- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Sezzle (SEZL): Assessing Valuation After Recent 20% Monthly Pullback

Reviewed by Simply Wall St

Sezzle (SEZL) shares slipped 2% to close at $73.93, rounding out a month where the stock is down nearly 20%. Year to date, however, Sezzle is still up more than 60% as investors weigh growth compared to recent declines.

See our latest analysis for Sezzle.

This month’s double-digit loss marks a notable pause in Sezzle’s sharp rally, but momentum is far from lost. The company’s share price is still up 62.6% year to date, and long-term investors have seen total returns surge more than 130% over the past year. Shifting sentiment in the short term is likely a mix of profit-taking and investors reassessing growth risks after such a rapid run, rather than a reversal of the broader positive trend.

If you’re keen to see what else is gaining traction, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading well below analyst targets but following such a strong rally, the big question is whether Sezzle’s recent pullback creates a true buying window or if all that future upside is already factored in.

Most Popular Narrative: 38% Undervalued

With Sezzle's fair value estimate at $119.25, substantially higher than the last close at $73.93, the narrative now points to a substantial upside, pivoting on robust growth expectations and improving profitability even as the rally cools off.

Strategic expansion of product offerings (On-Demand, Premium, and Anywhere) and cross-selling efforts targeting migration from low-margin On-Demand to higher-margin subscription products lays groundwork for increased consumer lifetime value and sustained improvement to net margins and earnings.

What gives Sezzle the edge? The fair value leans on a future financial mix of breakneck revenue growth, shifting customer behavior, and higher operating leverage that could reshape the digital payments landscape. Numbers this bold could change market perceptions overnight.

Result: Fair Value of $119.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy marketing spend and heightened credit losses could challenge Sezzle’s growth story if earnings do not keep pace with rising costs.

Find out about the key risks to this Sezzle narrative.

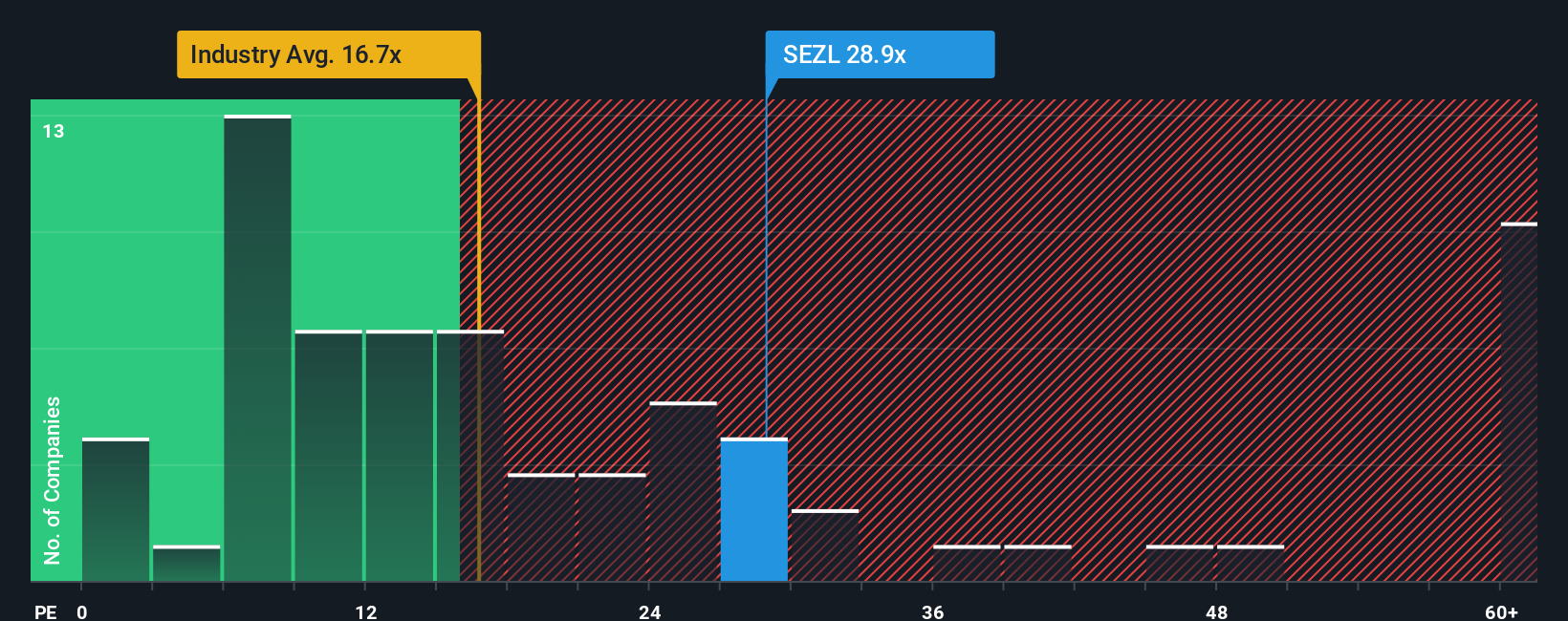

Another View: Based on Earnings Multiples

Looking at Sezzle’s valuation using its price-to-earnings ratio, the picture changes. Sezzle trades at 24.1 times earnings, which is more expensive than the US Diversified Financial industry average of 16.2x, but cheaper than the peer group at 31.5x. The fair ratio our analysis suggests is 25.1x, so it is fairly close. This introduces a valuation risk: could the market reset its expectations, or is this premium justified by Sezzle’s growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sezzle Narrative

If you see things differently or want to dig into the numbers firsthand, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Turn today's insight into action by tapping into fresh opportunities beyond Sezzle. Don't wait to see what moves the market next. Use these handpicked routes to precision investing:

- Spot untapped potential and track winners early with these 3575 penny stocks with strong financials, offering a selection of stocks boasting strong financials right from the start.

- Target steady returns and boost your income with these 17 dividend stocks with yields > 3%, featuring companies delivering dividend yields above 3%.

- Capture breakthroughs at the crossroads of science and investment with these 27 quantum computing stocks, showcasing pioneers in quantum computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives