- United States

- /

- Capital Markets

- /

- NYSE:AB

AllianceBernstein Holding’s Valuation: Assessing New ETF Launches and Recent Industry Accolades

Reviewed by Simply Wall St

AllianceBernstein Holding (AB) has just debuted two new actively managed ETFs: the AB New York Intermediate Municipal ETF and AB Core Bond ETF, on the New York Stock Exchange, signaling an effort to broaden its investment lineup. The firm also received the Asset Manager of the Year award, generating buzz about its commitment to client outcomes.

See our latest analysis for AllianceBernstein Holding.

With AllianceBernstein Holding’s recent ETF launches and industry recognition sparking fresh interest, the market’s response has been steady. The share price is up 6.4% year to date, and over the past year, the total shareholder return reached a robust 15.9%, suggesting that longer-term momentum is building even as the share price saw minor short-term shifts.

If you’re weighing your next investment move, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading just below analyst price targets and showing strong long-term returns, is AllianceBernstein Holding an undervalued pick for forward-looking investors, or has the market already factored in the firm's future growth?

Price-to-Earnings of 11.1x: Is it justified?

AllianceBernstein Holding is trading at a price-to-earnings ratio of 11.1x, which is much lower than both its peer average of 30.8x and the U.S. Capital Markets industry average of 23.7x. At the last close price of $39.42, the stock appears attractively valued on this basis.

The price-to-earnings (P/E) ratio helps investors compare a company’s share price to its per-share earnings, providing a snapshot of how much the market is paying for each dollar of earnings. A lower P/E can imply that the stock is undervalued, provided there are no major earnings quality concerns.

In AllianceBernstein Holding’s case, its P/E ratio not only undercuts industry norms but is also below its estimated fair P/E ratio of 11.8x. The market may move toward this level if sentiment rises or fundamentals improve.

Result: Price-to-Earnings of 11.1x (UNDERVALUED)

Explore the SWS fair ratio for AllianceBernstein Holding

However, slow net income growth and recent minor share price declines suggest that potential headwinds could still weigh on AllianceBernstein Holding’s outlook.

Find out about the key risks to this AllianceBernstein Holding narrative.

Another View: What Does the SWS DCF Model Say?

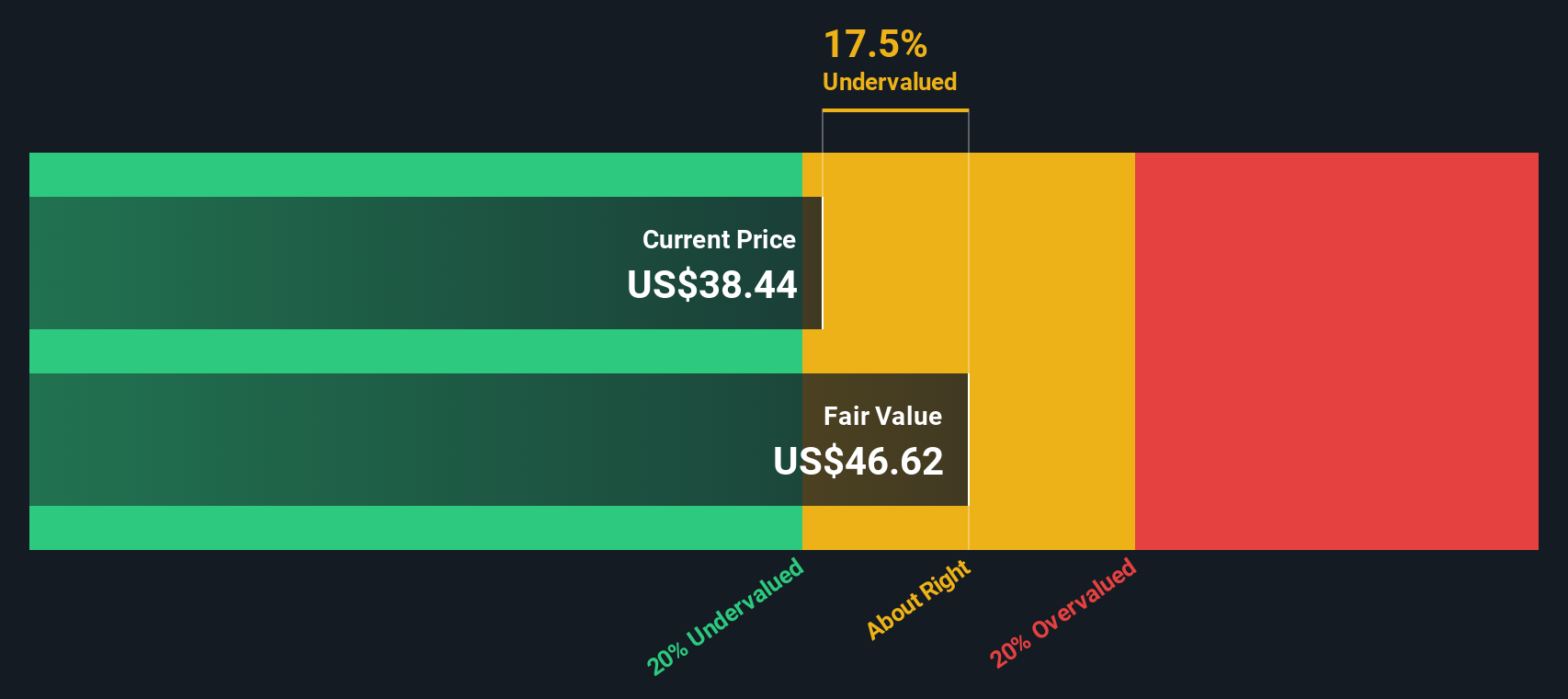

For a different perspective, our DCF model suggests AllianceBernstein Holding could be worth $47.42 per share, about 16.9% higher than its current price. This indicates even more upside than the low price-to-earnings ratio suggests. Could this model be identifying value the market is overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AllianceBernstein Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AllianceBernstein Holding Narrative

If you would rather analyze the numbers for yourself or think there’s more to the story, you can quickly build your own perspective in just a few minutes. Do it your way

A great starting point for your AllianceBernstein Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Searching for More Winning Opportunities?

Don’t let your portfolio settle when standout investment ideas are just a click away. Unlock tomorrow’s potential by checking out these hand-picked stock lists today:

- Capture cash flow advantages as you scan for opportunities among these 898 undervalued stocks based on cash flows that the market may be overlooking right now.

- Tap into strong income plays by reviewing these 15 dividend stocks with yields > 3% with reliable yields above 3% and solid fundamentals.

- Ride the next technology wave by examining these 30 healthcare AI stocks reshaping the future of medicine with smart AI innovation and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives