- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ) Valuation: Is There More Upside After Recent Steady Gains?

Reviewed by Simply Wall St

See our latest analysis for Nasdaq.

Nasdaq’s share price has edged higher so far this year, now sitting at $87.66. This reflects a steady 13.2% year-to-date share price return. Even with some modest dips recently, long-term performance remains robust, with a 36% three-year total shareholder return and 122% over five years. This shows the stock still has staying power for those focused on growth.

If you’re curious where momentum could build next, consider broadening your search and discover fast growing stocks with high insider ownership.

With Nasdaq’s current share price below analyst targets and its strong multi-year returns, the key question is whether the market is undervaluing its future prospects or if all potential gains are already reflected in the price.

Most Popular Narrative: 14.4% Undervalued

With Nasdaq’s fair value pegged at $102.35 in the most popular narrative, and the last close at $87.66, the current price leaves apparent upside for investors. The narrative rests on ongoing transformation efforts and high expectations for future profitability, setting the stage for a potentially pivotal few years.

Nasdaq's strategic investments in product innovation, international market expansion, and new product launches, especially in the index business, are expected to drive sustained revenue growth. These initiatives aim to strengthen their global position and diversify revenue streams from the Nasdaq 100, supporting long-term earnings performance.

Curious what kind of financial blueprints back this valuation? Analysts are making aggressive assumptions about future profits, margins, and market reach. The catalyst for this undervaluation may surprise you. Discover the precise projections driving such high expectations and why this narrative diverges from market skepticism.

Result: Fair Value of $102.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated competition and unpredictable macroeconomic conditions could easily disrupt Nasdaq’s growth assumptions. This could put the bullish narrative at risk.

Find out about the key risks to this Nasdaq narrative.

Another View: Caution in the Multiples

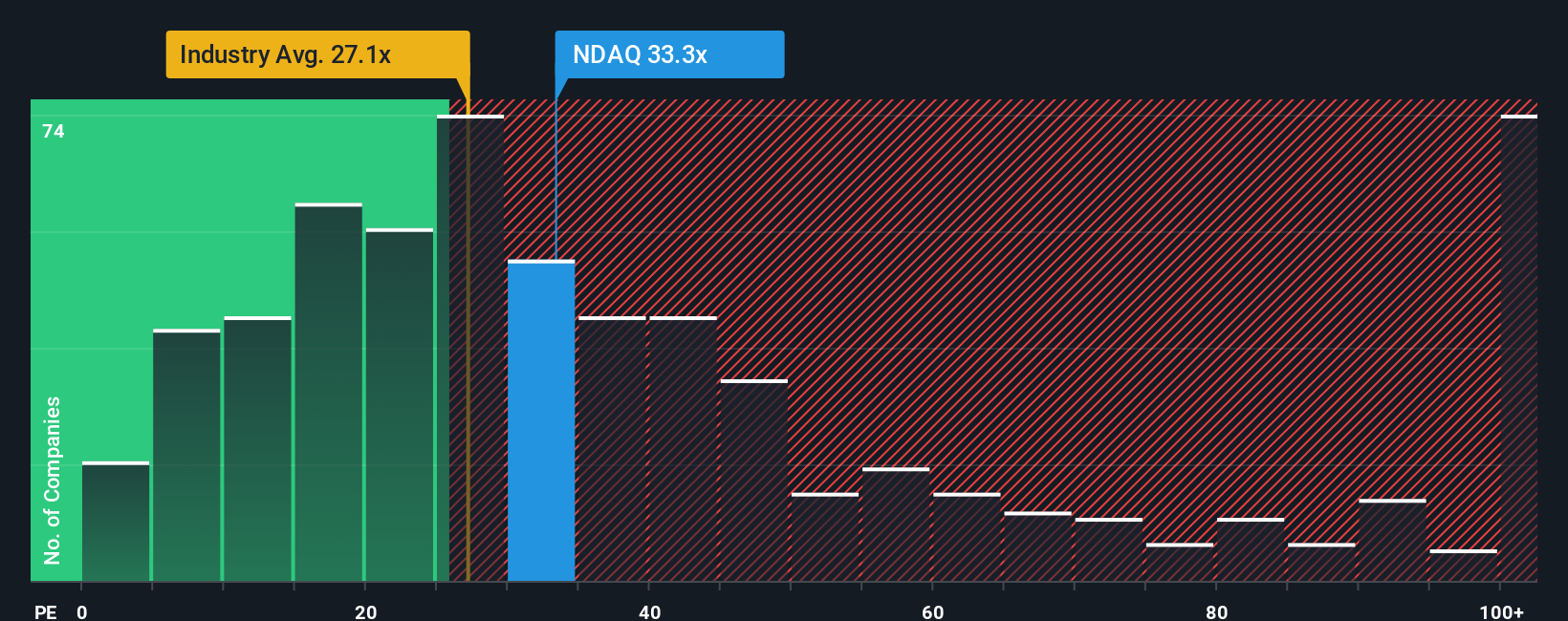

Despite optimism from the fair value model, Nasdaq currently trades at a price-to-earnings ratio of 30.8x. This is higher than its estimated fair ratio of 16x, and also above the average for the US Capital Markets industry at 23.6x. In practical terms, this means Nasdaq is priced at a premium to both its peers and historical expectations. This may affect future returns if the market shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If this perspective doesn’t match your own or you prefer diving into the numbers yourself, you can experiment and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Let your portfolio stand out by tapping into new investing trends. Don’t let great opportunities pass you by; see what you might be missing right now.

- Catch the momentum in high-yield opportunities by checking out these 16 dividend stocks with yields > 3% that consistently generate attractive income.

- Spot early-stage innovators making waves in emerging industries with these 3597 penny stocks with strong financials set for potential breakout growth.

- Fuel your portfolio with future-focused leaders by exploring these 30 healthcare AI stocks delivering breakthroughs at the intersection of technology and medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives