- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

What Sezzle (SEZL)'s 74.2% GMV Surge Driven by Innovation Means for Shareholders

Reviewed by Simply Wall St

- In the past quarter, Sezzle reported a 74.2% year-over-year increase in gross merchandise volume, attributing this growth to heightened consumer engagement driven by product innovation and targeted marketing initiatives.

- This impressive expansion was underpinned by the company's ongoing investment in customer-focused features, which has helped increase both purchase frequency and the size of its active consumer base.

- We'll now explore how Sezzle's strong GMV growth and consumer-focused strategies may influence the company's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Sezzle Investment Narrative Recap

To be a Sezzle shareholder, one needs to believe in the company’s ability to convert rapid gross merchandise volume growth into sustainable profits, while managing the risks of heavy marketing investment and a shifting product mix. The latest record-setting GMV rise speaks directly to Sezzle’s near-term growth catalyst, consumer engagement, but does not fully resolve persistent margin and credit risk concerns; thus, the impact on the most important risk is meaningful, but not transforming.

Of recent announcements, the introduction of new features like Sezzle Balance and enhanced budgeting tools is most relevant, as it ties directly to driving deeper user engagement and repeat usage, the very factors supporting GMV expansion and accelerating top-line momentum. Such product rollouts may support continued active user growth, a central catalyst for Sezzle’s value proposition, especially as competition for users across BNPL intensifies.

Yet, despite strong growth, investors should be mindful of how rising credit losses could affect...

Read the full narrative on Sezzle (it's free!)

Sezzle's narrative projects $885.4 million revenue and $232.2 million earnings by 2028. This requires 33.5% yearly revenue growth and a $127.6 million earnings increase from $104.6 million.

Uncover how Sezzle's forecasts yield a $131.67 fair value, a 38% upside to its current price.

Exploring Other Perspectives

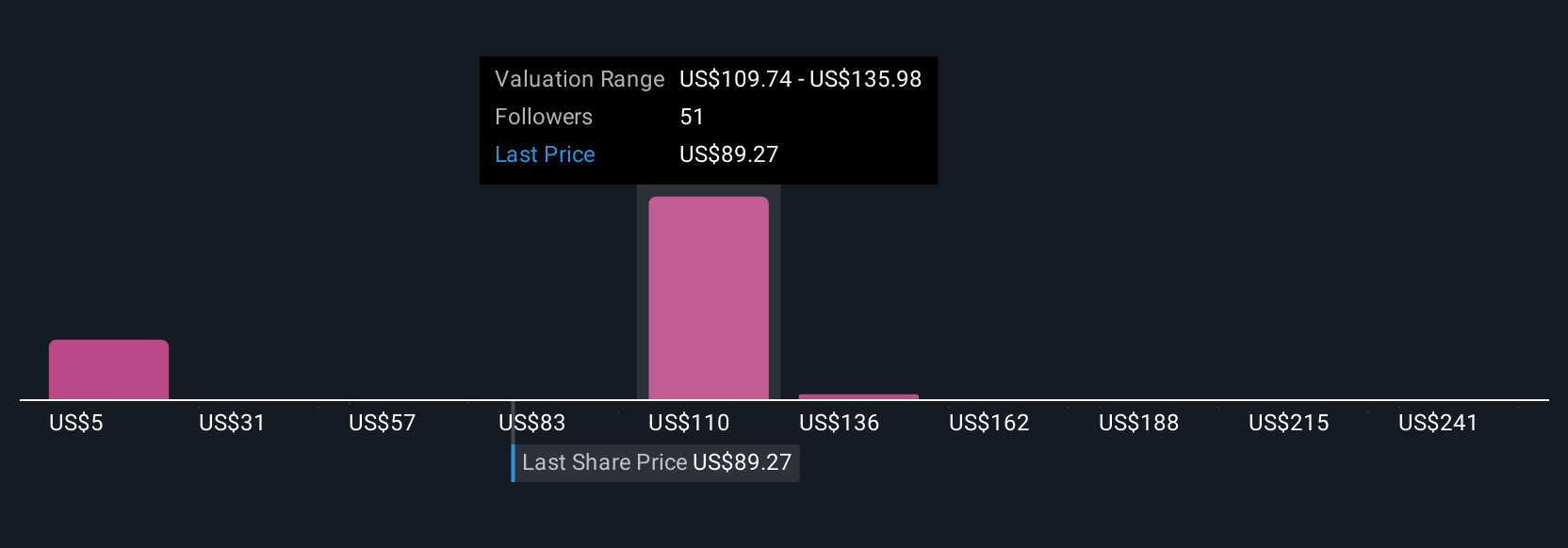

Simply Wall St Community members produced 13 fair value estimates for Sezzle, ranging from US$4.70 to US$346.57 per share. With most expecting fast user growth to fuel revenue, the wide spread shows just how differently you can view Sezzle’s path if you focus more on credit risk or margin pressures, explore these perspectives to see what matches your own outlook.

Explore 13 other fair value estimates on Sezzle - why the stock might be worth less than half the current price!

Build Your Own Sezzle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sezzle research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sezzle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sezzle's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives