- United States

- /

- Capital Markets

- /

- NasdaqGS:PAX

Patria Investments (PAX): $67.4M One-Off Loss Challenges Growth Premium and Bullish Narratives

Reviewed by Simply Wall St

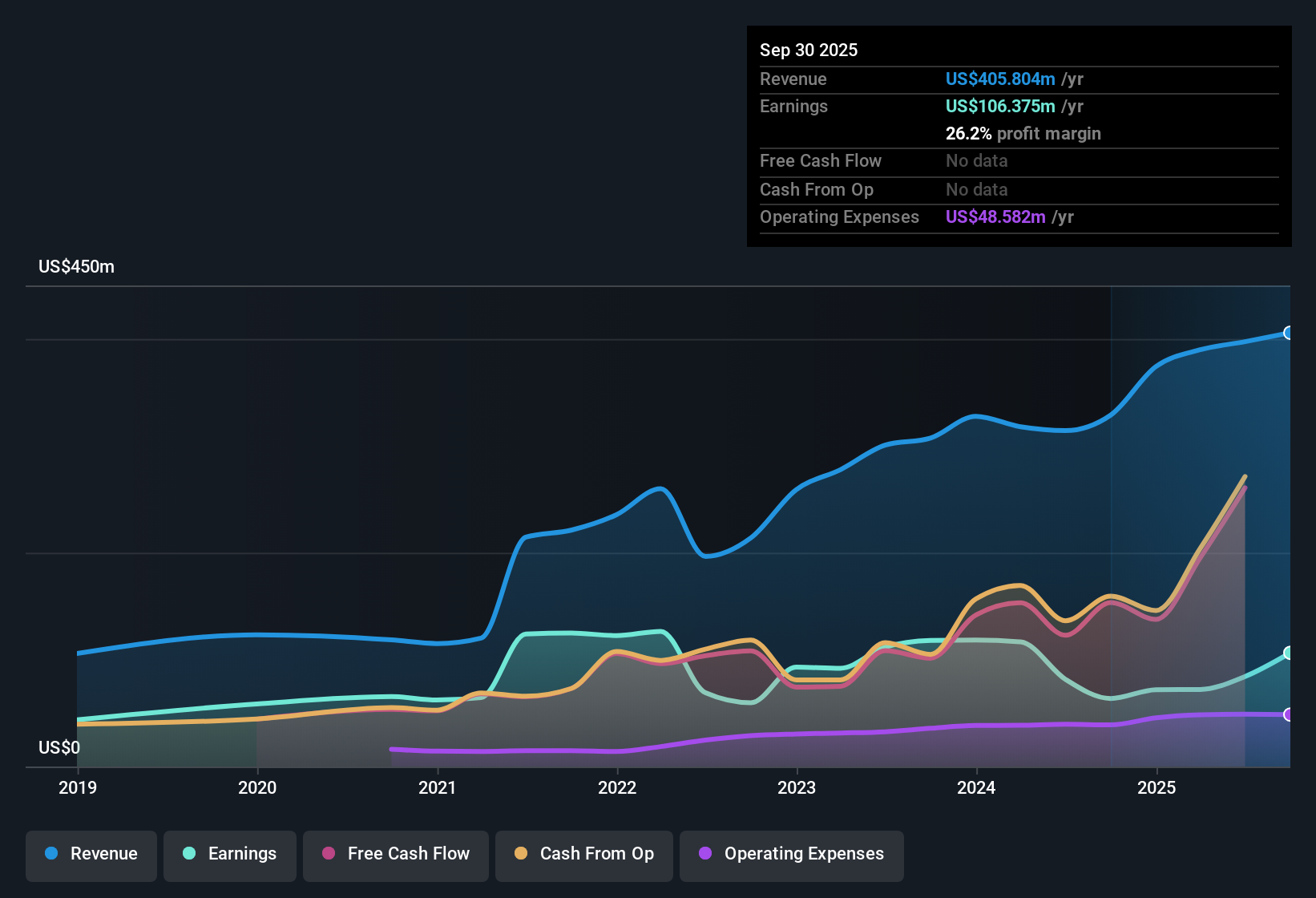

Patria Investments (PAX) reported a net profit margin of 21.2%, down from last year’s 26%, and earnings growth of 3.2% in the latest year, despite a flat longer-term track record. The consensus expects profit to expand by 30.5% annually over the next three years, while revenue is forecast to grow at 13.5% per year, outpacing the US market average of 10.5%. Shares currently trade above estimated fair value at $15.2 versus $10.9, and a hefty Price-to-Earnings ratio of 28.8x points to a lot of optimism built in, even as a one-off $67.4 million loss hit the latest results.

See our full analysis for Patria Investments.The next step is to see how these results stack up against the broader narratives followed by investors and the community at Simply Wall St. Some trends might surprise, while others could prompt a rethink.

See what the community is saying about Patria Investments

Profit Margin Squeezed: 21.2% Now, Forecasted to Shrink Further

- Analysts expect net profit margins to fall from the current 21.2% to just 9.9% over the next three years, nearly halving profitability even as revenue grows.

- According to the analysts' consensus view, robust fundraising and fee-earning assets are expected to power long-term growth. However, the ongoing trend of fee compression and diversification into new products could continue to pressure margins.

- Consensus notes that average fee rates are guided down from 95 to 92 to 94 basis points, with margin impact visible already in this year’s numbers.

- Despite scale advantages from expansion into Latin America and Europe, margin compression remains a core challenge as product mix shifts toward lower-fee strategies.

- To see how analysts weigh margin risks versus growth drivers in detail, review the full consensus perspective on Patria Investments' outlook. 📊 Read the full Patria Investments Consensus Narrative.

Share Count on the Rise, Dilution Risk Ahead

- Patria's outstanding shares are forecast to increase by nearly 4% per year over the next three years, setting up potential dilution for existing investors.

- The analysts' consensus narrative suggests that strategic expansion in Latin America and into new funds will likely require ongoing capital raises. This boosts fundraising capacity but can cap per-share earnings growth.

- Growth in shares outstanding could outpace earnings improvement, especially as analysts expect total earnings to decline to $51.6 million from $84.2 million by 2028.

- Consensus also flags that fund launches and cross-border deals raise operational complexity, making efficient capital deployment crucial for supporting returns amid dilution.

Trading at a Steep Premium: 28.8x P/E vs. Peers

- With a Price-to-Earnings ratio of 28.8x, Patria shares command a notable premium over both industry (23.7x) and direct peer (15.2x) averages. The $15.2 share price stands well above DCF fair value of $10.90.

- The analysts' consensus view highlights that while analysts set a price target of $16.29, implying only 7% upside from current levels, this valuation factors in high expectations for resilient revenue and successful diversification, despite forecast declines in both profit margins and net income.

- Consensus argues that to justify today’s valuation, Patria would need to trade at an astonishing 71.2x P/E on forecast 2028 earnings, nearly triple today's sector average.

- Premium multiples reflect optimism around alternative asset flows but leave little margin for error if growth or margins disappoint.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Patria Investments on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these numbers tell a different story? Take a moment to shape your viewpoint and share your narrative in just a few minutes. Do it your way

A great starting point for your Patria Investments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Patria Investments faces shrinking profit margins, dilution risk, and a valuation premium. This allows little room for error if earnings or growth falter.

If you want to avoid overpaying for lofty expectations, consider these 836 undervalued stocks based on cash flows to focus on companies trading more sensibly relative to fair value and financial outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAX

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives