- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

Marqeta, Inc. (NASDAQ:MQ) Investors Are Less Pessimistic Than Expected

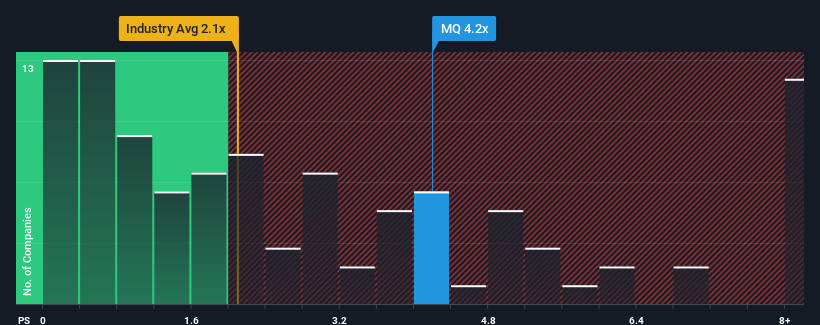

When you see that almost half of the companies in the Diversified Financial industry in the United States have price-to-sales ratios (or "P/S") below 2.1x, Marqeta, Inc. (NASDAQ:MQ) looks to be giving off strong sell signals with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Marqeta

How Has Marqeta Performed Recently?

With revenue growth that's inferior to most other companies of late, Marqeta has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Marqeta.How Is Marqeta's Revenue Growth Trending?

In order to justify its P/S ratio, Marqeta would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 8.8% gain to the company's revenues. The latest three year period has also seen an excellent 162% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 0.03% each year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 1.0% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Marqeta's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Marqeta's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Marqeta's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Marqeta, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026