- United States

- /

- Capital Markets

- /

- NasdaqGS:TROW

The Bull Case For T. Rowe Price (TROW) Could Change Following Launch of Four New Active Bond ETFs

Reviewed by Sasha Jovanovic

- T. Rowe Price Group recently launched four new active fixed income ETFs, including short-term, long-term, and high yield municipal bond strategies, as well as a multi-sector income offering, all now trading on the NASDAQ exchange.

- This expansion brings the firm’s active ETF lineup to 28 products, reflecting a continued focus on meeting investor demand for diversified, actively managed fixed income solutions and broadening its presence in the ETF market.

- We’ll examine how the rollout of new active fixed income ETFs may broaden T. Rowe Price’s client reach and affect its growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

T. Rowe Price Group Investment Narrative Recap

To be a shareholder in T. Rowe Price Group, you need confidence in the long-term relevance of active investment management and the firm’s ability to expand into new product areas, especially as fee competition and client preference shifts persist. The recent launch of four new active fixed income ETFs could help broaden T. Rowe Price’s client base and support its growth outlook, although the most significant short-term catalyst, stabilizing net asset inflows, will require more than new ETF offerings, and the most critical risk of fee pressure in core active funds remains largely unchanged by this announcement.

Among recent announcements, the October introduction of Managed Lifetime Income (MLI), a retirement solution offering stable monthly income for life, stands out. This launch is highly relevant given the ongoing demand for innovative retirement products and ties back to the key catalyst of expanding solutions for an aging population, which could support future asset and revenue growth amid broader market headwinds.

However, it’s important for investors to also watch out for ongoing fee compression in the industry and what that could mean if...

Read the full narrative on T. Rowe Price Group (it's free!)

T. Rowe Price Group's outlook anticipates $7.6 billion in revenue and $2.3 billion in earnings by 2028. This is based on an annual revenue growth rate of 2.3% and a $0.3 billion earnings increase from the current $2.0 billion level.

Uncover how T. Rowe Price Group's forecasts yield a $110.25 fair value, a 9% upside to its current price.

Exploring Other Perspectives

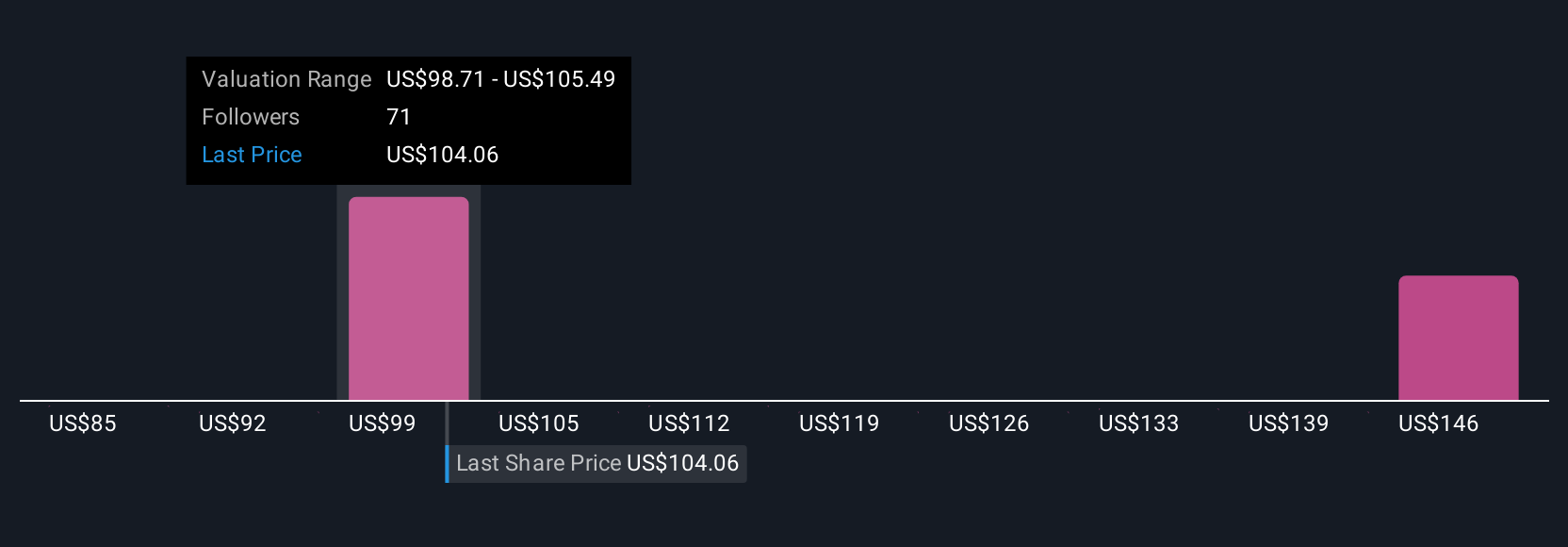

Simply Wall St Community members offered seven unique fair value estimates for T. Rowe Price Group, ranging from US$91.26 to US$146.78 per share. With a diverse set of opinions around future growth and fee pressures, it is clear that perspectives vary widely, take the opportunity to explore several viewpoints before making your own assessment.

Explore 7 other fair value estimates on T. Rowe Price Group - why the stock might be worth as much as 44% more than the current price!

Build Your Own T. Rowe Price Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your T. Rowe Price Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free T. Rowe Price Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate T. Rowe Price Group's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T. Rowe Price Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TROW

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026