- United States

- /

- Capital Markets

- /

- NasdaqGS:STEP

Assessing StepStone Group After Fund Launches and a 5.9% Yearly Share Price Gain

Reviewed by Bailey Pemberton

- Wondering if StepStone Group is a hidden gem or getting pricey? You are not alone, and we're here to break down the numbers in plain English.

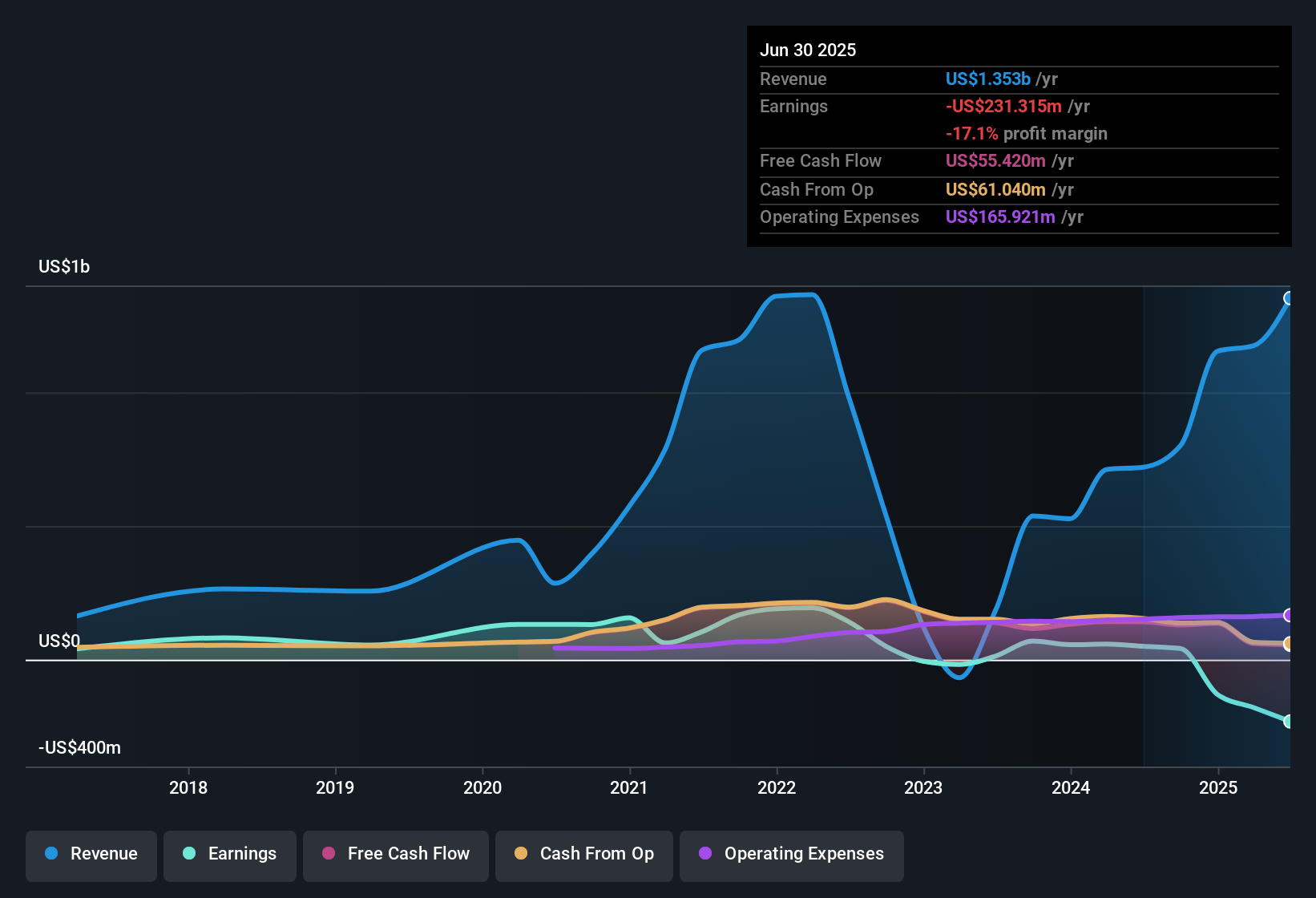

- The stock has seen returns of 5.4% year-to-date and 5.9% over the last year, despite minor pullbacks in the last week and month.

- StepStone's share price has been influenced by recent headlines detailing its continued expansion in private markets and new fund launches, which have caught the eye of both industry watchers and investors. This activity has added a new layer of anticipation and attention to where the company might go next.

- Right now, StepStone Group scores a 3 out of 6 on our quick valuation checklist, which offers a good starting point. We will dive into a few standard valuation methods next, and then reveal what we think is the smartest way to spot value by the end of the article.

Find out why StepStone Group's 5.9% return over the last year is lagging behind its peers.

Approach 1: StepStone Group Excess Returns Analysis

The Excess Returns valuation method helps investors figure out whether a company is creating value over and above its basic cost of capital. This approach focuses on how profitably a business deploys shareholder funds, using key measures like Book Value, Return on Equity, and the company’s ability to generate income beyond its equity cost.

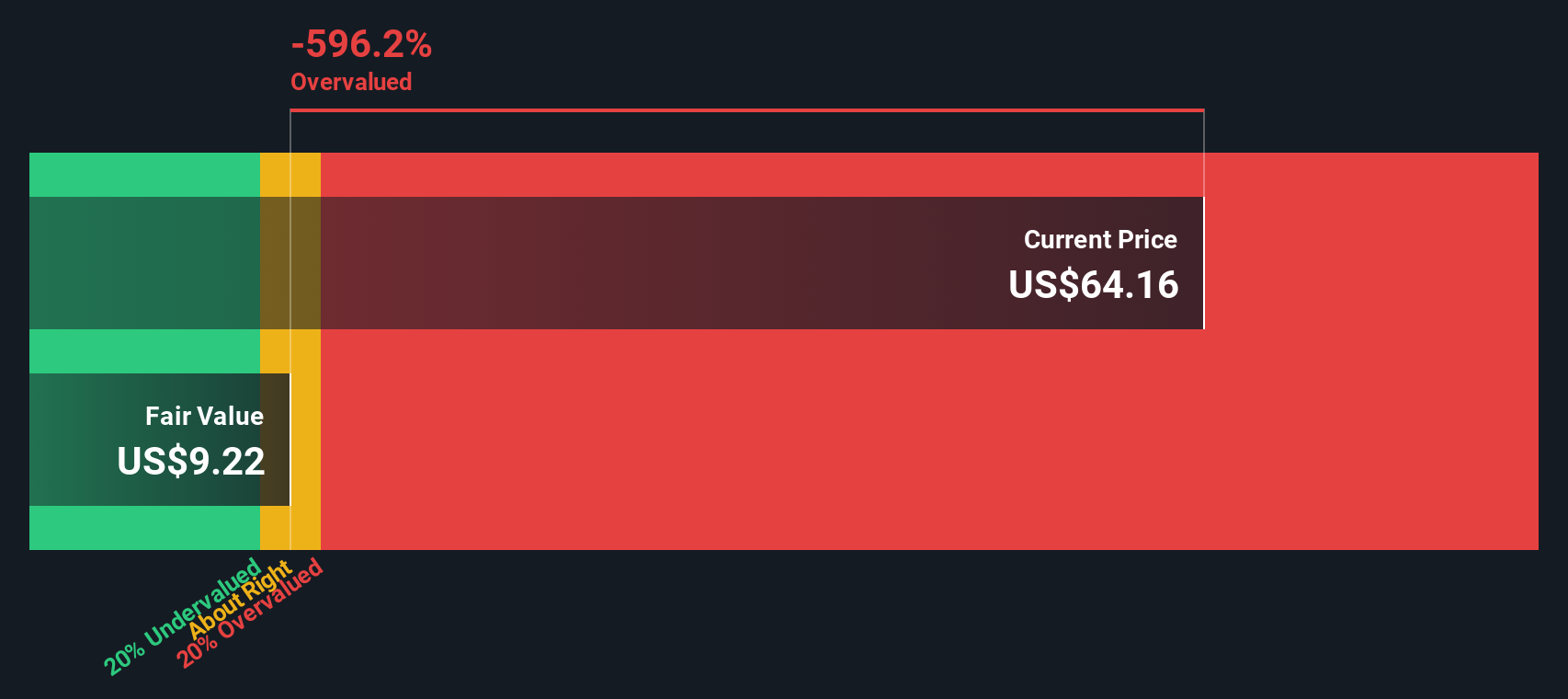

For StepStone Group, the model points to a Book Value of $1.96 per share and a Stable EPS of $0.99 per share, based on the median return from the past five years. The company's Cost of Equity is $1.16 per share, leading to an Excess Return of -$0.17 per share. The average Return on Equity is 8.33%, and the Stable Book Value is $11.89 per share. This paints a picture of a business struggling to consistently earn more than it costs to fund its equity base.

Based on these inputs, the Excess Returns model produces an intrinsic value that is far below the current share price. The model implies StepStone Group stock is overvalued by 558.1%, suggesting the market is pricing in much more optimism than what recent fundamentals support.

Result: OVERVALUED

Our Excess Returns analysis suggests StepStone Group may be overvalued by 558.1%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: StepStone Group Price vs Sales

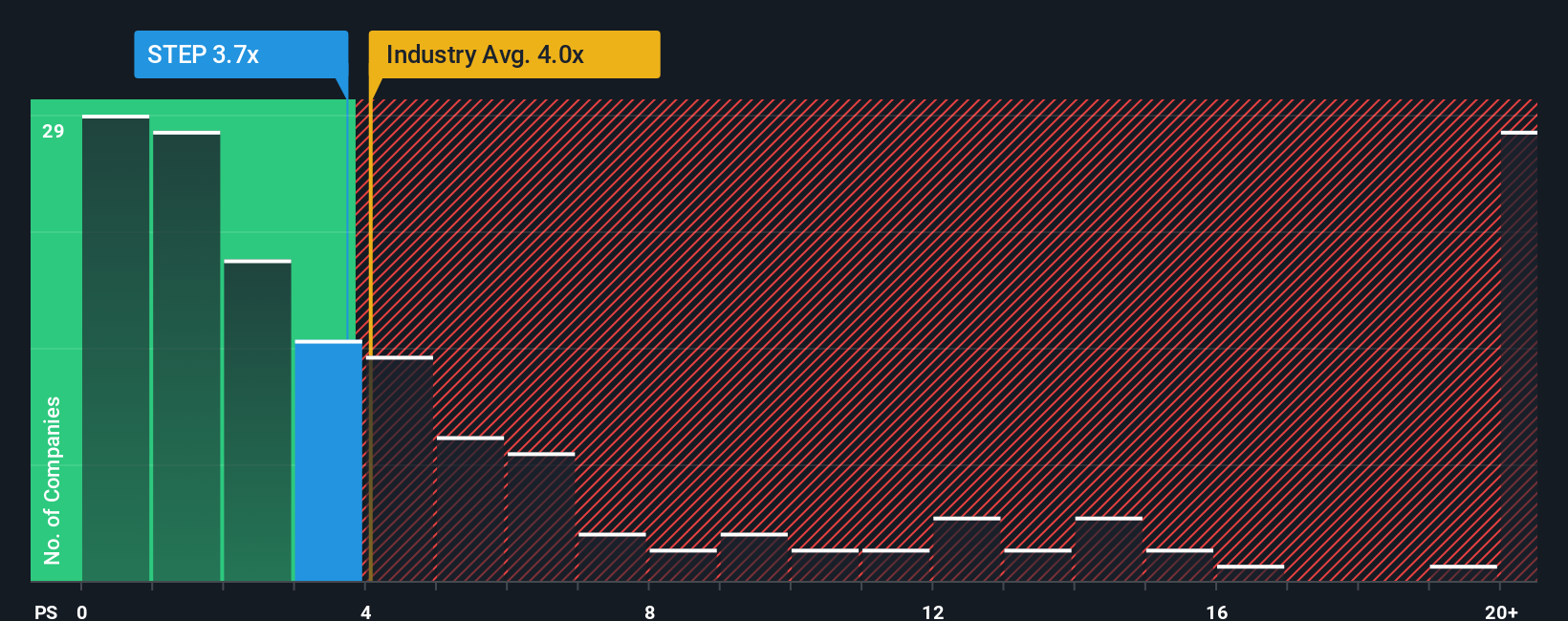

For companies in the financial sector, especially those with positive revenue but lumpy or negative earnings, the Price-to-Sales (P/S) ratio is often a more reliable valuation tool than earnings-based multiples. It helps gauge how much investors are willing to pay for each dollar of revenue, which is particularly useful when profits are volatile or temporarily pressured.

A company’s P/S multiple should reflect its growth prospects and risk profile. Businesses with higher, more predictable revenue growth and lower risk typically justify a higher P/S multiple, while companies facing structural challenges or unpredictable results generally trade lower.

StepStone Group currently trades at a P/S ratio of 3.59x. That is a shade below the industry average of 3.81x and significantly below the average peer ratio of 5.85x. However, to determine what multiple StepStone should trade at, we use Simply Wall St’s proprietary “Fair Ratio.” This Fair Ratio, calculated from the company’s individual growth outlook, profit margin, market size, and industry risks, arrives at 1.49x for StepStone. Unlike simple peer or industry averages, the Fair Ratio is tailored to the company’s circumstances and the broader market environment, making it a more relevant yardstick for investors.

Comparing StepStone’s current P/S of 3.59x to its Fair Ratio of 1.49x suggests the stock is trading at a significant premium relative to its fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your StepStone Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind the numbers, allowing you to connect your personal perspective on a company, such as StepStone Group, to your assumptions about its future revenue, margins, and overall value. By anchoring your view to a financial forecast and a specific fair value, Narratives make it easy to see how your beliefs stack up against reality.

This approach is both powerful and accessible, thanks to Simply Wall St’s Community page, where millions of investors build and share their Narratives. Narratives help you decide if it is the right time to buy or sell by showing whether your Fair Value lines up with the current Price. As news or earnings updates roll in, Narratives automatically stay up to date, so your thesis evolves with real-world events.

For StepStone Group, for example, one investor might see a bright future and value the stock as high as $70, while another anticipates challenges and sets fair value closer to $19. Narratives capture these differences, helping you invest with more confidence and clearer context.

Do you think there's more to the story for StepStone Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STEP

StepStone Group

A private equity and venture capital firm specializing in primary, direct, fund of funds, secondary direct, and secondary indirect investments.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives