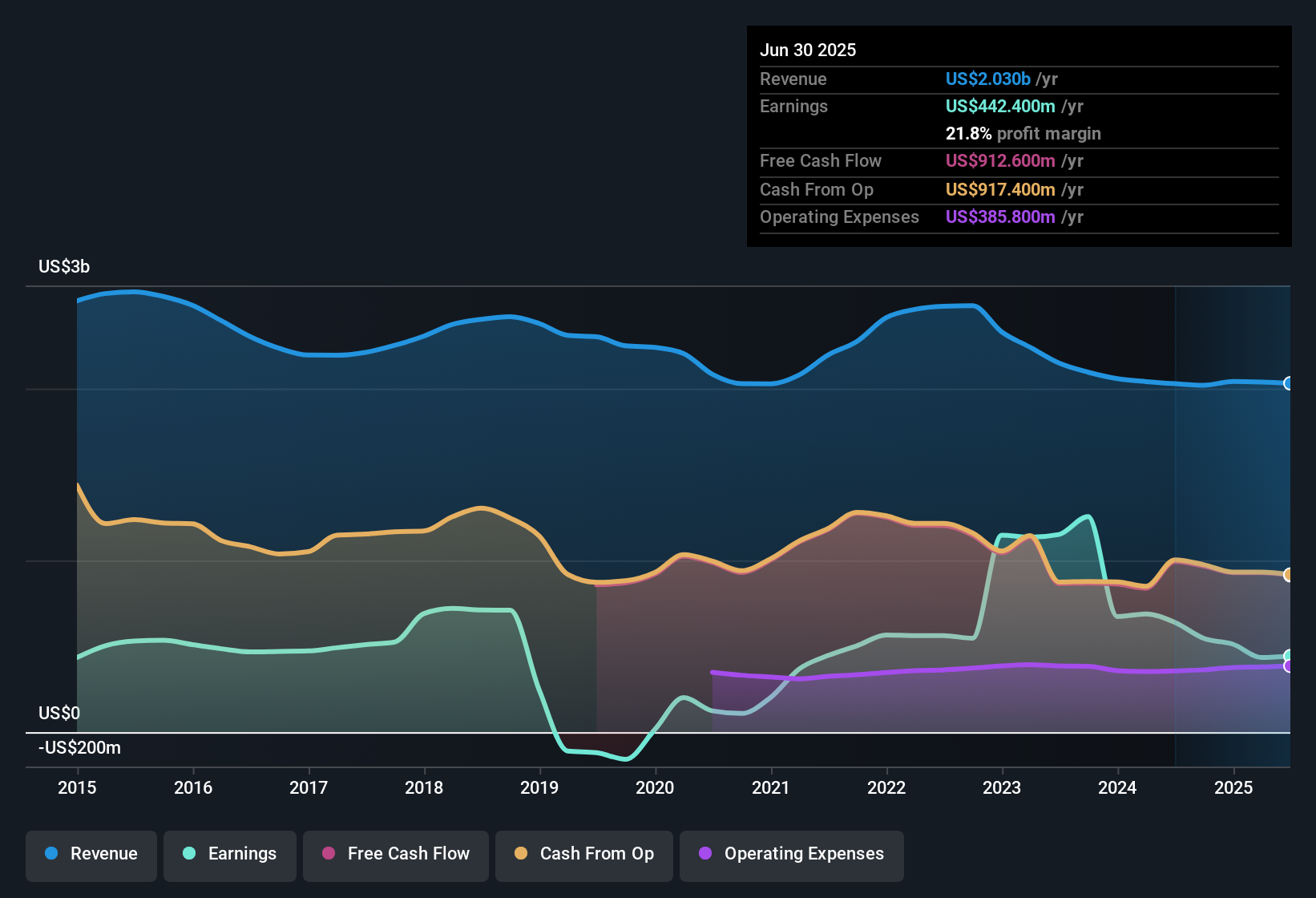

Affiliated Managers Group (AMG) Net Profit Margin Drops to 21.8%, Challenging Recent Value Narratives

Reviewed by Simply Wall St

Affiliated Managers Group (AMG) delivered a net profit margin of 21.8% for the period, down from 31.5% last year, while earnings have grown at an average annual rate of 14% over the past five years. Looking ahead, earnings are forecast to grow at 12.3% per year and revenue at 5.7% per year. Both metrics trail the broader US market’s pace. With shares trading slightly below estimated fair value and high-quality earnings supporting the story, questions around profit margin direction are likely to remain front and center for investors.

See our full analysis for Affiliated Managers Group.Now, let’s see how AMG’s results line up with the commonly held market narratives, and where expectations could be set for a reality check.

See what the community is saying about Affiliated Managers Group

Alternative Assets Up 20% in 6 Months

- AMG increased its alternative assets under management by 20% over the last six months, marking its strongest organic growth quarter in 12 years.

- Analysts' consensus view: robust affiliate performance and rising demand for specialized, higher-fee alternative strategies support future net margin improvement and help insulate revenue from fee compression.

- This surge in alternatives is expected to drive both revenue growth and higher net margins as more premium fees are generated through affiliates like AQR.

- Still, the gains are partly offset by ongoing outflows in traditional equity strategies and rising concentration risk among a few large affiliates.

- Consensus narrative notes that record inflows and a deep pipeline of new partnerships position AMG for margin expansion and long-term earnings stability, especially as private markets drive higher fee rates.

📊 Read the full Affiliated Managers Group Consensus Narrative.

Analyst Price Target Just 12.5% Above Current Price

- With the current share price at $256.56, the analyst price target of $288.71 is only 12.5% higher, indicating expectations of modest upside.

- Analysts' consensus view: this relatively tight gap reflects their belief that AMG's valuation already prices in growth forecasts, with consensus expecting revenue of $2.2 billion and earnings of $594.9 million by 2028.

- To align with the consensus price target, AMG would need to reach a PE ratio of 12.8x on expected 2028 earnings, substantially below the current US Capital Markets industry average of 26.7x.

- Even with analyst optimism about affiliate-driven growth, modest upside to the target price suggests a balanced outlook that weighs both rewards and risks.

Profit Margin Seen Rebounding to 27% by 2028

- Analysts estimate AMG's net profit margin will improve from 21.8% today to 27.0% within three years, reversing the recent decline seen in 2023.

- Analysts' consensus view: margin rebound hinges on expanding high-fee alternative strategies and continued cost discipline, but risks remain due to concentration in key affiliates and volatility in private markets fundraising.

- Although margin recovery is expected, persistent outflows from traditional strategies and pricing pressure could limit gains if alternative segment growth slows.

- This creates a tug-of-war between margin tailwinds from affiliate expansion and potential headwinds from industry-wide trends toward passive, lower-cost investing.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Affiliated Managers Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on the figures? In just a few minutes, you can build and share your own perspective. Do it your way

A great starting point for your Affiliated Managers Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite progress in alternatives and prospects for margin recovery, AMG faces lingering risks from volatile profit margins, continued outflows in traditional strategies, and below-market revenue growth forecasts.

If steadier results matter most to you, use stable growth stocks screener (2087 results) to target companies that consistently deliver reliable earnings and revenue, regardless of the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives