- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

Does PayPal's Recent Partnerships Signal an Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if PayPal Holdings is trading at a bargain or if there's more volatility on the horizon? You're not alone. Knowing whether a stock is undervalued or overpriced can be a game changer for your portfolio.

- Shares have had a rough go recently, slipping 2.3% over the past week and down 21.0% year-to-date, hinting at shifting market sentiment and possible changes in growth or risk factors.

- Recent headlines have centered around PayPal’s continued push into digital payments and new partnerships, each stirring fresh debate among investors about the long-term potential of its evolving business model. Industry chatter about growing competition and regulatory changes has also played into the narrative, affecting short-term price moves.

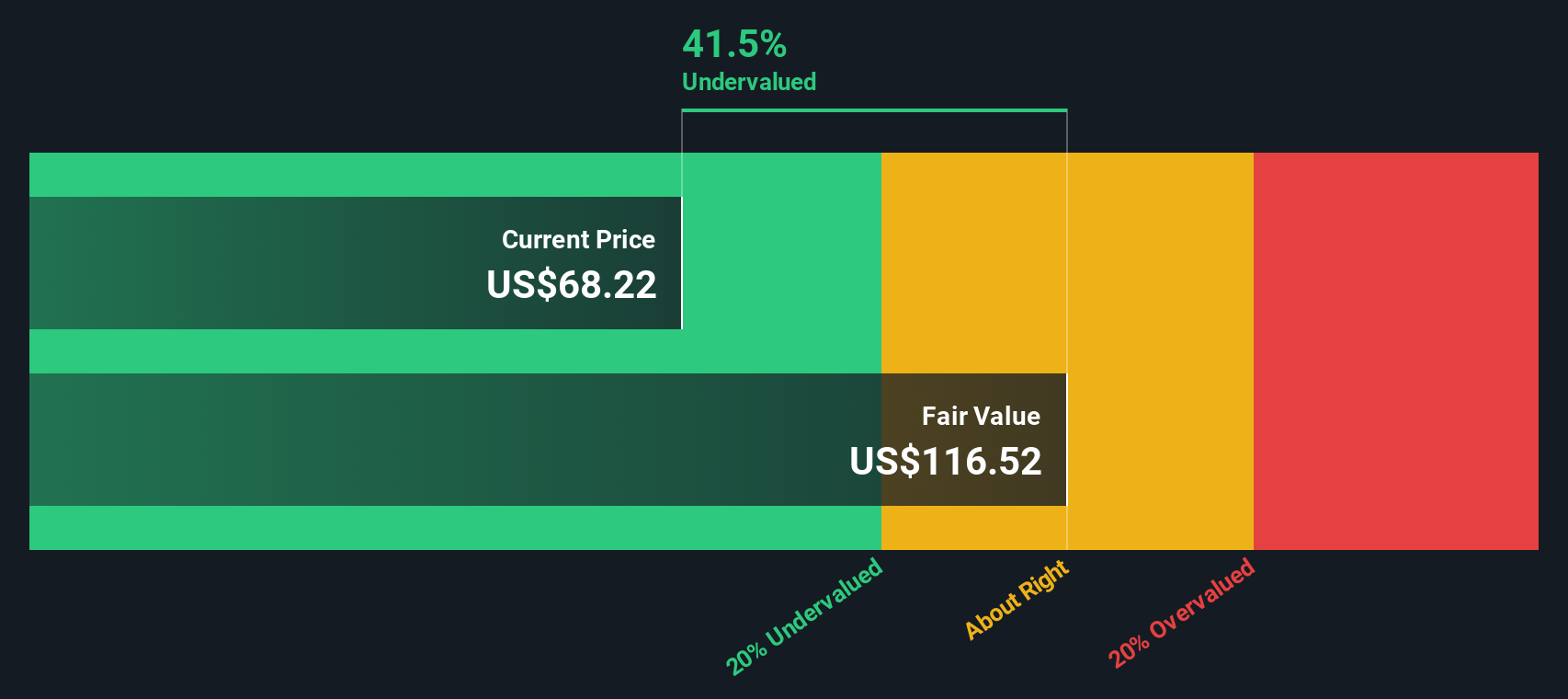

- Despite all the noise, PayPal currently notches a 6 out of 6 on our valuation score, which means it is theoretically undervalued across every key check we use. Next, we’ll break down what these valuation checks mean, but stick around for a perspective that goes beyond just the numbers.

Find out why PayPal Holdings's -16.4% return over the last year is lagging behind its peers.

Approach 1: PayPal Holdings Excess Returns Analysis

The Excess Returns valuation approach measures how much value a company creates beyond the minimum required return for its investors. In essence, it evaluates whether PayPal Holdings delivers stronger than expected returns on the capital invested in its business.

PayPal stands out with a solid Book Value of $21.46 per share and a Stable EPS of $6.14 per share, based on projections from 11 analysts. The company’s average Return on Equity is an impressive 24.18%, which far surpasses its Cost of Equity at $1.92 per share. This results in an Excess Return of $4.22 per share. Over the long term, PayPal’s Stable Book Value is anticipated to reach $25.40 per share, reflecting projected resilience and expansion in the company’s financial base, as estimated by eight analysts.

According to this model, the intrinsic value for PayPal shares sits at $119.73, calculated using its historical and projected excess returns. Given where the stock trades today, this represents a 43.2% discount. This suggests shares are meaningfully undervalued by the market and could have room for upward re-rating.

Result: UNDERVALUED

Our Excess Returns analysis suggests PayPal Holdings is undervalued by 43.2%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

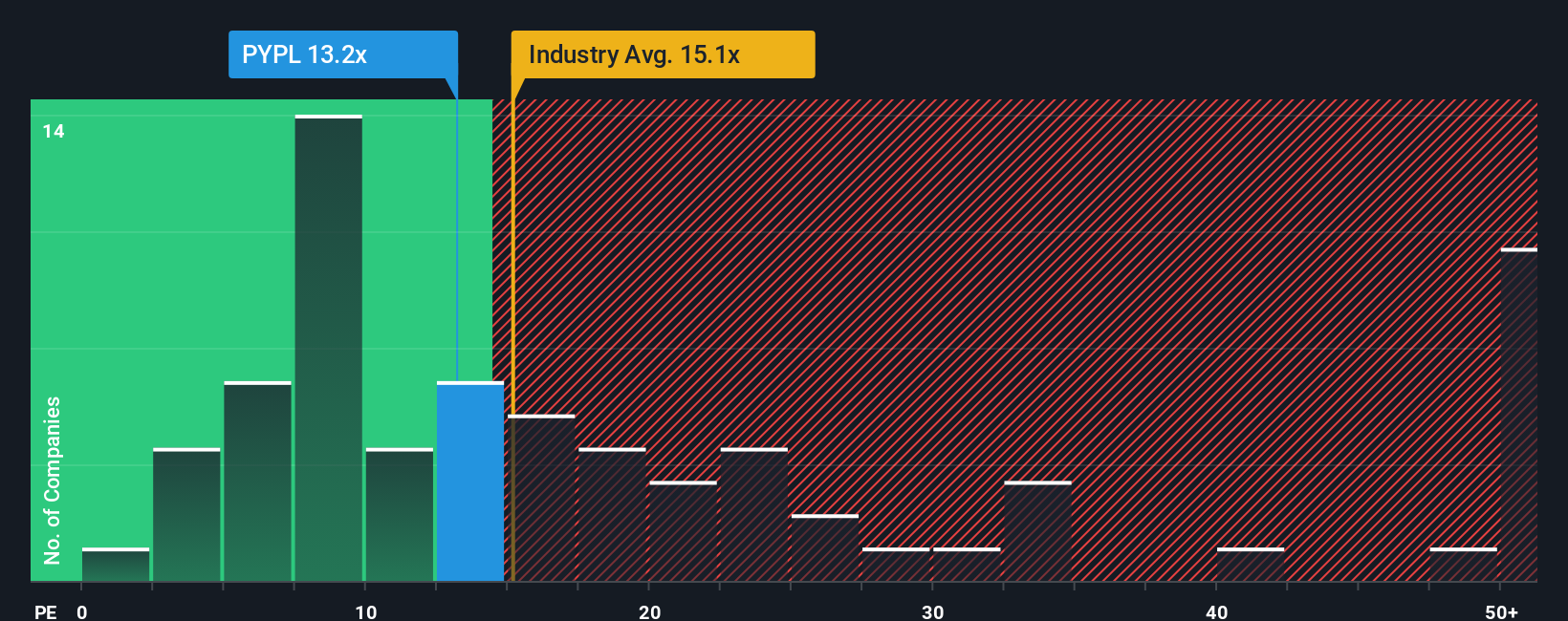

Approach 2: PayPal Holdings Price vs Earnings

For companies like PayPal Holdings that are profitable and generate consistent earnings, the Price-to-Earnings (PE) ratio is especially useful for valuation because it shows how much investors are willing to pay today for a dollar of current earnings. This makes it a straightforward way to compare valuation across similar profitable firms.

What counts as a "normal" or "fair" PE ratio often comes down to how fast a company is expected to grow and the risks it faces. Companies with strong earnings growth or lower perceived risk can often justify higher PE ratios, while slower-growing or riskier businesses typically trade at lower multiples.

Currently, PayPal's PE ratio is 13x. This is slightly below the industry average of 15.2x and just under the peer average of 13.4x, suggesting that the stock trades at a modest discount to its sector. However, comparing to industry averages or individual peers can miss the nuances that make each company unique.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for PayPal is 17.5x, reflecting a blend of the company’s specific factors such as its future earnings growth, profitability, risk profile, market size and sector conditions. This goes deeper than just comparing peers or sectors by holistically capturing the business’s opportunities and threats.

Since PayPal’s current PE ratio of 13x is well below the Fair Ratio of 17.5x, the implication is clear: the stock appears undervalued based on this approach and may offer investors value if the company can meet expectations.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PayPal Holdings Narrative

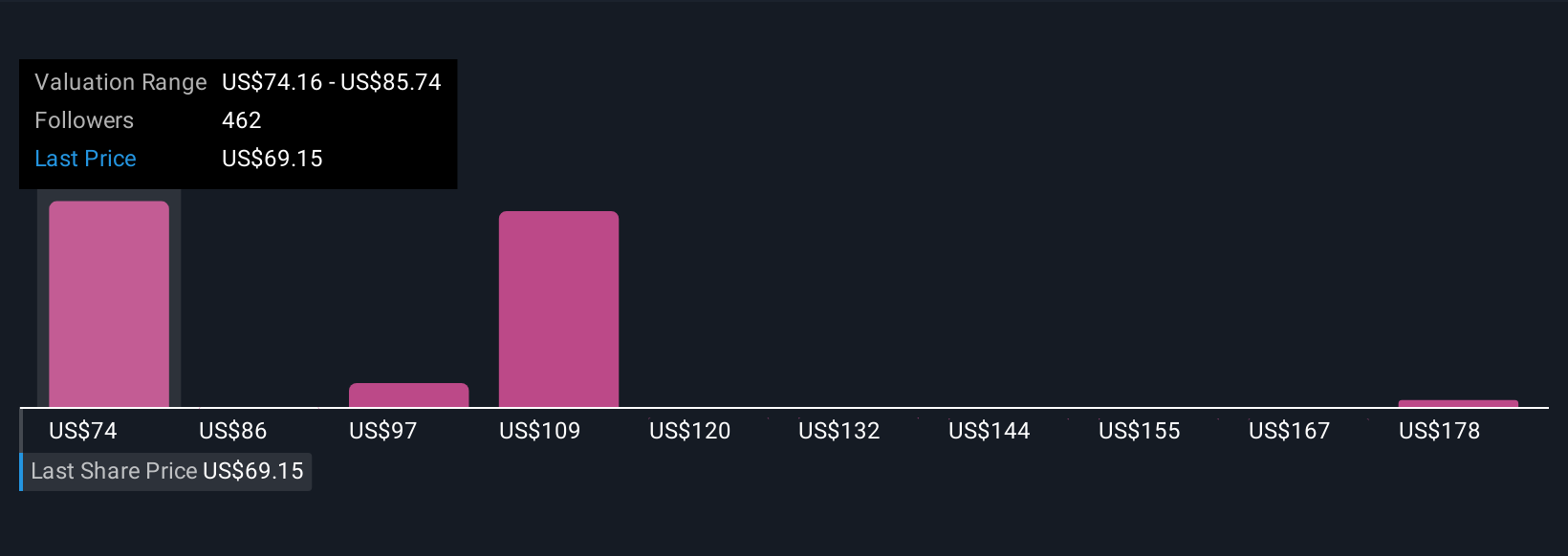

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple way to connect your perspective on a company’s story, including your assumptions about its future revenue, earnings, and margins, directly to a fair value estimate, all in one place.

Narratives go beyond the numbers by helping investors express their outlook on a company’s opportunities and risks. They link those beliefs to a transparent financial forecast that reveals a customized fair value. On Simply Wall St, Narratives are an easy-to-use feature within the Community page, where millions of investors can share, update, and discuss their investment stories.

The power of Narratives lies in their dynamic nature. They update automatically as new information, such as fresh news or company earnings, becomes available. This means you get real-time valuation changes and insights, helping you confidently compare your Fair Value with the current Price to decide when to buy or sell.

For example, some investors are excited about PayPal’s robust growth from Venmo and new merchant solutions, resulting in higher fair value estimates around $111. Others remain cautious on digital wallet competition and forecast fair values closer to $62. Whatever your view, Narratives give you the tools to back your story with data and make smarter investment decisions every time.

Do you think there's more to the story for PayPal Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives