- United States

- /

- Diversified Financial

- /

- NasdaqGM:NMIH

Is Record Insurance Growth and Surging Revenue Shifting the Investment Narrative for NMI Holdings (NMIH)?

Reviewed by Sasha Jovanovic

- NMI Holdings, Inc. reported higher-than-expected third-quarter 2025 revenue of US$178.68 million and net income of US$96 million, reflecting strong portfolio growth and disciplined expense management.

- An interesting insight from the results is the company’s expansion of its insured portfolio to a record US$218.4 billion, demonstrating resilience amid increased claims expenses and ongoing macroeconomic challenges.

- We’ll assess how the robust revenue growth and record insurance-in-force shape the outlook for NMI Holdings’ long-term investment case.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

NMI Holdings Investment Narrative Recap

For investors considering NMI Holdings, the core belief is that disciplined growth in the company’s insured portfolio, together with careful expense management and risk controls, will enable the business to withstand housing market cycles and macroeconomic challenges. The recent earnings report, which delivered higher-than-expected revenue and robust net income, reinforces the ongoing catalyst of top-line growth from new insurance written, while highlighting the immediate risk of rising claims expenses as the macro environment evolves. At present, the impact of the latest results appears to support the positive catalysts for the stock more than it materially alters the existing risk profile.

Among recent company developments, NMI Holdings’ continued share buyback activity stands out. The buyback program, now expanded with a new US$250 million authorization through 2027, signals management’s confidence in the company's underlying value, which may further enhance return on equity and support earnings per share growth, a factor directly aligned with the earnings momentum highlighted in the latest quarter.

Yet, amid these positives, investors should not overlook the potential for increased claims volatility if localized housing downturns begin to affect some of NMI’s key…

Read the full narrative on NMI Holdings (it's free!)

NMI Holdings' narrative projects $812.2 million revenue and $410.6 million earnings by 2028. This requires 6.1% yearly revenue growth and a $32.9 million earnings increase from $377.7 million today.

Uncover how NMI Holdings' forecasts yield a $44.14 fair value, a 20% upside to its current price.

Exploring Other Perspectives

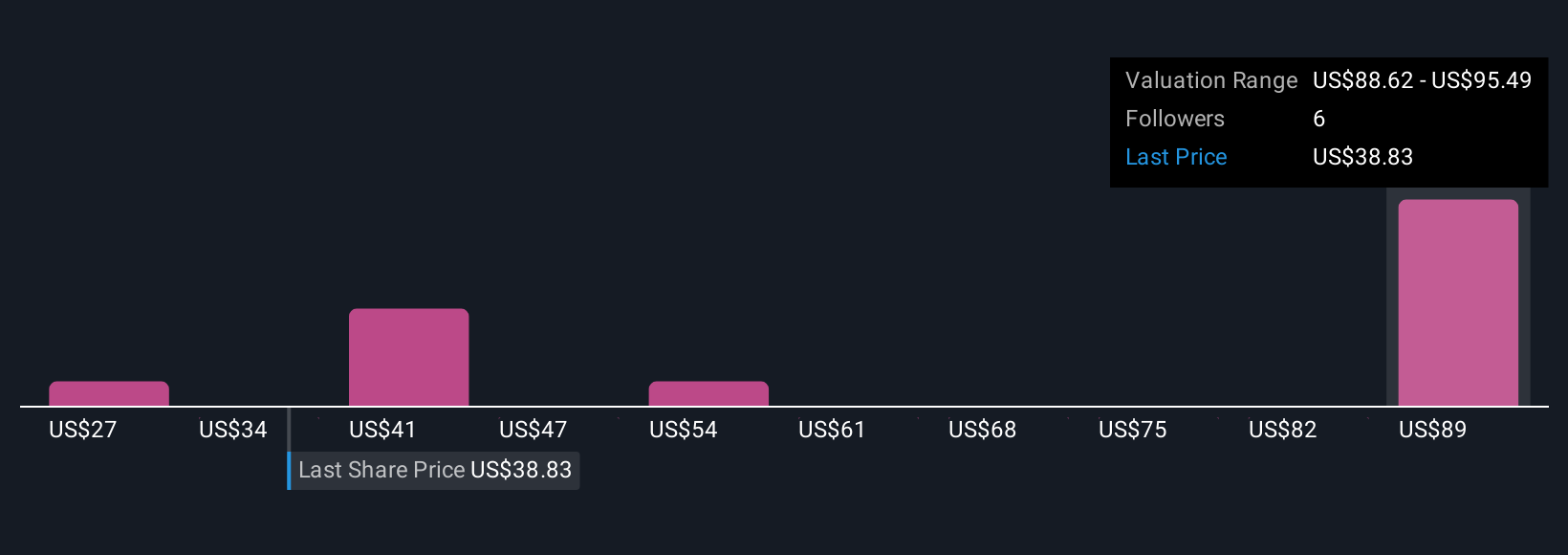

Simply Wall St Community members provided four unique fair value estimates for NMI Holdings, ranging from US$26.80 to US$97.85 per share. While opinions differ widely, recent top-line momentum and ongoing buyback initiatives may have broader implications for long-term business performance, so consider exploring several viewpoints.

Explore 4 other fair value estimates on NMI Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own NMI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NMI Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NMI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NMI Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NMI Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NMIH

NMI Holdings

Provides private mortgage guaranty insurance services in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives