- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Did Record Q3 Earnings and Capital Raise Just Shift Farmer Mac’s (AGM) Growth Narrative?

Reviewed by Sasha Jovanovic

- Federal Agricultural Mortgage Corporation reported record third-quarter 2025 earnings, achieving US$55 million in net income and reinforcing its growth in renewable energy and infrastructure finance, while also declaring quarterly dividends for both common and preferred shareholders.

- Issuance of US$100 million in new preferred stock has further strengthened the company's capital position and supported an improved Tier 1 capital ratio of 13.9%.

- We’ll consider how the continued expansion in infrastructure and renewable energy finance impacts Farmer Mac’s longer-term growth outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Federal Agricultural Mortgage Investment Narrative Recap

To be a shareholder in Federal Agricultural Mortgage Corporation, you need to believe in the company’s unique position serving agricultural and rural infrastructure finance as well as its drive to expand into renewable energy and broadband segments. The recent record earnings and dividend declarations reinforce Farmer Mac’s ability to generate consistent income, but they do not materially change the near-term risk of regulatory uncertainty facing its renewable energy portfolio or alter the biggest catalyst, which continues to be portfolio diversification.

The most relevant news is the board’s affirmation of dividends for both common and preferred shareholders, highlighting management’s ongoing commitment to rewarding capital providers even as Farmer Mac invests in growth areas like renewable energy and infrastructure finance. This dividend consistency, alongside growth in key segments, remains important for investor confidence, especially as broader market and regulatory risks persist.

On the flip side, investors should be aware that changes to renewable energy tax credits or permitting processes could quickly shift the outlook for…

Read the full narrative on Federal Agricultural Mortgage (it's free!)

Federal Agricultural Mortgage is projected to reach $514.9 million in revenue and $239.2 million in earnings by 2028. This outlook implies an annual revenue growth rate of 11.8% and a $52.9 million increase in earnings from the current $186.3 million.

Uncover how Federal Agricultural Mortgage's forecasts yield a $226.00 fair value, a 39% upside to its current price.

Exploring Other Perspectives

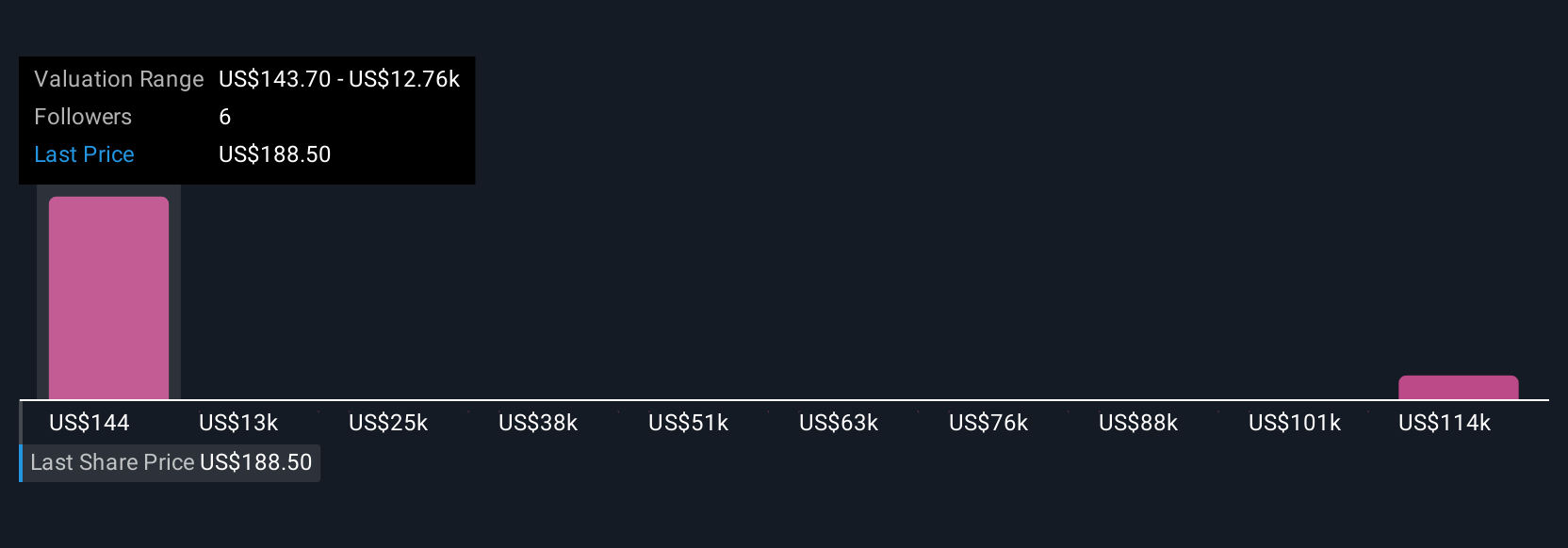

Simply Wall St Community members provided five fair value estimates for Farmer Mac, with projections ranging from US$138.59 up to US$126,258.88. While many see potential from ongoing expansion into renewable energy finance, others remain cautious given how regulatory risks could impact the company’s future performance.

Explore 5 other fair value estimates on Federal Agricultural Mortgage - why the stock might be worth 15% less than the current price!

Build Your Own Federal Agricultural Mortgage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Federal Agricultural Mortgage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Agricultural Mortgage's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and good value.

Market Insights

Community Narratives