- United States

- /

- Capital Markets

- /

- NYSE:AAMI

Will Acadian Asset Management's (AAMI) Dividend and Downgrade Shift Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

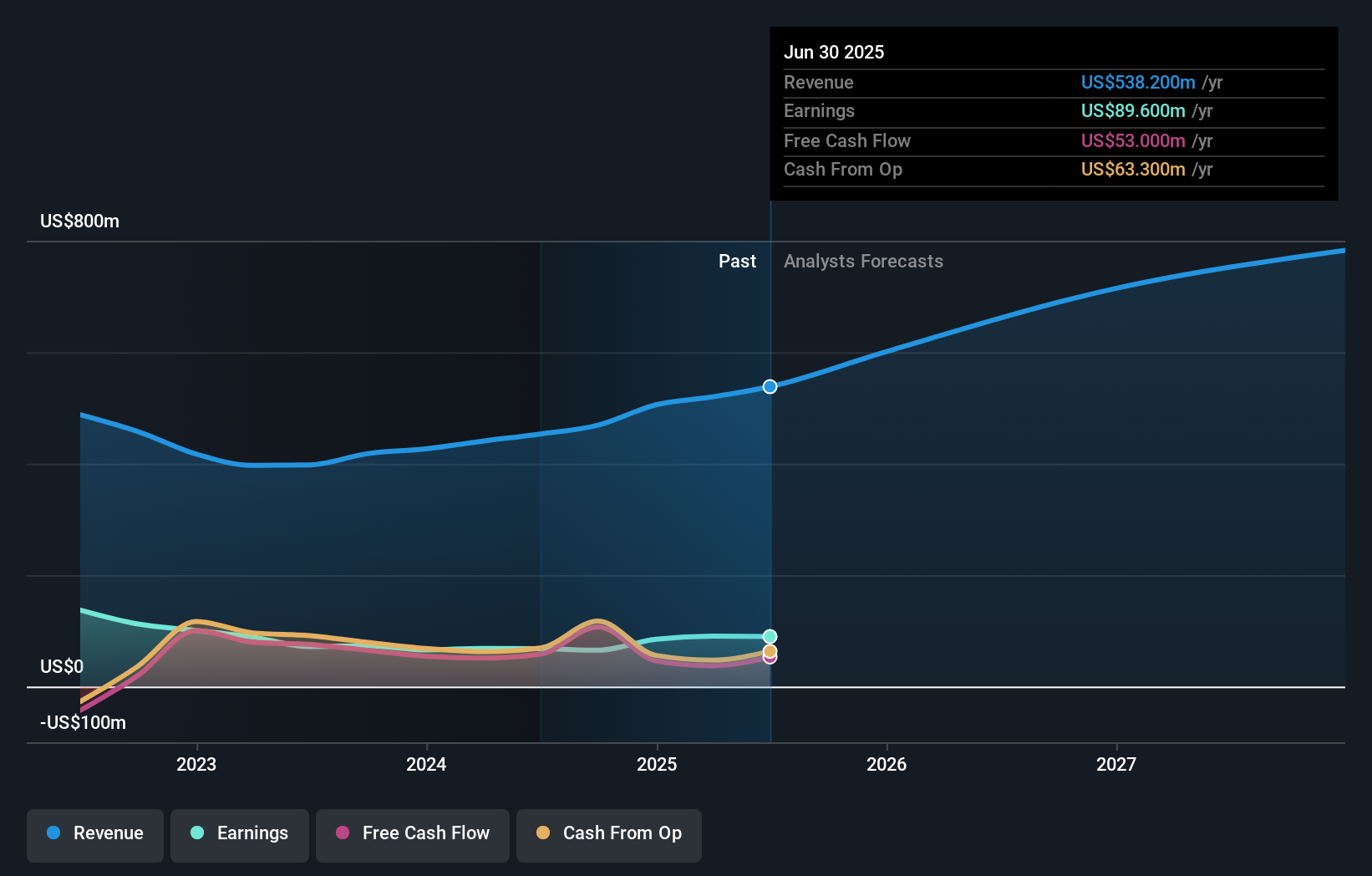

- Earlier this week, Acadian Asset Management Inc. reported third-quarter net income of US$15.1 million and announced the payment of a quarterly dividend to stockholders in late September.

- This update came shortly before Weiss Ratings downgraded its outlook from buy to hold, with broader analyst sentiment ranging from hold to positive as the company disclosed approximately US$166 billion in assets under management at quarter's end.

- In light of the recent ratings downgrade, we’ll explore how the third-quarter results shape Acadian Asset Management’s current investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Acadian Asset Management's Investment Narrative?

To remain confident in Acadian Asset Management today, an investor needs to see value in the firm's core ability to grow revenue consistently while balancing the risks of fluctuating earnings and high leverage. The latest third-quarter update, us$15.1 million in net income and a reaffirmed dividend, should generally be seen as supportive of the company's narrative of stability and shareholder rewards. However, the Weiss Ratings shift to a hold rating may put a temporary spotlight on near-term issues, such as ongoing margin pressure or the impact of debt on returns, which had not been fully reflected in earlier consensus price targets and prior upbeat analysis. Despite a remarkable run-up in share price over the year, the recent news is unlikely to be a material shift for most major short-term catalysts, namely revenue growth trends and capital return initiatives. Still, there is a renewed reason to keep an eye on how future quarters reflect the expected balance between revenue growth and risk management.

But beneath the headlines, debt exposure remains a key risk investors should not ignore. Acadian Asset Management's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Acadian Asset Management - why the stock might be worth less than half the current price!

Build Your Own Acadian Asset Management Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Acadian Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadian Asset Management's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives