- United States

- /

- Mortgage REITs

- /

- NYSE:ABR

Should You Revisit Arbor Realty Trust After Its 17% Drop This Week?

Reviewed by Bailey Pemberton

- Wondering if Arbor Realty Trust is a bargain or an opportunity you might regret missing? You are not alone in thinking about whether now is the right time to dive in or hold off.

- The stock has seen some wild moves lately, dropping 17.1% in just the past week and 30.6% for the year so far. This signals that investor sentiment and perceived risk are shifting.

- Headlines have been buzzing with discussions of the broader commercial real estate market’s uncertainty and changing interest rate expectations. Both of these factors have clearly played into Arbor’s recent market swings. For example, analysts have highlighted regulatory updates and evolving loan market dynamics, both of which are relevant to Arbor’s business and current stock volatility.

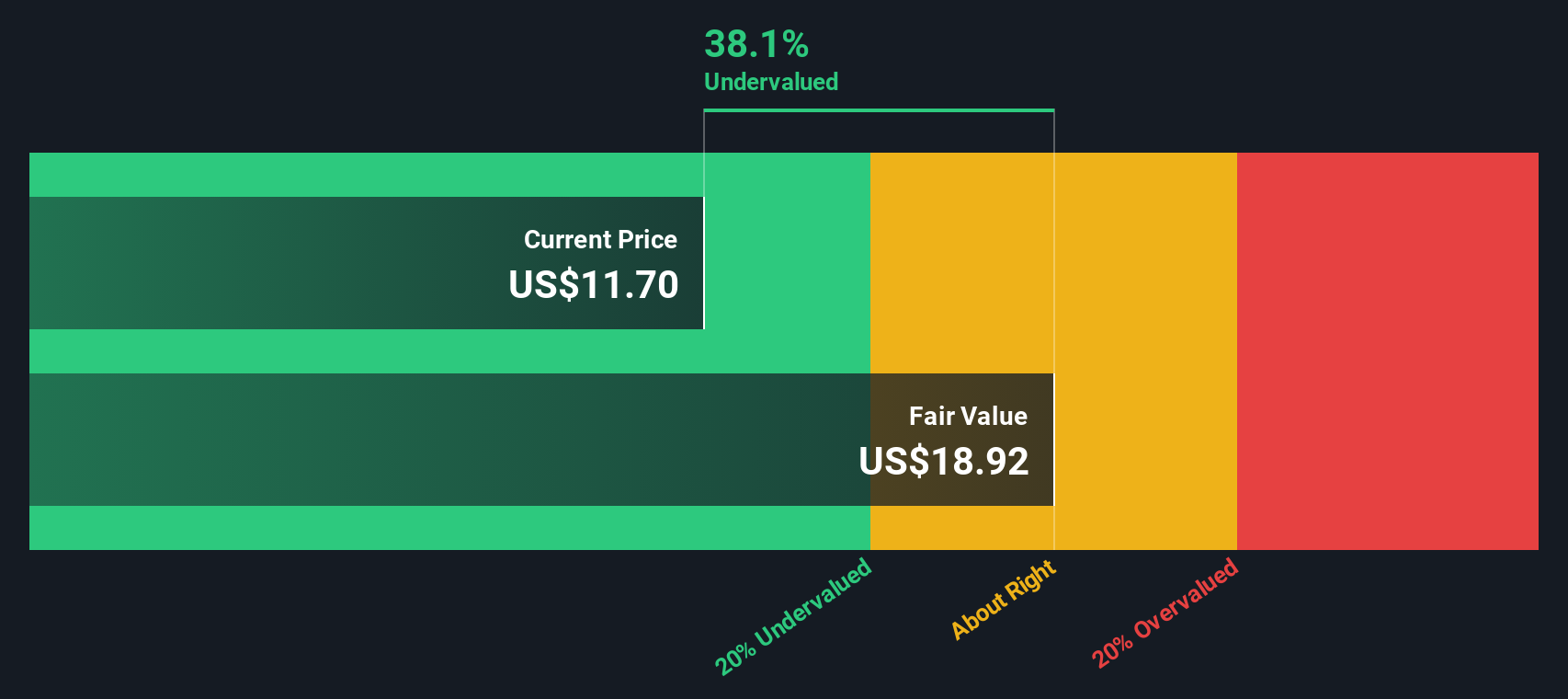

- Despite all the noise, Arbor Realty Trust clocks in with a strong 5 out of 6 valuation score, which means it is undervalued by most of the checks we run. Up next, we will break down how that score stacks up from multiple valuation angles. There is an even more insightful perspective you will want to stick around for at the end.

Find out why Arbor Realty Trust's -28.3% return over the last year is lagging behind its peers.

Approach 1: Arbor Realty Trust Excess Returns Analysis

The Excess Returns valuation approach focuses on how well a company generates returns on invested capital above its cost of equity. Instead of only looking at earnings or cash flows, this method evaluates whether Arbor Realty Trust creates real value beyond what shareholders could earn elsewhere at similar risk.

Arbor currently has a Book Value of $12.08 per share. On a stable basis, it earns $1.34 per share, which is calculated from the median Return on Equity over the past five years. The cost of equity is $1.05 per share, leaving an excess return of $0.29 per share. This suggests Arbor has historically delivered on its investments, with an average Return on Equity of 11.21%.

Looking ahead, analysts expect the stable Book Value to be $11.93 per share, based on the weighted future estimates of three analysts. These numbers reflect a consistent outlook for Arbor’s financial foundation and earnings potential.

The Excess Returns model estimates the intrinsic value of Arbor Realty Trust at $16.95 per share. With the current share price significantly below this level, the model implies the stock is 43.5% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Arbor Realty Trust is undervalued by 43.5%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Arbor Realty Trust Price vs Earnings

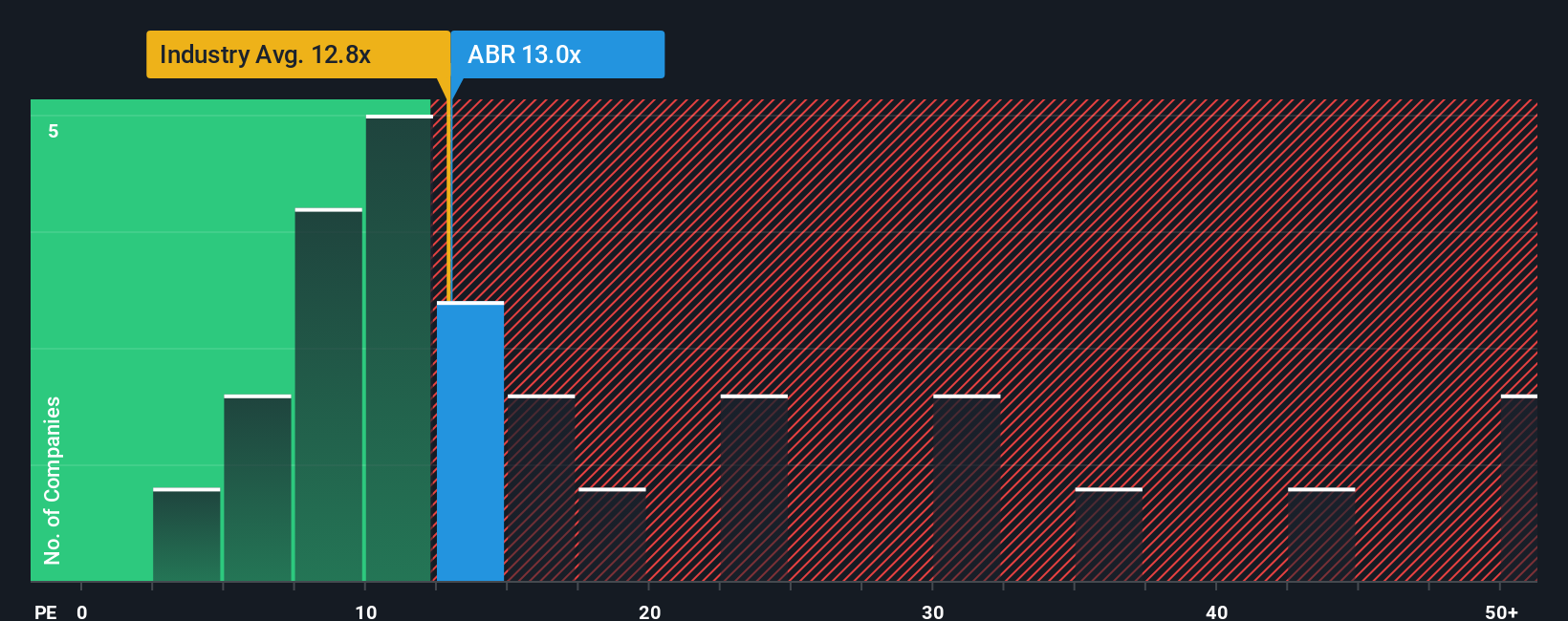

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is a popular and practical way to gauge whether a stock is attractively valued. The PE ratio reflects how much investors are willing to pay for each dollar of earnings, and it is most meaningful when a business has a solid earnings record, as Arbor Realty Trust does.

Growth prospects and risk levels play a major part in determining what qualifies as a “normal” or “fair” PE ratio. Fast-growing companies or those seen as less risky often command higher PE multiples, while slower-growing or riskier businesses tend to trade at lower ones.

Arbor Realty Trust is trading on a PE ratio of 12.27x right now. This stacks up closely against the average for Mortgage REITs, which is 12.45x, and nearby peers, which are at 13.10x. These numbers suggest that Arbor is trading roughly in line with the general market expectations for its sector.

Simply Wall St’s proprietary Fair Ratio for Arbor clocks in at 13.59x. This metric goes deeper than basic peer or industry averages, as it also factors in Arbor’s earnings growth, profit margins, risk profile, market cap, and the unique circumstances of its industry. It tailors the expectation to Arbor’s specific outlook, so the Fair Ratio provides a more customized view of what investors might justifiably pay for the stock.

Comparing the Fair Ratio of 13.59x to Arbor’s current PE of 12.27x, the valuation looks attractively discounted, suggesting the stock may be undervalued by this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arbor Realty Trust Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives, a feature on Simply Wall St that helps you look beyond the numbers and craft or follow a story tied to Arbor Realty Trust’s future.

A Narrative is an easy-to-use tool that allows you to translate your perspective on a company by considering its outlook, opportunities, and risks directly into a financial forecast, and then see what that suggests for fair value. Instead of just crunching numbers, you can connect your understanding of Arbor’s story, including expected revenue, earnings, and profit margins, to arrive at a fair value estimate that reflects your unique view.

This approach is dynamic and accessible. Thanks to millions of investors in the Simply Wall St Community page, it is now easier than ever to compare and shape Narratives as new news or earnings data arrives. Narratives help investors make smarter decisions by highlighting whether their fair value is above or below the current price, making it clearer when to consider buying or selling.

For Arbor Realty Trust, some investors expect significant recovery and assign a fair value as high as $15.00 per share, while others are more cautious with estimates as low as $10.50. This difference reflects how your story and your Narrative truly matter.

Do you think there's more to the story for Arbor Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABR

Arbor Realty Trust

Invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives