- United States

- /

- Capital Markets

- /

- NYSE:AB

New ETF Launches and Industry Award Might Change The Case For Investing In AllianceBernstein (AB)

Reviewed by Sasha Jovanovic

- AllianceBernstein Holding L.P. and AllianceBernstein L.P. recently launched two actively managed ETFs, the AB New York Intermediate Municipal ETF (NYM) and the AB Core Bond ETF (CORB), on the New York Stock Exchange, with Jane Street as Lead Market Maker.

- The launch was accompanied by industry recognition, as AllianceBernstein’s municipal platform received the Money Management Institute/BarBarron’s 2025 Asset Manager of the Year award for the retail advisory segment, highlighting the firm’s focus on client outcomes and innovation in fixed income solutions.

- Next, we’ll consider how the new ETF offerings and industry award could strengthen AllianceBernstein’s position in actively managed bond products.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

AllianceBernstein Holding Investment Narrative Recap

To be confident in AllianceBernstein Holding, investors must see long-term value in its broad expansion of actively managed fixed income solutions, especially as traditional product lines face fee compression and industry competition. The launch of two new bond ETFs may help solidify the firm’s fixed income presence but is unlikely to materially offset the most important near-term catalyst: net inflows to high-fee asset classes remain central. The biggest risk, persistent institutional equity outflows, remains unresolved by this launch.

Among recent announcements, the October debut of the AB California Intermediate Municipal ETF (CAM) is most directly related. Like the newest New York and Core Bond ETFs, these product additions target demand for actively managed municipal and core bond strategies, signaling a commitment to capturing inflows amid margin pressures in other parts of the business.

On the other hand, investors should be aware that increased competition and ongoing fee compression in fixed income could...

Read the full narrative on AllianceBernstein Holding (it's free!)

AllianceBernstein Holding's outlook anticipates $5.5 billion in revenue and $431.8 million in earnings by 2028. This scenario assumes a 245.2% annual revenue growth rate and a $34.7 million increase in earnings from current earnings of $397.1 million.

Uncover how AllianceBernstein Holding's forecasts yield a $40.43 fair value, a 3% upside to its current price.

Exploring Other Perspectives

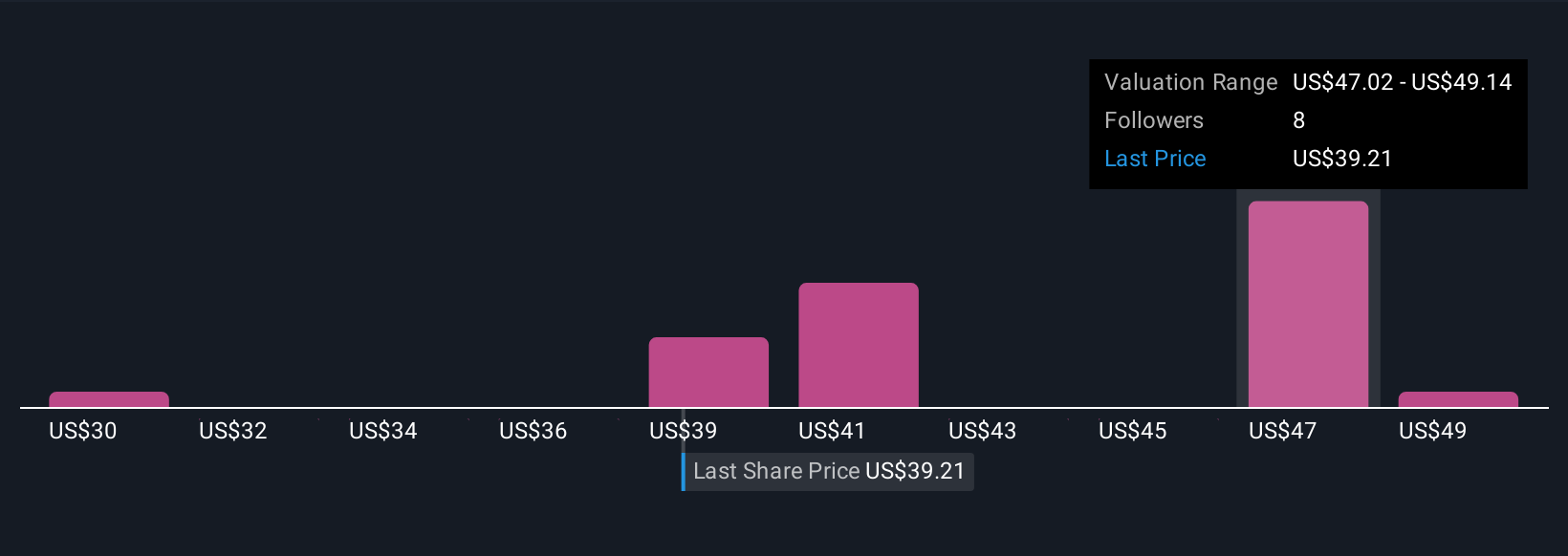

Simply Wall St Community members see fair value ranging from US$30 to US$51.27 across four estimates. While product launches support the fixed income franchise, competition and fee pressures offer plenty for you to weigh as you compare diverse community outlooks.

Explore 4 other fair value estimates on AllianceBernstein Holding - why the stock might be worth 23% less than the current price!

Build Your Own AllianceBernstein Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AllianceBernstein Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AllianceBernstein Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AllianceBernstein Holding's overall financial health at a glance.

No Opportunity In AllianceBernstein Holding?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives