- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Tradeweb Markets (TW): Is the Current Valuation an Opportunity After a Period of Steady Trading?

Reviewed by Kshitija Bhandaru

See our latest analysis for Tradeweb Markets.

Tradeweb Markets’ share price has taken a breather lately, but the bigger story is a year-to-date decline of 17.2%, with momentum still fading after a challenging few months. Even with a strong three-year total shareholder return of 103%, recent performance suggests investors have become more cautious about growth and valuation as the stock retraces some gains.

If you’re weighing your next move, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors asking, after a sharp pullback, is Tradeweb’s current valuation a bargain, or does the recent price reflect more cautious expectations for future growth? Is this a buying opportunity, or is everything already priced in?

Most Popular Narrative: 26% Undervalued

Tradeweb Markets is trading well below the widely followed fair value estimate of $147.47, with the last close at $108.77. The numbers behind this valuation suggest much higher expectations for future profitability and platform growth than the stock currently reflects.

Tradeweb is poised to benefit from the ongoing migration of fixed income and derivatives trading from manual and voice channels to electronic platforms. This shift is evidenced by record electronic trading volumes and expanding adoption of automated tools like AiEX and Portfolio Trading. These developments can drive sustained transaction growth and fee revenue expansion.

Curious about what’s powering such a bold valuation target? This narrative leans on some blockbuster growth assumptions, ambitious profit expansions, and a premium earnings multiple that’s higher than most competitors. The real surprises are in the granular projections for future margins, recurring revenue, and industry leadership, but you’ll have to see the full story for the numbers driving that optimism.

Result: Fair Value of $147.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition and changes in trading behaviors could slow Tradeweb’s growth if electronic adoption stalls or if fee pressures intensify in key markets.

Find out about the key risks to this Tradeweb Markets narrative.

Another View: What Do the Ratios Show?

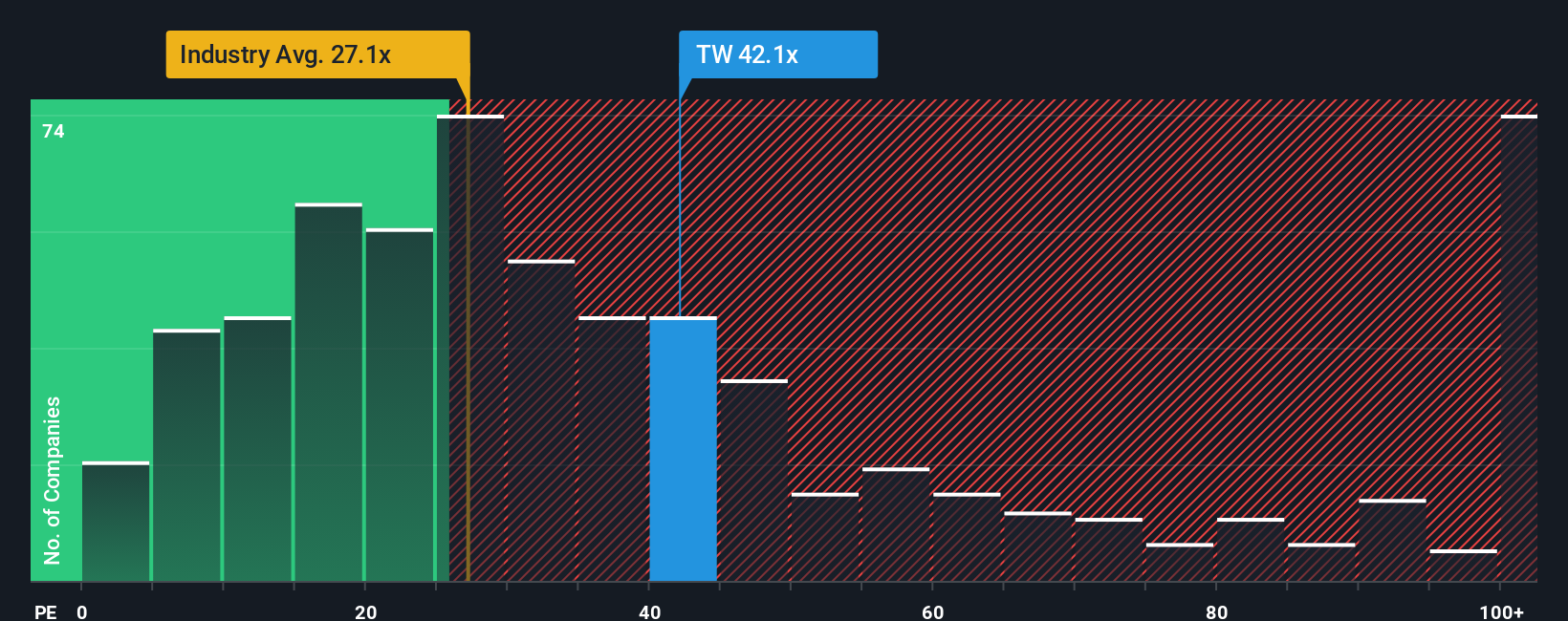

Looking at Tradeweb Markets through this lens, the company is priced at 41.6 times earnings, which is noticeably higher than both the industry average (25.7x) and its peer group (29.4x). The market’s own fair ratio, based on regression, is just 18.4x. This gap suggests investors are paying a hefty premium, which could mean increased risk if growth does not deliver.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tradeweb Markets Narrative

If you have your own view or want to dig into the numbers firsthand, building your own narrative is quick and straightforward. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tradeweb Markets.

Looking for More Investment Opportunities?

Don’t leave your next big win to chance. Be proactive and scan new sectors before the crowd moves in. The right screener provides a shortcut to untapped advantage and smarter investing.

- Boost your portfolio with income by targeting these 18 dividend stocks with yields > 3% delivering yields above 3% for reliable returns in any market.

- Capitalize on the artificial intelligence trend by securing your spot among these 25 AI penny stocks reshaping tomorrow’s tech landscape.

- Seize undervalued opportunities early and get the inside track with these 897 undervalued stocks based on cash flows based on strong cash flows and real-world potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives