- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

A Look at TPG (TPG) Valuation After Major AI Data Center Investment with Tata Consultancy Services

Reviewed by Simply Wall St

TPG (TPG) made headlines with its major investment in HyperVault, an ambitious AI data center project by Tata Consultancy Services. This move highlights TPG’s evolving strategy as it increases its focus on the AI and digital infrastructure space.

See our latest analysis for TPG.

TPG’s headline-making investment in HyperVault sent a strong signal to the market, but the company’s share price has faced some recent headwinds, slipping 12.4% year-to-date and posting a 1-year total shareholder return of -18.2%. While the 3-year total shareholder return of nearly 79% still highlights long-term value creation, momentum has clearly faded in recent months despite the firm’s high-profile deals and ongoing diversification.

If you’re interested in what’s fueling growth across the finance world, this is the perfect moment to explore fast growing stocks with high insider ownership

With shares still trading below analyst price targets and fresh investments energizing TPG’s growth outlook, the key question for investors now is whether the current valuation offers real upside or if the market is already looking ahead to future gains.

Most Popular Narrative: 15.1% Undervalued

TPG’s narrative-based fair value lands at $65.85, with the last close of $55.88 trailing far behind. Here is the pivotal growth driver anchoring this perspective.

Thematic investment focus in high-growth areas (sustainability, digital infrastructure, healthcare, AI) is enabling TPG to capitalize on long-term, secular shifts toward these sectors. This is driving outperformance in investment returns and supporting growth in carried interest and incentive income, positively impacting earnings.

Curious where the numbers behind this valuation come from? The narrative draws on bold projections, with booming earnings, rising profit margins, and an aggressive expansion into next-level growth sectors. See exactly how these levers shape the fair value and why this price target is proving hard to ignore.

Result: Fair Value of $65.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as persistent fundraising headwinds and cautious sentiment among major investors could challenge TPG’s long-term growth assumptions.

Find out about the key risks to this TPG narrative.

Another View: Looking Through a Different Lens

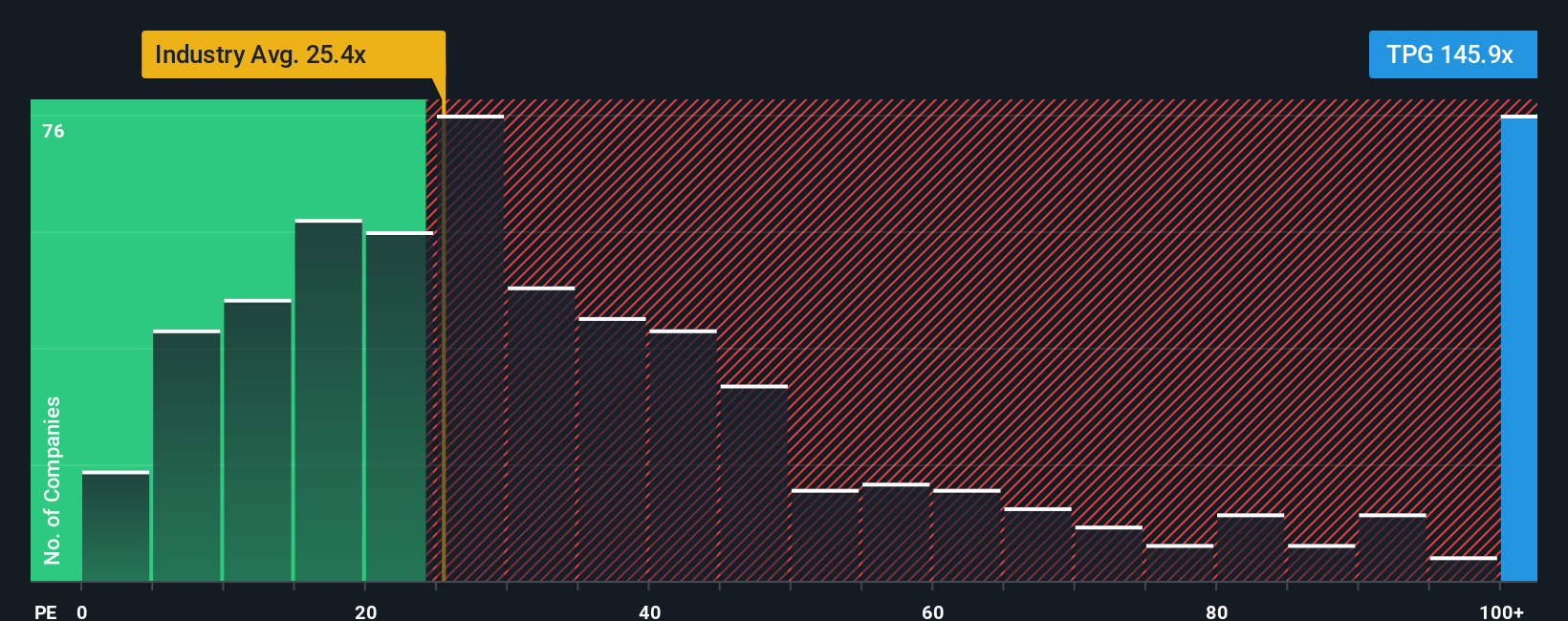

Switching perspectives, a glance at TPG’s price-to-earnings ratio reveals it trades at 139.1x, which is well above industry peers at 23.4x and higher than its fair ratio of 30.8x. This gap suggests the stock is expensive, highlighting the risk that investors may be paying too much for future growth. Could the market be overestimating TPG’s potential, or is there a premium worth paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TPG Narrative

If you see the story differently, or want to dig deeper into the numbers yourself, you can create your own TPG narrative in just a few minutes using our tools, and Do it your way.

A great starting point for your TPG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next market-beating move could be just a click away. Don’t let fresh opportunities slip by. Broaden your scope and strengthen your portfolio today:

- Target steady income streams and tap into market resilience when you uncover these 17 dividend stocks with yields > 3% boasting attractive yields above 3%.

- Boost your growth strategy with these 917 undervalued stocks based on cash flows brimming with unrealized upside based on proven cash flow metrics.

- Expand your game plan into future-defining tech by scanning these 25 AI penny stocks shaping the pace of innovation and tomorrow’s returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives