- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

What Does Renewed Bond Trading Competition Mean for MarketAxess Holdings’ Share Price in 2025?

Reviewed by Bailey Pemberton

- Wondering if MarketAxess Holdings is a bargain or overpriced these days? You are not alone, especially as investors rethink what “fair value” really means for fintech leaders right now.

- The stock has faced a rough patch, dropping 4.1% over the past month and a steep 28.5% so far this year. This might signal new risks or hidden opportunities worth exploring.

- Recent news coverage has highlighted renewed competition in electronic bond trading and regulatory shifts in the U.S. fixed income markets. Both factors are cited as contributing to the recent share price volatility. These stories underline how industry evolution and investor sentiment are moving in real time for MarketAxess Holdings.

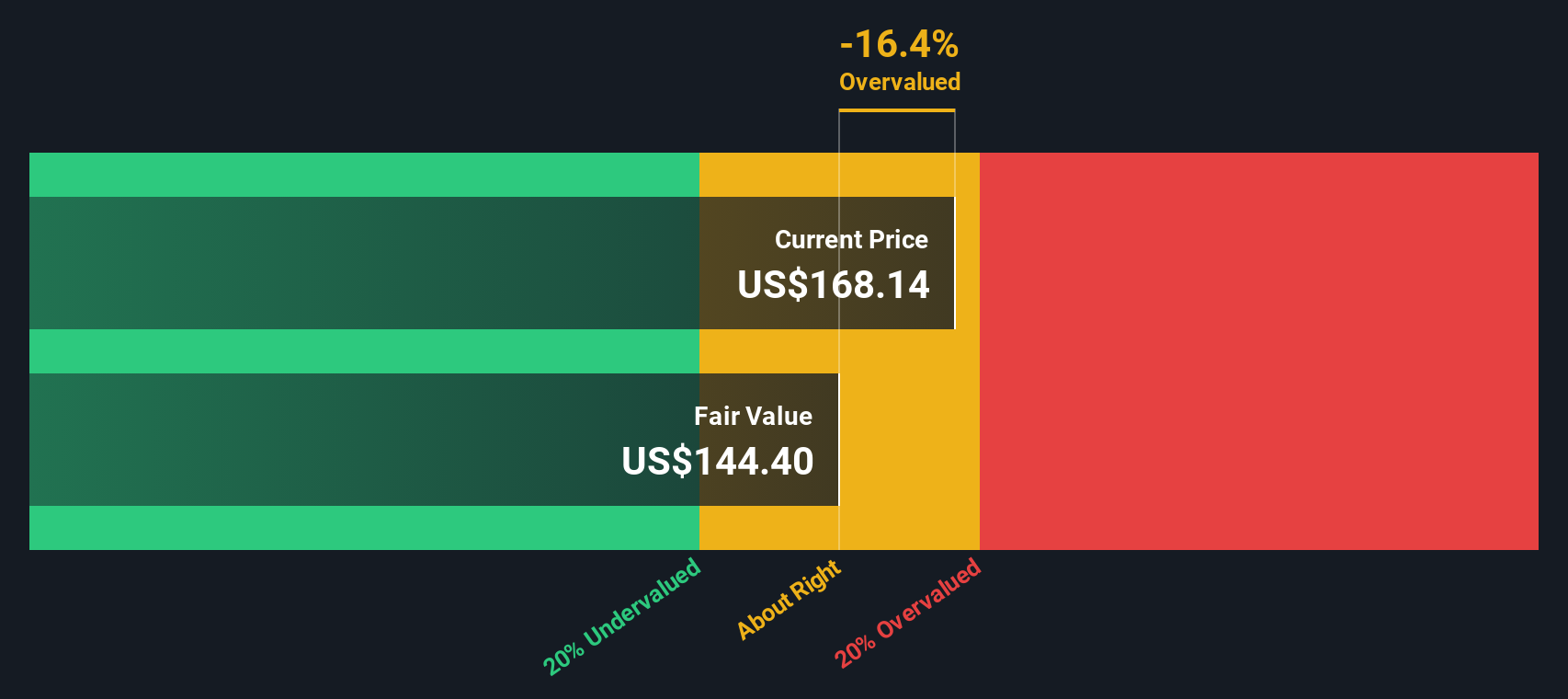

- When it comes to valuation, the company currently scores 0 out of 6 on our value checks, meaning it is considered undervalued in none of the main metrics. Let us break down these valuation approaches and stay tuned for an even smarter way to gauge fair value by the end of this article.

MarketAxess Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MarketAxess Holdings Excess Returns Analysis

The Excess Returns valuation model measures how effectively a company generates profits above the required rate of return for its shareholders. It looks specifically at MarketAxess Holdings' ability to create value from its capital, distinguishing excess profits from what the company would earn if just matching the cost of equity.

For MarketAxess Holdings, analysts estimate a stable Earnings Per Share (EPS) of $8.28, based on weighted future Return on Equity forecasts from eight industry analysts. The company’s Book Value per share stands at $37.05, with an anticipated stable Book Value of $43.20 per share in the future. MarketAxess' average Return on Equity is a robust 19.17%, far exceeding its cost of equity of $3.45 per share. The implied excess return, after accounting for this cost, is $4.83 per share, signaling that the company is still producing value for shareholders above its funding cost.

Despite these solid returns on invested capital, the Excess Returns model estimates an intrinsic value that is 13.8% below the current share price. This means the market is pricing MarketAxess Holdings above the level justified by its excess profit generation.

Result: OVERVALUED

Our Excess Returns analysis suggests MarketAxess Holdings may be overvalued by 13.8%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

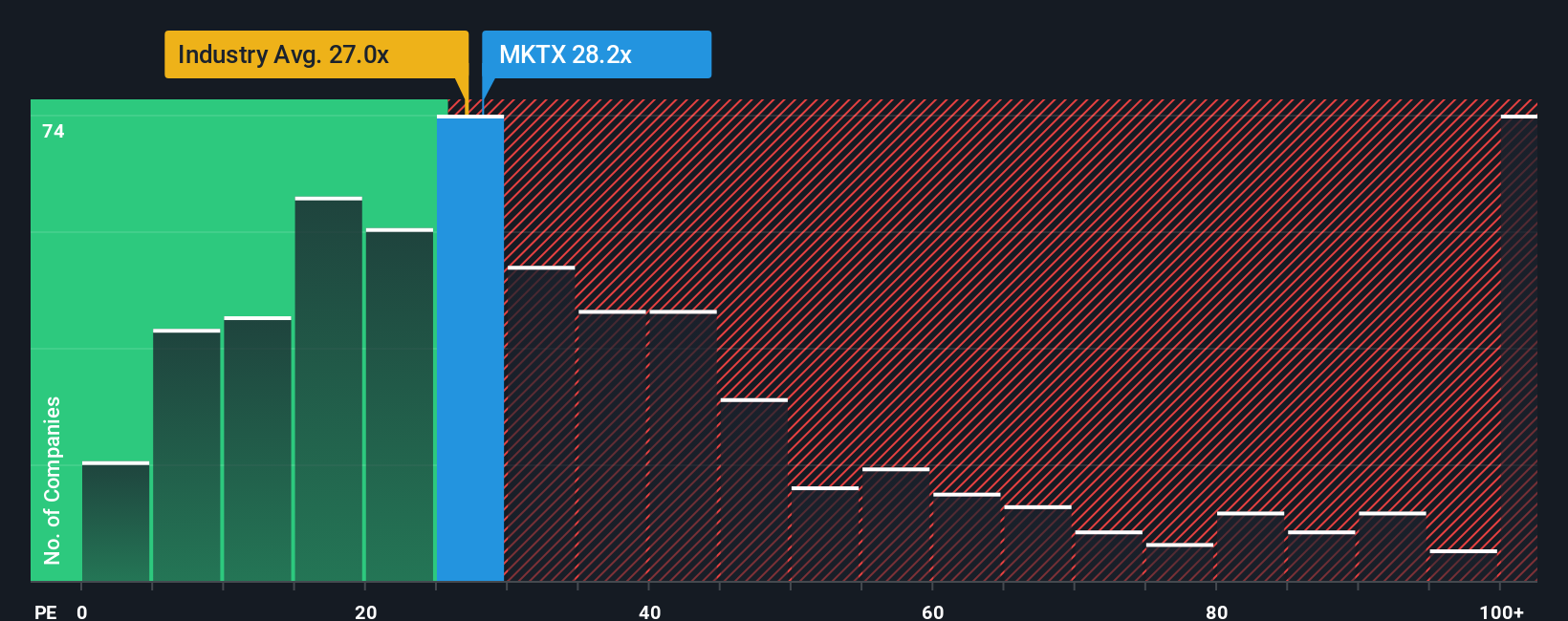

Approach 2: MarketAxess Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a trusted yardstick for evaluating profitable companies like MarketAxess Holdings because it directly compares how much investors are willing to pay for each dollar of current earnings. This makes it especially useful when earnings are stable and reflect the company's core performance.

Typically, a "normal" or "fair" PE ratio depends on expectations about future growth and potential risks. Fast-growing or lower-risk companies usually trade at higher PE ratios, while slower-growth or riskier companies are assigned lower ratios. This means that simply comparing PE ratios across companies or industries without context can give misleading impressions.

Right now, MarketAxess Holdings trades at a PE ratio of 27x. For context, this is higher than both the Capital Markets industry average of 23.8x and its close peer group average of 25.5x. However, Simply Wall St introduces the concept of a “Fair Ratio,” a proprietary figure in this case 14.6x, that goes beyond basic comparisons. The Fair Ratio models what a reasonable PE would be for MarketAxess Holdings based on its expected earnings growth, profitability, risk profile, market cap, and position within its industry.

This Fair Ratio method offers a sharper lens, since it accounts for the factors that make MarketAxess unique. By this model, the company’s current PE of 27x is well above its Fair Ratio of 14.6x, indicating the shares trade at a premium even after factoring in its distinct strengths and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MarketAxess Holdings Narrative

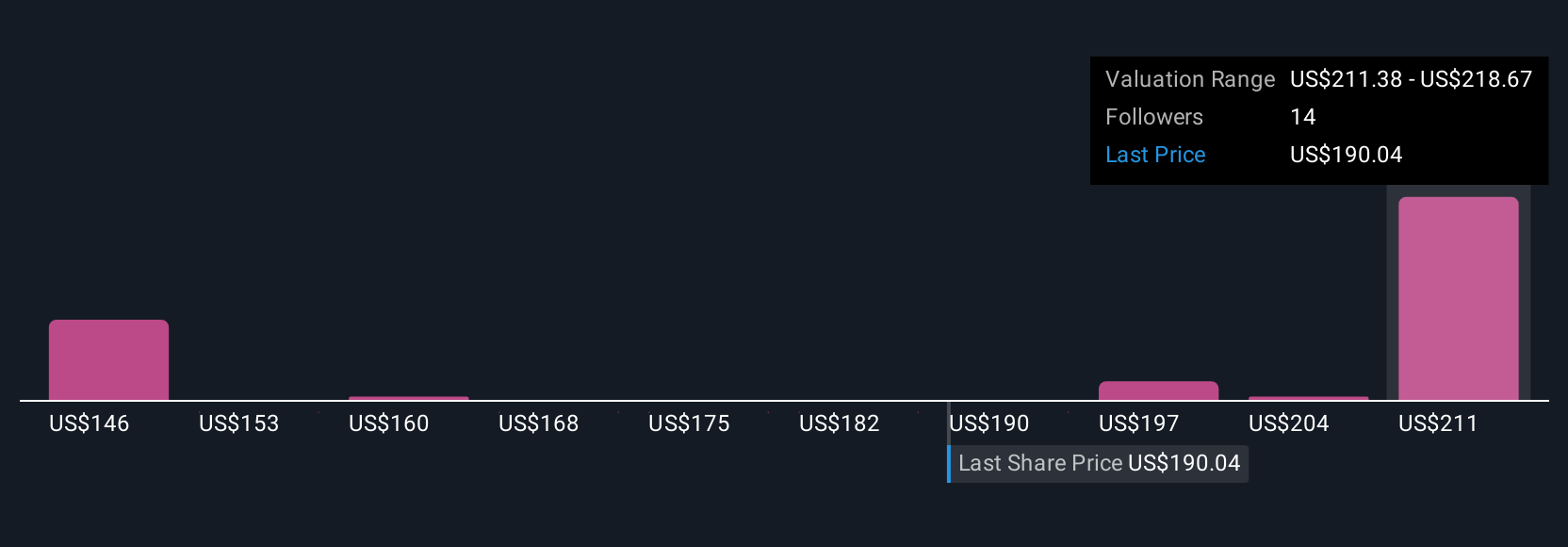

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your own story about a company, a way to connect your beliefs and perspectives on MarketAxess Holdings' future to a clear set of financial forecasts and, ultimately, a calculated fair value.

With Narratives, you step beyond historic ratios and simple models by linking your view of the company, its upcoming catalysts, industry shifts, or competitive threats, to numbers that reflect those convictions such as future revenues, earnings growth rates, and margins. Narratives are designed to be approachable and dynamic, available for free to millions of investors within the Simply Wall St Community page, making it easy for anyone to share, compare, and update their own investment story as new news or earnings emerge.

By comparing each Narrative’s updated Fair Value to the current share price, you can quickly identify whether the stock is under- or overvalued according to your (or the community’s) assumptions, helping you make better buy, hold, or sell decisions in real time. For example, one investor’s bullish Narrative for MarketAxess Holdings factors in record trading volumes and sees fair value at $274, while a more cautious view that emphasizes competition and margin pressure lands at just $164, demonstrating how flexible and personalized Narratives can be.

Do you think there's more to the story for MarketAxess Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives