- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

A Look at Marqeta (MQ) Valuation Following Strong Q3 Earnings and Analyst Estimate Beats

Reviewed by Simply Wall St

Marqeta (MQ) delivered an upbeat Q3 performance, with revenue rising 28% year on year and surpassing analysts’ expectations in both revenue and EBITDA. Shares gained nearly 7% following the earnings release.

See our latest analysis for Marqeta.

Marqeta’s breakout quarterly results have helped spark a near 27% year-to-date climb in its share price, signaling growing confidence from investors after a turbulent stretch. The company’s 23% total shareholder return over the past year suggests momentum is returning, despite some volatility in longer-term performance.

If Marqeta’s recent bounce has you thinking about what else could be gaining speed, now is a smart time to discover fast growing stocks with high insider ownership.

With Marqeta’s shares up sharply after its strong results and trading about 30% below analyst price targets, is the market still underestimating its growth potential? Alternatively, are future gains already reflected in the current price?

Most Popular Narrative: 23.4% Undervalued

The most widely followed narrative places Marqeta’s fair value well above its $4.74 last close, pointing to a significant upside if forecasts are met. This sets up a high-expectation backdrop with bullish assumptions fueling the gap.

"Ongoing product innovation, including real-time decisioning, advanced fraud management using AI/ML, flexible and credit-enabled card credentials, and value-added services, is increasing customer retention, expanding wallet share, and enabling premium pricing. This supports margin expansion and growing gross profit."

Want to know the secret behind this bold valuation? The numbers driving the story include explosive profit projections, striking margin expansion, and a profit ratio more often seen in blue-chip disruptors. Curious what assumptions power analysts’ ambitious price target? Uncover the fine print and see which bold forecasts shape the fair value calculation.

Result: Fair Value of $6.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on top clients and intensifying competition in card issuing could quickly disrupt Marqeta’s growth story if those dynamics shift.

Find out about the key risks to this Marqeta narrative.

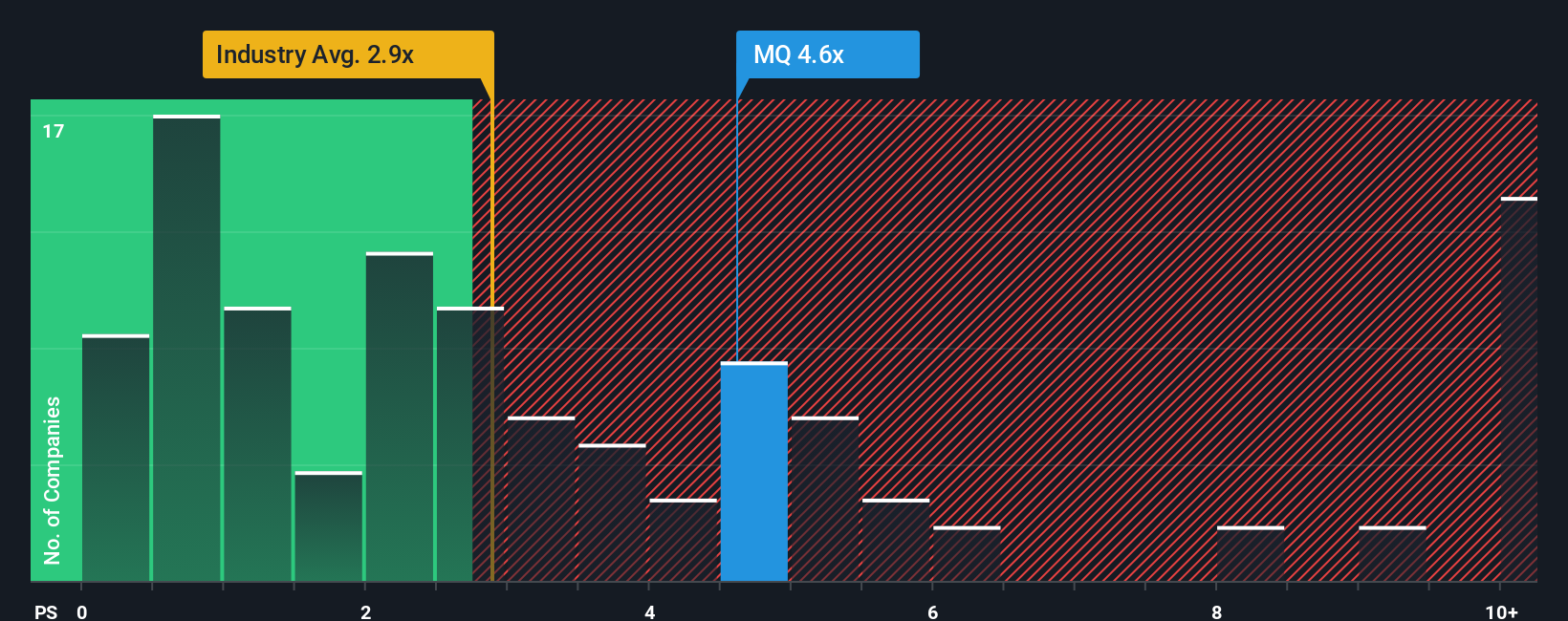

Another View: Market Multiples Tell a Different Story

While fair value models suggest Marqeta could be undervalued, market multiples send a cautionary signal. Its price-to-sales ratio stands at 3.5x, noticeably higher than both the US Diversified Financial industry average of 2.5x and peer average of 1.3x. This premium may reflect optimism, but it raises the bar for future performance and raises the question of whether investors could be paying up for growth that is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If these perspectives do not align with your views or you prefer your own research, you can dig into the numbers and build your own story in just a few minutes. Do it your way.

A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with powerful stock ideas you will not want to overlook. The right screener could help you spot tomorrow’s industry leaders and high-potential opportunities. Set yourself up for smarter investing.

- Uncover strong income opportunities by checking out these 14 dividend stocks with yields > 3% offering yields above 3%, perfect for building a steady cash flow.

- Capitalize on the artificial intelligence revolution and browse these 25 AI penny stocks set to benefit from rapid advancements and cutting-edge innovation in the AI space.

- Pinpoint hidden gems trading below their intrinsic value by jumping into these 927 undervalued stocks based on cash flows, where you can find stocks primed for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026