- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

Is StoneCo Fairly Priced After 135% Rally and New E-Commerce Partnership in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if StoneCo is trading at a bargain or if the recent buzz is just noise? You are not alone. Let's break down what might be driving the stock's value story right now.

- StoneCo's share price has surged by 135.1% year-to-date and is up 65.4% over the past year, hinting at rapidly shifting market sentiment and renewed investor appetite.

- Recently, StoneCo made headlines after announcing a new partnership with a major e-commerce platform, which has added fresh optimism to its growth prospects and seems to have contributed to the stock's strong run. Ongoing fintech industry consolidation and regulatory developments have also kept investors closely watching StoneCo’s next moves.

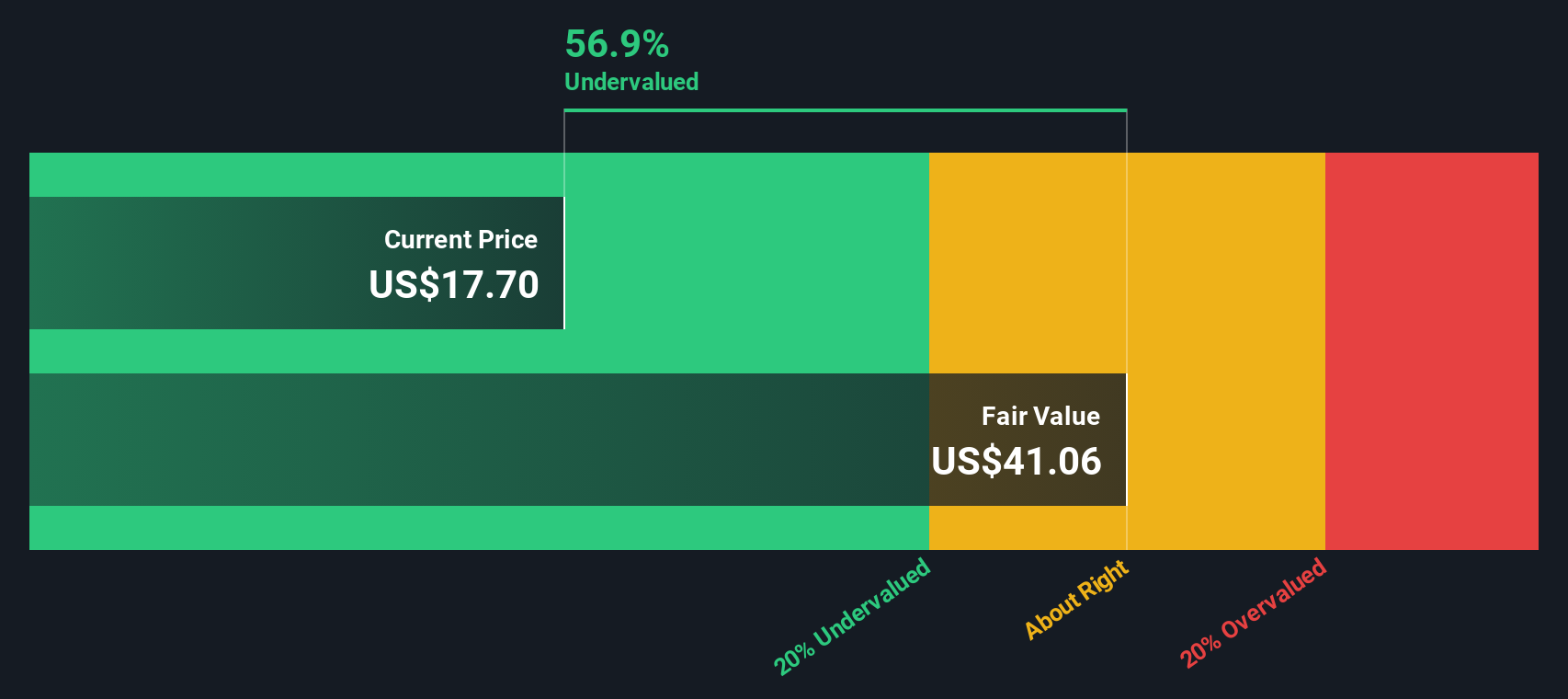

- The company currently scores a 5 out of 6 on our valuation checklist, meaning it is considered undervalued in nearly all major areas. Before we get to the even smarter approach for assessing fair value at the end of this article, let’s dig through StoneCo’s current valuation using the most popular methods.

Approach 1: StoneCo Excess Returns Analysis

The Excess Returns valuation model estimates a company's true worth by looking at how much profit it can generate above the cost of its equity capital. In other words, it calculates how effectively the business puts shareholders' money to work compared to a typical required return.

For StoneCo, the numbers are compelling. The company's book value stands at $43.24 per share. Analysts project a stable earnings per share (EPS) of $11.82 based on future returns on equity, while the stable book value is expected to reach $49.71 per share. StoneCo's average return on equity is an impressive 23.78%, comfortably outpacing its cost of equity of $3.66 per share. This results in an annual excess return of $8.16 per share, highlighting strong profitability relative to risk.

Using this approach, the model estimates StoneCo's fair value at $44.78 per share. With the current share price trading at a significant 57.5% discount to this intrinsic value, the Excess Returns methodology points to the stock being notably undervalued at present.

Result: UNDERVALUED

Our Excess Returns analysis suggests StoneCo is undervalued by 57.5%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

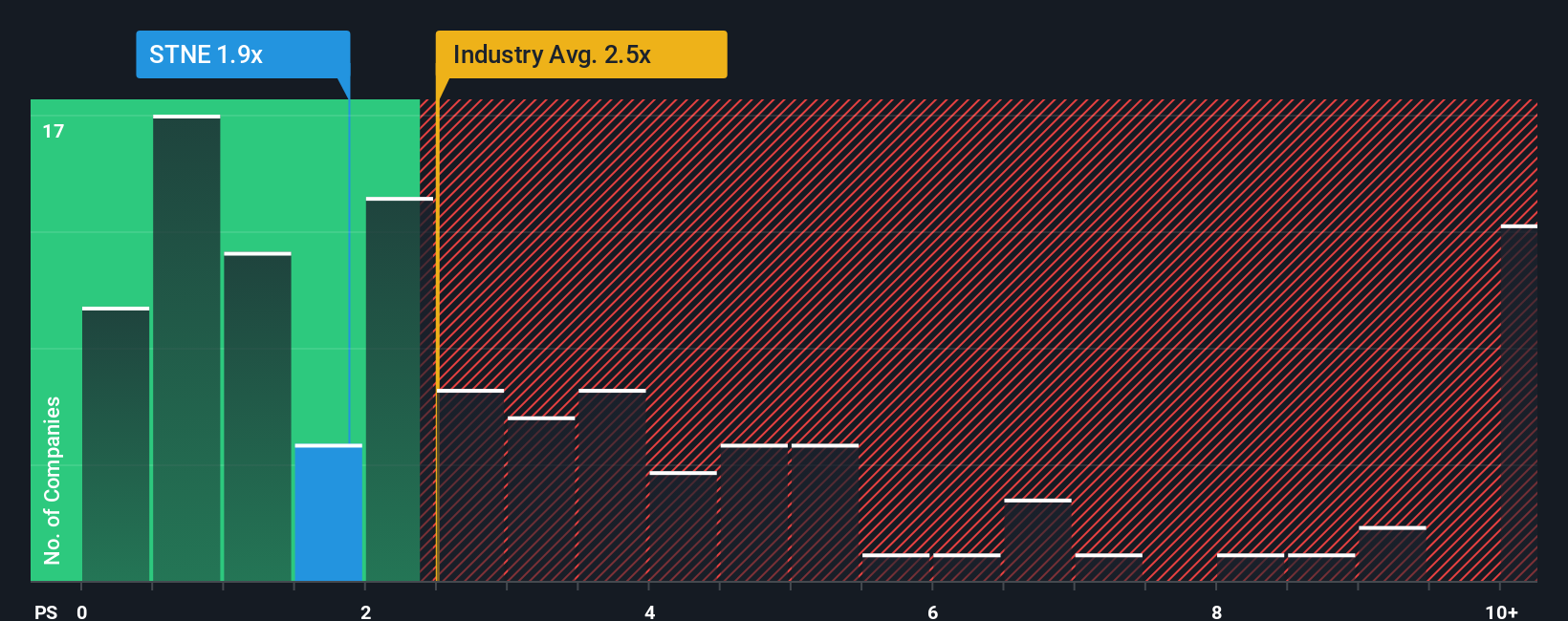

Approach 2: StoneCo Price vs Sales

The Price-to-Sales (PS) ratio is a popular way to value companies like StoneCo, especially in the diversified financial sector, where net profits can be sensitive to temporary charges or rapid investment cycles. For companies generating healthy revenue growth—even if earnings can fluctuate—PS offers a clear snapshot of how much investors are paying for each dollar of sales.

But not all PS multiples are created equal. Growth prospects and risk profile play a huge part in what could be considered a “normal” or “fair” PS ratio. Companies with faster revenue growth, stronger margins, or greater market opportunity can often command higher multiples. Those facing headwinds or higher uncertainty will typically trade on lower ratios.

StoneCo currently trades at a PS ratio of 1.98x. When stacked against the industry average of 2.39x and a peer average of 2.92x, StoneCo appears attractively priced on a relative basis. However, Simply Wall St’s proprietary Fair Ratio, calculated using StoneCo’s revenue growth, profit margins, industry classification, and risk profile, lands at 2.85x. This Fair Ratio goes beyond basic comparisons by accounting for business quality, growth trajectory, and market cap. It results in a far more accurate gauge of valuation than just industry or peer averages alone.

Since StoneCo’s current multiple is well below its Fair Ratio, the shares look undervalued using this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your StoneCo Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, Simply Wall St’s innovative tool that helps you link the real story behind a company to your own financial forecast and estimate of fair value.

A Narrative is simply your personal take on a company’s future, a concise story that explains your assumptions about where StoneCo is headed, including your own estimates for its future revenue, profit margins, and growth. By building a Narrative, you connect your view of the business (what you think will drive its growth or add risk) directly to a financial outlook and a fair value calculation.

This approach empowers you to make transparent, data-driven investment decisions. When your Narrative’s Fair Value is meaningfully above or below the current share price, it may be time to consider buying or selling. Narratives are easy to create and update right from StoneCo’s Community page on Simply Wall St, where millions of investors share and refine their perspectives.

Narratives stay current and automatically adjust as new news or earnings are released, so your valuation always reflects the latest information. For example, some investors believe StoneCo is worth as much as $19.97 based on aggressive client growth and capital return, while others take a more cautious stance with a fair value closer to $14.37 due to concerns about competition and loan risk.

Do you think there's more to the story for StoneCo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives