- United States

- /

- Capital Markets

- /

- NasdaqGS:TROW

Should Investors Reconsider TROW After a 3.7% Weekly Gain Despite a Tough Year?

Reviewed by Bailey Pemberton

- If you have ever wondered whether T. Rowe Price Group is a bargain or overpriced, you are not alone. Now is an ideal time to take a closer look and see how its value compares.

- The stock has seen a 3.7% increase over the past week, even as its year-to-date and one-year returns remain in negative territory at -10.8% and -14.2% respectively. This highlights both volatility and changing investor sentiment.

- Recent news has focused on changing market conditions and asset management trends that directly affect firms like T. Rowe Price Group. Analysts and investors are watching closely as the company positions itself for long-term client growth and responds to changes in fee structures. There has also been discussion about its ability to innovate and stay competitive in the evolving investment landscape.

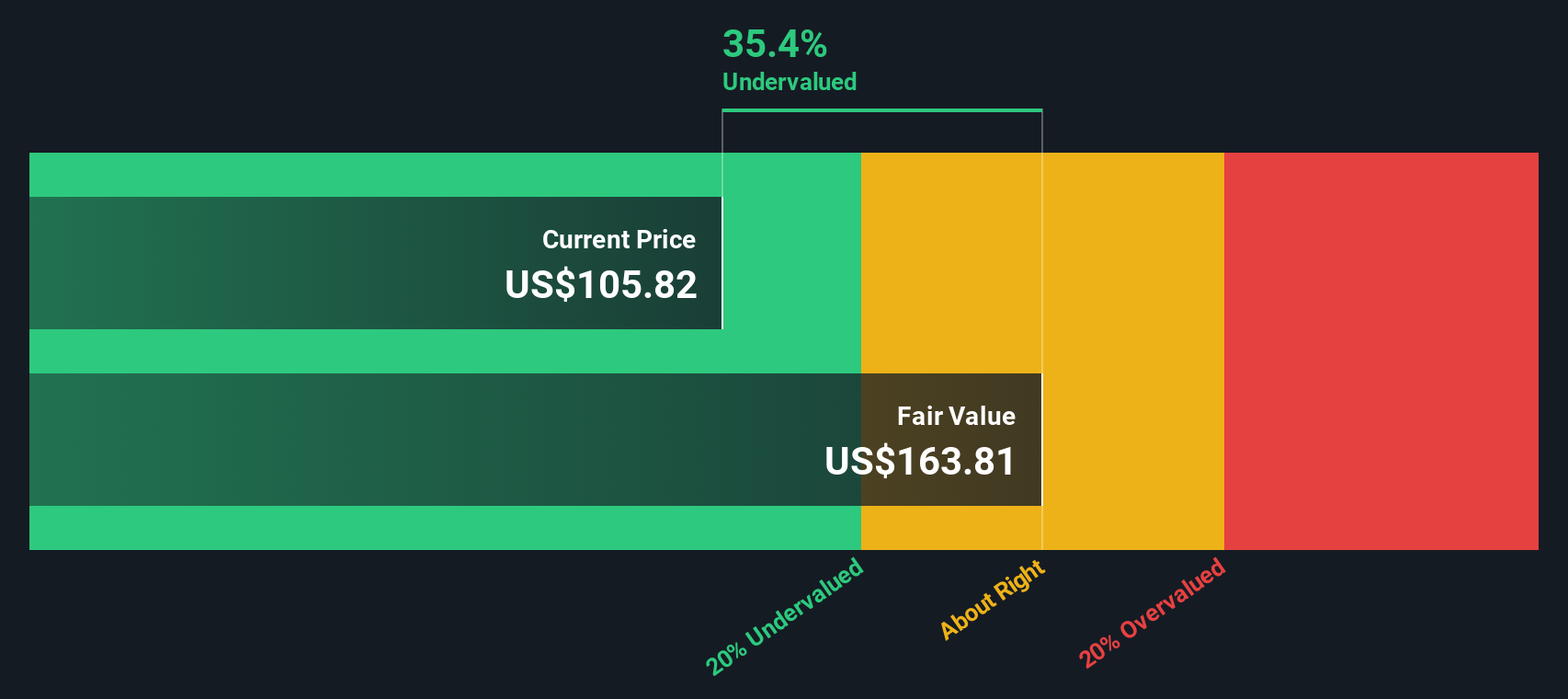

- Using traditional metrics, T. Rowe Price Group scores a 5 out of 6 on our undervaluation checks. This warrants a closer examination of the models behind this score. Also, stay tuned for a new perspective on what really matters when valuing the stock.

Find out why T. Rowe Price Group's -14.2% return over the last year is lagging behind its peers.

Approach 1: T. Rowe Price Group Excess Returns Analysis

The Excess Returns valuation method measures how much value a company generates over and above its cost of equity. This approach focuses on the firm's ability to deliver superior returns on invested capital, which is a vital consideration for asset management businesses like T. Rowe Price Group.

For T. Rowe Price Group, the core data points are telling:

- Book Value: $49.45 per share

- Stable EPS: $8.74 per share (Source: Weighted future Return on Equity estimates from 4 analysts.)

- Cost of Equity: $3.97 per share

- Excess Return: $4.77 per share

- Average Return on Equity: 17.84%

- Stable Book Value: $48.97 per share (Source: Weighted future Book Value estimates from 2 analysts.)

According to this model, T. Rowe Price Group's estimated intrinsic value stands at $147.38 per share. This figure is roughly 31.4% above its recent trading price, reflecting a significant implied discount. Under the excess returns approach, the stock appears materially undervalued at current levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests T. Rowe Price Group is undervalued by 31.4%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: T. Rowe Price Group Price vs Earnings

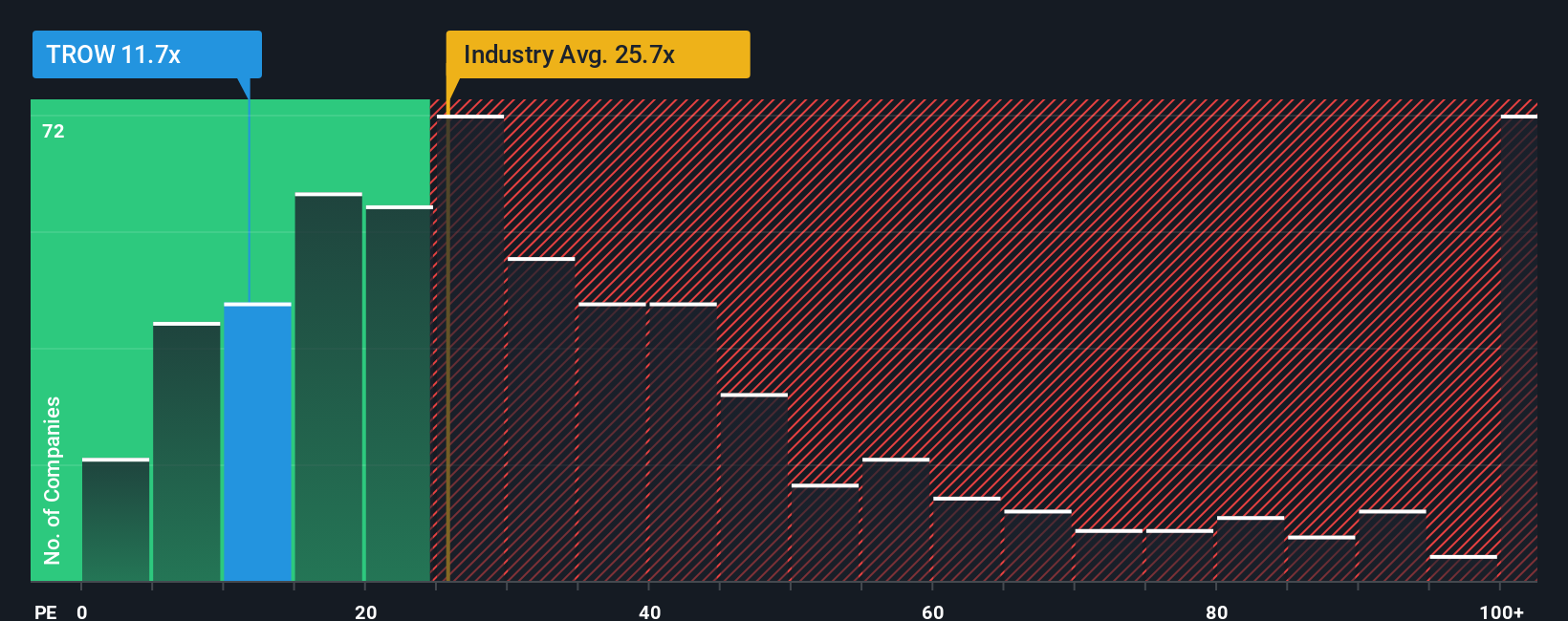

The Price-to-Earnings (PE) ratio is widely used to assess valuation for companies that consistently generate profits, like T. Rowe Price Group. A PE ratio shows how much investors are willing to pay for each dollar of earnings, making it a direct measure of market expectations for future growth and perceived risk.

Generally, higher expected growth or stronger financial health justifies a higher PE ratio, while more risk or slower growth tends to lower what is considered a fair or “normal” PE. For T. Rowe Price Group, its current PE stands at 10.87x, notably below the industry average PE of 23.36x and the peer group average of 60.03x. This suggests that either the market is underestimating its future earnings potential or sees greater risks in the business relative to its industry and peers.

Simply Wall St's proprietary "Fair Ratio" for T. Rowe Price Group is 15.47x. Unlike the blunt tool of peer or industry comparisons, the Fair Ratio incorporates several nuanced factors such as expected earnings growth, market cap, profit margins, and company-specific risks to establish a more tailored benchmark. This approach adapts to the characteristics that make T. Rowe Price Group unique, rather than assuming a one-size-fits-all standard.

With T. Rowe Price Group trading at 10.87x compared to its Fair Ratio of 15.47x, the stock appears to be undervalued according to this more complete perspective.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your T. Rowe Price Group Narrative

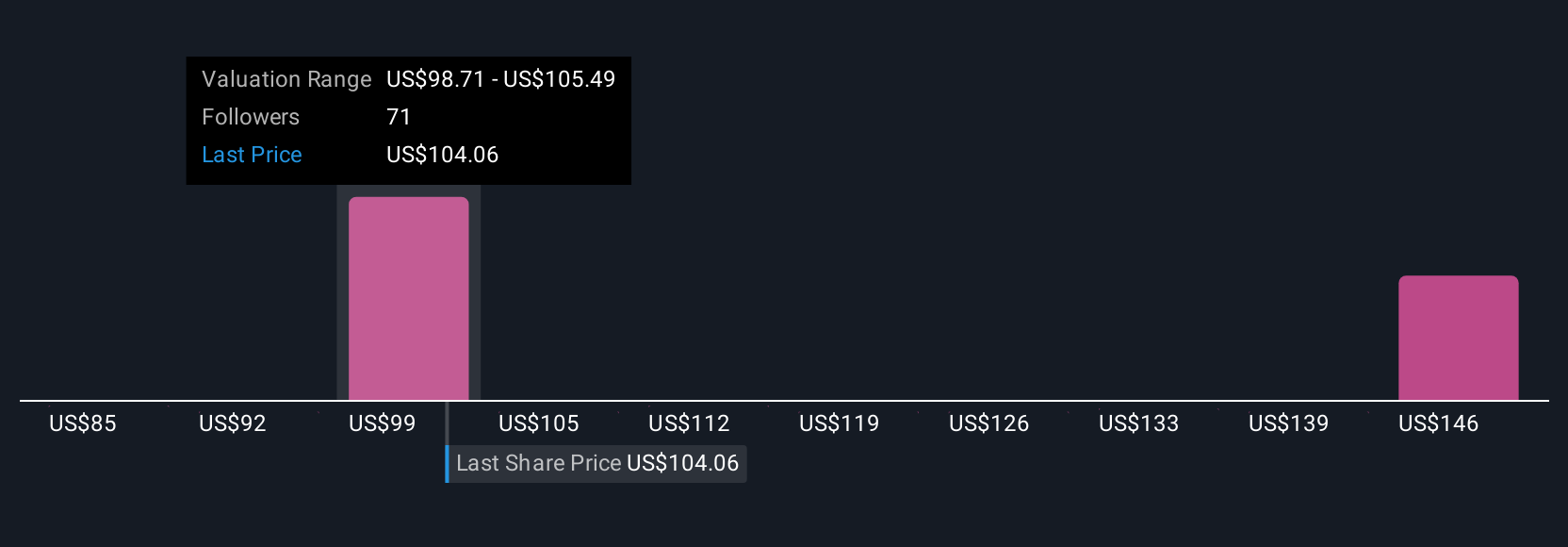

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way for investors to express their story or perspective about a company by connecting their own estimates for fair value, future revenue, earnings, and margins to a coherent financial outlook.

With Narratives, you link what you believe about a company's future, such as business growth, risks, or industry changes, to a forecast and a fair value. This allows you to make sense of the numbers through your personal lens. This approach is available and easy to use on Simply Wall St's Community page, where millions of investors share and update their Narratives as new information emerges, such as earnings announcements or breaking news.

Narratives make it straightforward to decide when to buy or sell by helping you track the gap between your fair value estimate and the current price. Each Narrative updates dynamically to reflect real-world events, so your view stays relevant. For example, different investors looking at T. Rowe Price Group recently had fair value estimates ranging from $91 to $116 per share, reflecting their unique expectations about the company's future growth and challenges.

Do you think there's more to the story for T. Rowe Price Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T. Rowe Price Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TROW

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success