- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

How Investors Are Reacting To Northern Trust (NTRS) Securing Key Role in Singapore’s S$5B Equity Market Initiative

Reviewed by Sasha Jovanovic

- Avanda Investment Management recently announced that it has expanded its fund services relationship with Northern Trust to support a mandate from the Monetary Authority of Singapore as part of the Equity Market Development Programme, a S$5 billion (approximately US$3.8 billion) initiative aimed at strengthening Singapore’s asset management ecosystem.

- This development highlights Northern Trust’s growing role in supporting international asset managers with advanced operations outsourcing, risk analytics, and administration services in Asia’s evolving capital markets.

- We'll examine how this expanded involvement in Singapore’s equity market development could influence Northern Trust's global growth story.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Northern Trust Investment Narrative Recap

For shareholders, the core belief in Northern Trust centers on its ability to grow by serving complex global institutions and investing in technology-driven operational efficiencies. The recent expansion in Singapore underscores its international reach, but does not materially change the biggest short-term catalyst, whether expense management can offset ongoing industry fee pressure, or the main risk of competition in high-value markets dampening fee growth and margins.

Of the recent announcements, the expanded fund services mandate for Avanda under Singapore’s Equity Market Development Programme is most relevant. This move strengthens Northern Trust’s presence in Asia, linking its outsourcing and analytics business directly to global market opportunities, though the immediate impact on earnings or margin improvement is limited, given ongoing cost pressures and slow revenue growth forecasts.

However, investors should be aware that despite these global wins, increasing competition in core markets creates a risk that...

Read the full narrative on Northern Trust (it's free!)

Northern Trust's narrative projects $8.2 billion revenue and $1.4 billion earnings by 2028. This requires a 1.6% yearly decline in revenue and a decrease in earnings of $0.7 billion from $2.1 billion currently.

Uncover how Northern Trust's forecasts yield a $134.86 fair value, a 5% upside to its current price.

Exploring Other Perspectives

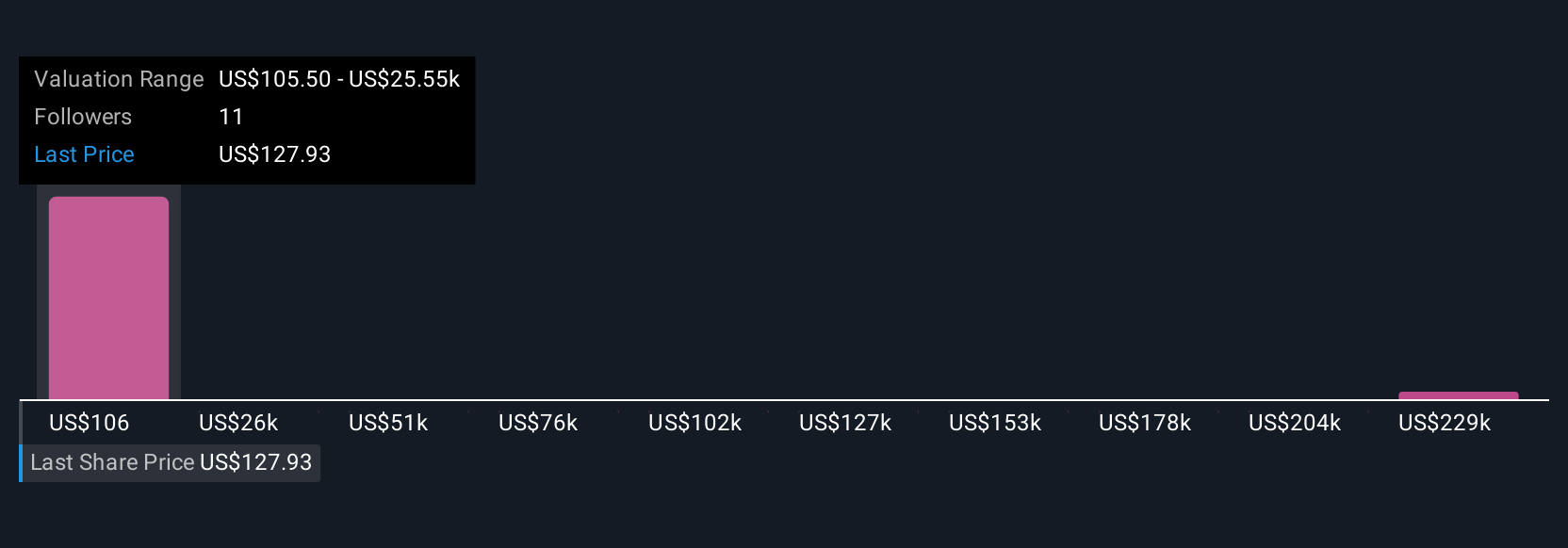

Fair value estimates from 4 Simply Wall St Community members range widely, from US$114 to an outlier at US$254,541 per share. While many are optimistic, remember industry fee pressure and technology investment demands could limit near-term performance, so consider several alternative viewpoints before making decisions.

Explore 4 other fair value estimates on Northern Trust - why the stock might be a potential multi-bagger!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives