- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

Marqeta (MQ) Valuation in Focus Following Analyst Downgrade and Partnership Concerns

Reviewed by Simply Wall St

Recent moves by top analysts have put Marqeta (MQ) in the spotlight, as the company faces fresh scrutiny over its revenue growth prospects and the implications of key customer relationships. These developments follow coverage initiations and a notable downgrade.

See our latest analysis for Marqeta.

While headlines have swirled around analyst downgrades and leadership changes, including the appointment of Sarah Barkema as Principal Accounting Officer, Marqeta’s share price has cooled recently, posting a 1-year total shareholder return of -22.56% despite an impressive 21.45% year-to-date share price rise. That contrast hints at some cautious optimism in the short term but underscores that longer-term momentum is still catching up.

If you're tracking shifts in the fintech sector, now is the perfect moment to discover fast growing stocks with high insider ownership.

With shares trading well below recent analyst targets and lingering questions about growth and partnerships, investors now face a pivotal choice: Is Marqeta undervalued following the recent cooldown, or is the market fairly pricing in future risks and rewards?

Most Popular Narrative: 27% Undervalued

With Marqeta’s fair value in the leading narrative standing significantly above Friday’s $4.53 close, current prices reflect a marked discount to what analysts think the business could be worth if expectations play out. The stage is set for a deeper look into the bullish case driving this divergence.

"Ongoing product innovation, including real-time decisioning, advanced fraud management using AI/ML, flexible and credit-enabled card credentials, and value-added services, is increasing customer retention, expanding wallet share, and enabling premium pricing. This supports margin expansion and growing gross profit."

Want to know what’s fueling Marqeta’s premium valuation? The numbers behind this fair value depend on margin expansion, big earnings targets, and a future profit multiple that attracts investor attention. Curious what bold forecasts are shaping this optimism? Find out what’s behind the valuation jump by reading the full narrative.

Result: Fair Value of $6.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Marqeta’s reliance on a few major clients and the fast-changing payments landscape could quickly alter its growth trajectory if key trends shift.

Find out about the key risks to this Marqeta narrative.

Another View: Is the Market Paying Too Much?

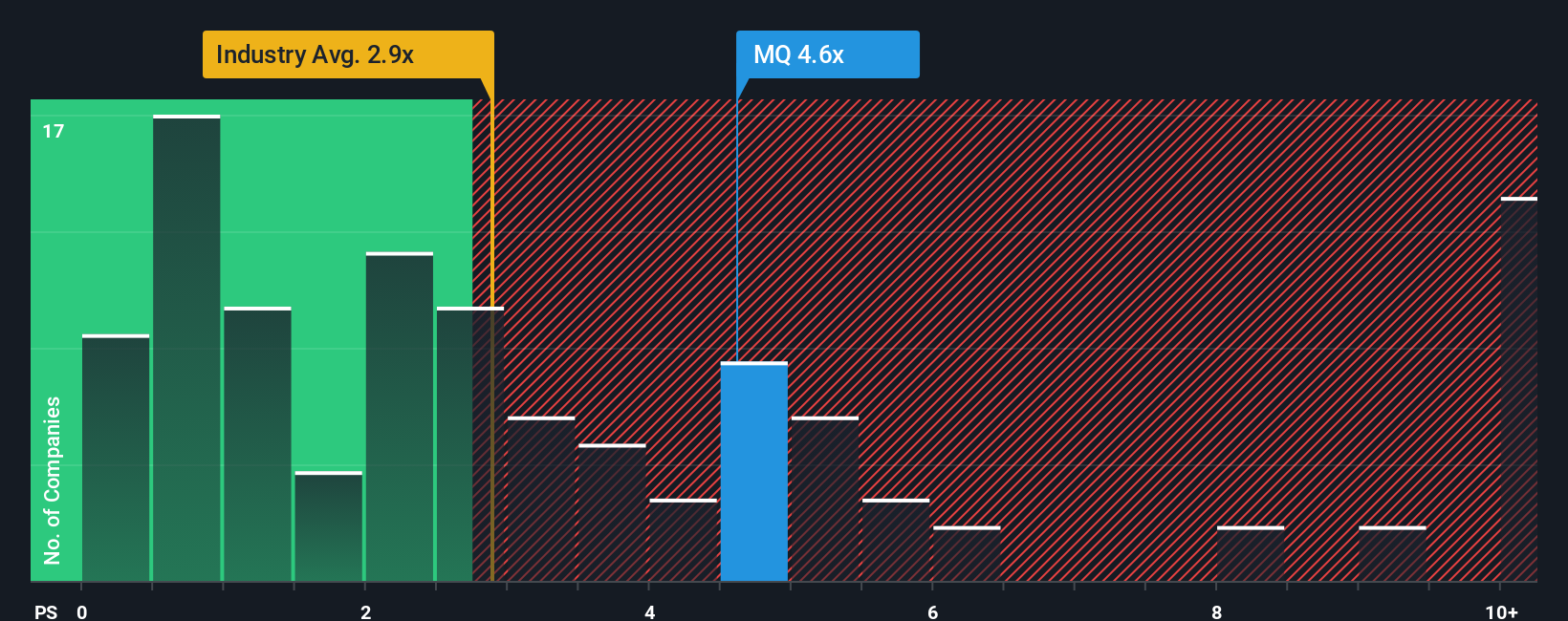

Looking beyond fair value estimates, Marqeta’s price-to-sales ratio tells a different story. At 3.7x, the company trades higher than both the US Diversified Financial industry average of 2.4x and its peers at 1.4x. It is also above its fair ratio of 2.9x. This premium hints that investors might be paying up for future growth, but is it justified if market expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you want a different angle or trust your own analysis, know that building your personal narrative from the latest data takes just a few minutes. So why not Do it your way?

A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock new opportunities and keep your investments ahead of the curve with screener-powered stock ideas curated to suit ambitious investors hungry for real results.

- Browse these 22 dividend stocks with yields > 3% offering attractive yields. This can help you grow your income and cushion your portfolio against market swings.

- Spot tomorrow’s tech leaders by reviewing these 26 AI penny stocks that are driving change with artificial intelligence breakthroughs across industries.

- Boost your contrarian edge by evaluating these 832 undervalued stocks based on cash flows, and seize undervalued gems the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives