- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Will PayPal’s (PYPL) AI Commerce Collaboration With Wix Reshape Its Growth and Competitive Narrative?

Reviewed by Sasha Jovanovic

- Wix.com recently announced a strategic collaboration with PayPal to provide AI-powered product discovery and agentic commerce services to Wix merchants, enabling seamless catalog sync and checkout through leading AI channels like Perplexity and PayPal's own shopping agent.

- This initiative positions PayPal at the forefront of integrating payments, risk mitigation, and buyer protection within AI-driven commerce, simplifying merchant participation in emerging AI shopping experiences and potentially broadening its reach among ecommerce partners.

- We’ll explore how PayPal’s AI-powered merchant services collaboration with Wix could reshape its investment narrative and broaden business opportunities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

PayPal Holdings Investment Narrative Recap

For me, the core investment thesis for PayPal centers on its evolution from a pure payments processor to a robust commerce platform powered by data and AI. The recent Wix.com collaboration reinforces PayPal's push into AI-driven shopping, though its immediate impact on the company's biggest short-term catalyst, driving merchant adoption and value-added services, might not be material yet. Investors should still pay close attention to competitive pressures in key markets, as this remains a prominent risk affecting near-term performance.

Among the recent news, PayPal's introduction of agentic commerce services, announced on October 29, is especially relevant. This launch enables integration with multiple ecommerce partners and AI channels, supporting PayPal's broader ambitions in transforming how merchants and shoppers engage with digital commerce experiences.

By contrast, the risk posed by fiercer competition in the UK market is something investors should be aware of, especially when...

Read the full narrative on PayPal Holdings (it's free!)

PayPal Holdings' outlook anticipates $38.1 billion in revenue and $5.4 billion in earnings by 2028. This scenario assumes a 5.6% annual revenue growth rate and a $0.7 billion increase in earnings from the current $4.7 billion.

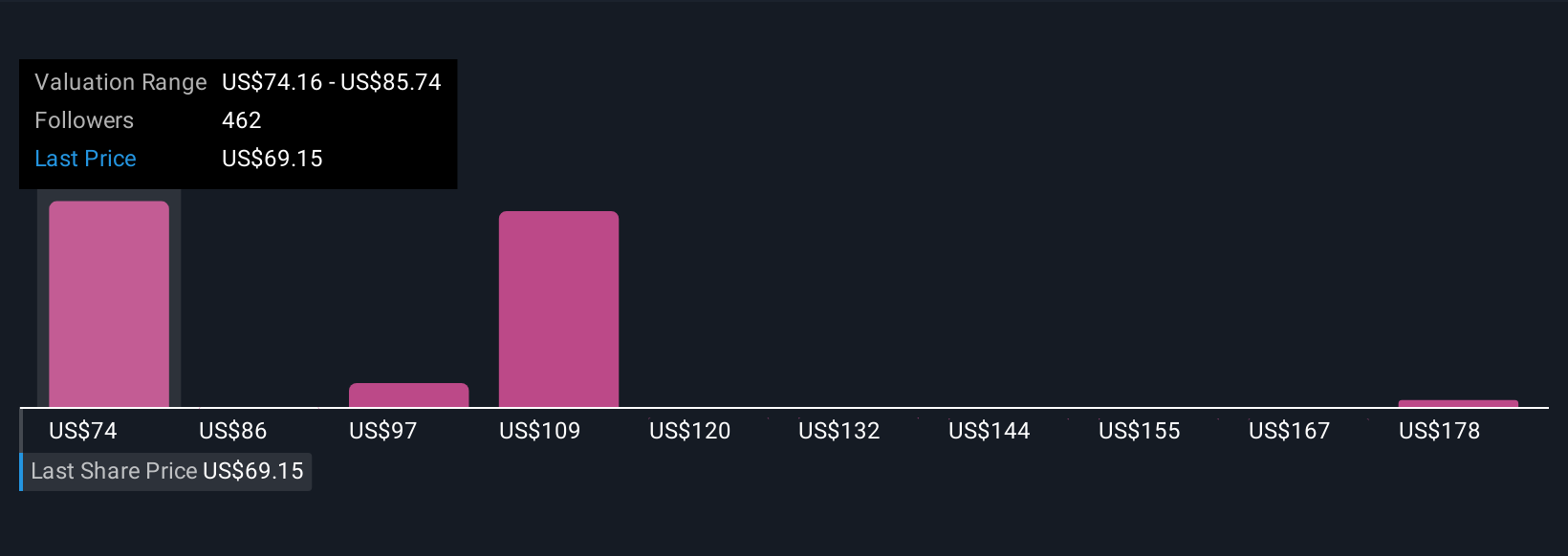

Uncover how PayPal Holdings' forecasts yield a $82.22 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members contributed 46 fair value estimates for PayPal ranging from US$75.68 to US$118.44 per share. While you may see opportunity in PayPal's AI-driven expansion, views on valuation and future performance vary widely so exploring diverse community insights is essential.

Explore 46 other fair value estimates on PayPal Holdings - why the stock might be worth just $75.68!

Build Your Own PayPal Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PayPal Holdings research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free PayPal Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PayPal Holdings' overall financial health at a glance.

No Opportunity In PayPal Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives