- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Tradeweb (TW) Margin Upside Reinforces Bullish Narratives Despite Stretched Valuation

Reviewed by Simply Wall St

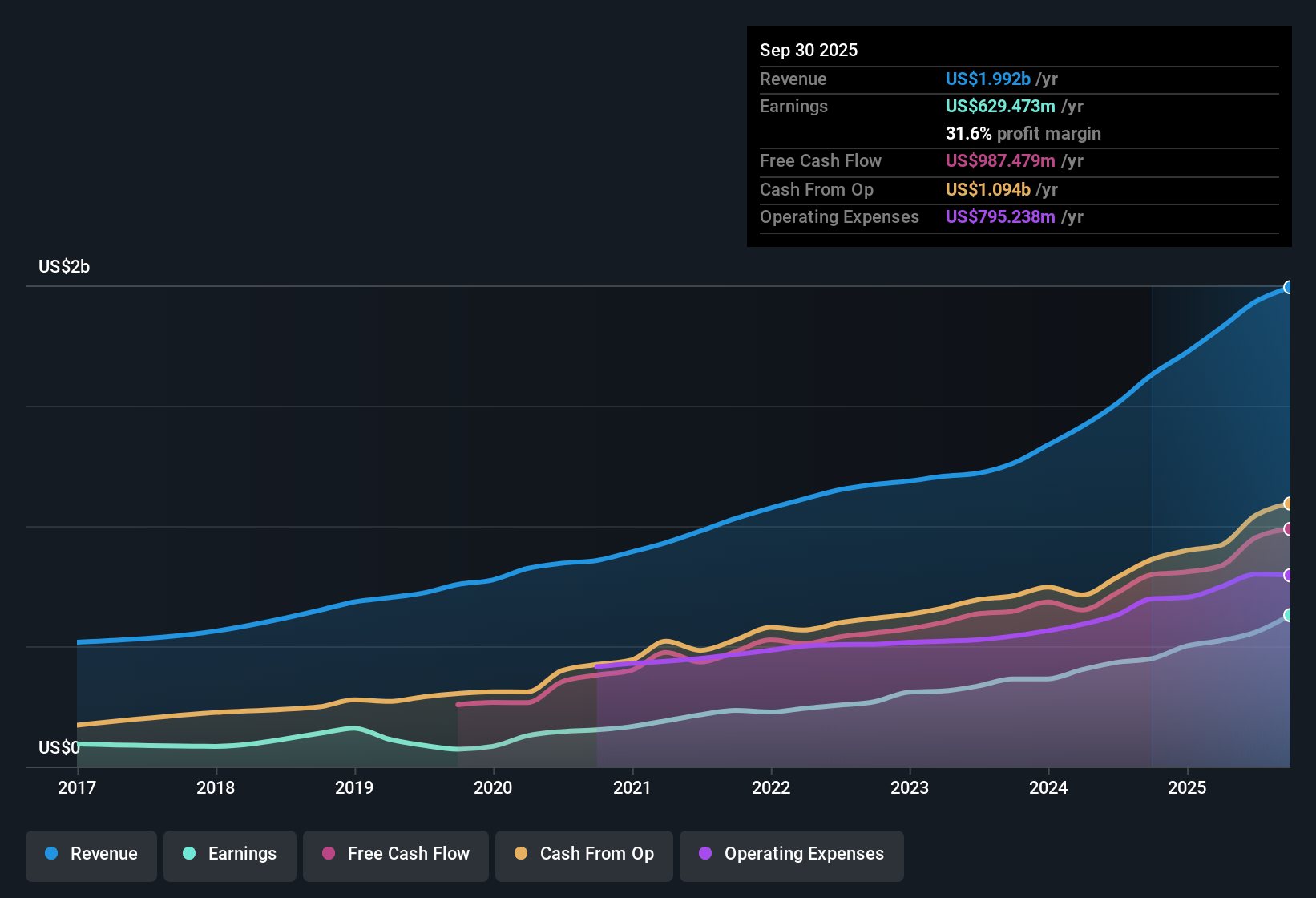

Tradeweb Markets (TW) delivered a net profit margin of 28.9%, up from last year’s 28.7%, with annual earnings growth running at a stellar 28.9%, beating its impressive five-year average of 24.8%. Looking forward, earnings are forecast to rise by 14.04% per year and revenue by 9.1% annually. However, both figures are set to trail the broader US market pace. With margins remaining resilient and profits accelerating, the latest results highlight operational quality. Investors may take note of the high Price-To-Earnings ratio, which stands well above peer and industry standards.

See our full analysis for Tradeweb Markets.The next section puts these results up against the current narratives on Tradeweb, highlighting where the numbers reinforce market sentiment and where surprises might emerge.

See what the community is saying about Tradeweb Markets

Recurring Revenue Streams Gain Momentum

- International revenue jumped 41% year-on-year, with emerging market swaps revenue climbing over 40%. This outpaced the core US growth rate and indicates where Tradeweb is expanding fastest.

- Analysts' consensus view suggests the increasing share of high-margin, recurring fees from global expansion, electronic trading, and platform integration provides more defensible and scalable earnings compared to reliance on variable, transaction-based revenue lines.

- Consensus highlights workflow automation and integration with major OMS/EMS systems (such as Aladdin), as well as new digital asset initiatives, as catalysts for sticky, recurring subscription fees that support margin durability through market cycles.

- Record electronic trading volumes and broader international adoption add resilience, reducing over-dependence on any single geography or client segment.

Analysts contend that this stronger growth in higher-margin, recurring revenue gives Tradeweb additional tools to weather market shifts compared to some rivals.

📊 Read the full Tradeweb Markets Consensus Narrative.Fee Compression and Margin Risks Surface

- Fee per million is under pressure in flagship products, as dealer migration from variable to fixed fee plans, along with a shift away from higher-fee retail activity, is squeezing net margins and moderating the historical pace of transaction-based revenue growth.

- According to the analysts' consensus view, what is notable is the way management is balancing the positives of expanding global and electronic platforms with caution around drivers that could erode future profitability.

- Increased investment in technology and people, combined with industry consolidation and direct connectivity trends among major clients, is expected to slow EBITDA margin expansion even as revenues grow. This is a key point of tension in the consensus case.

- Downward pressure on traditional fee streams and intensifying competition from both established peers and fintech entrants present meaningful risks to maintaining or increasing market share in core segments.

Stretched Valuation Versus Industry Benchmark

- The company’s Price-To-Earnings ratio is 39.8x, which is well above the peer average of 27.6x and the sector average of 25.2x. It also stands notably higher than the DCF fair value of $62.23 when compared to the current share price of $104.15.

- Analysts' consensus view underlines the valuation gap as a point of ongoing debate, especially with the analyst price target at $133.33, which is about 28% above the last share price.

- Consensus points out that for the current valuation to be justified, Tradeweb would need earnings to rise to $917.7 million (EPS of $3.70) by September 2028 with the company trading at an even higher PE of 49.5x, significantly above the broader industry multiple of 26.7x.

- This sets a high hurdle for further upside, given that profits and revenue are projected to grow at slower rates than the US market average. As a result, valuation remains a core sticking point for investors considering entry today.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tradeweb Markets on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your insights and craft a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tradeweb Markets.

See What Else Is Out There

Tradeweb’s valuation remains stretched compared to sector benchmarks, with slower forecasted profit and revenue growth setting a high bar for continued upside.

Worried about overpaying for potential? Shift your focus to these 837 undervalued stocks based on cash flows to uncover opportunities where current prices offer greater long-term value for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives