- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

MarketAxess Holdings (MKTX): Assessing Valuation Following Recent Share Price Weakness

Reviewed by Simply Wall St

MarketAxess Holdings (MKTX) has been in focus lately as investors review its recent share performance and fundamentals. With the stock seeing a mix of returns this year, some are reassessing its current valuation.

See our latest analysis for MarketAxess Holdings.

MarketAxess Holdings’ share price has stumbled in recent months, with its latest price closing at $159.98 and a year-to-date share price return of -28.99%. After a challenging stretch, the 1-year total shareholder return now stands at -43.93%, highlighting that momentum has been fading for a while even as some investors eye long-term potential.

If you are looking to broaden your perspective beyond recent volatility, this could be the perfect moment to discover fast growing stocks with high insider ownership

With shares trading well below recent highs and some analysts forecasting upside, the question becomes whether MarketAxess is truly undervalued right now, or if the market has already accounted for its future earnings growth.

Most Popular Narrative: 21.1% Undervalued

Compared to the most followed narrative's fair value estimate of $202.67, MarketAxess Holdings' last close at $159.98 looks attractive to those betting on its upside potential. The numbers behind this view highlight the scale of future growth built into this consensus expectation.

The company is rapidly expanding into new geographies and asset classes, particularly through its growth in emerging markets (EM) and Eurobonds, which saw more than 20% volume growth and double-digit commission revenue increases. This suggests the addressable market is broadening and could support higher long-term revenue and earnings.

Want to know which bold revenue and margin assumptions are powering this high fair value? There is one key set of growth drivers poised to shift the narrative even further. Curious how this future blueprint stacks up against industry norms? Unlock the details; one surprising forecast could change your outlook on MarketAxess.

Result: Fair Value of $202.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market share losses and rising competition from more established rivals could quickly undermine the growth narrative for MarketAxess Holdings.

Find out about the key risks to this MarketAxess Holdings narrative.

Another View: Multiples Tell a Different Story

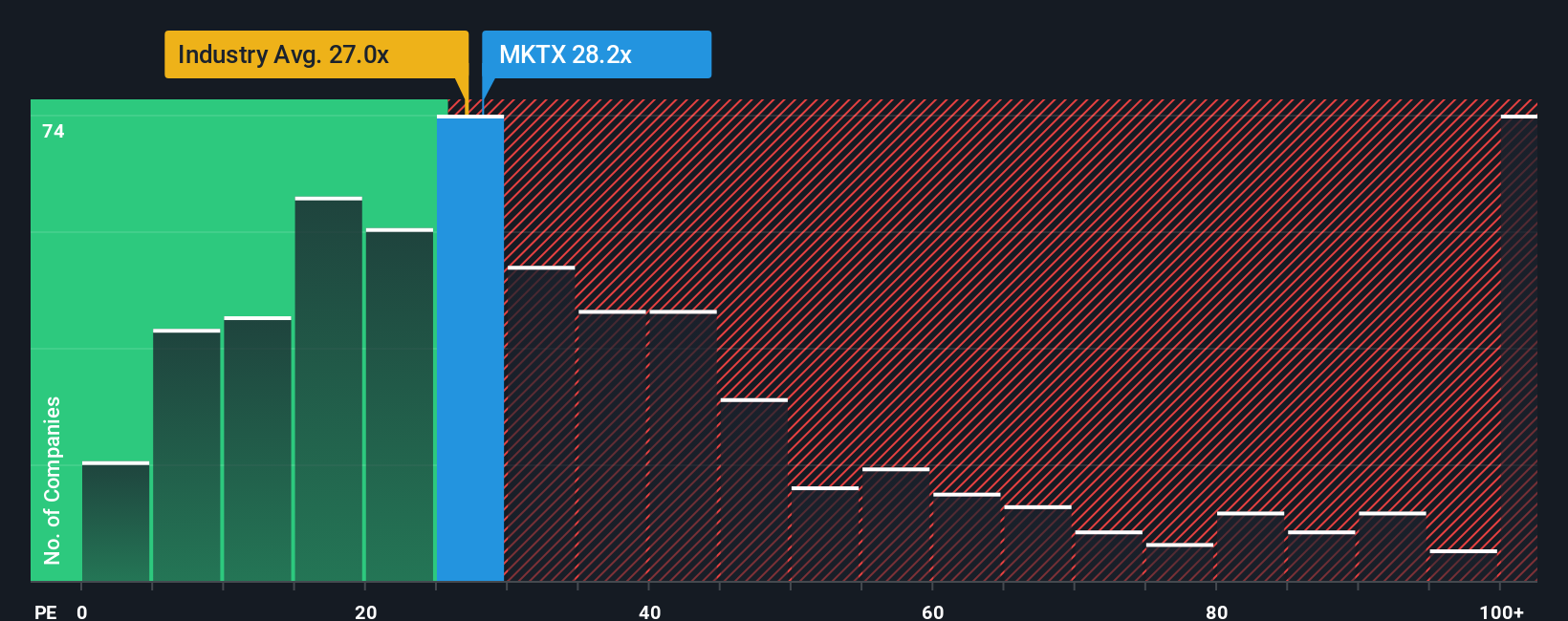

Looking beyond the narrative fair value, MarketAxess trades at a price-to-earnings ratio of 26.8x, which is higher than the US Capital Markets industry average of 25.2x and above its own fair ratio of 15.9x. This gap suggests investors may be paying a premium, introducing valuation risks if expectations are not met. Could the market be overestimating future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MarketAxess Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own story in just a few minutes. So why not Do it your way

A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investing Opportunities?

Don’t let your search for great stocks stop here. There are bold ideas waiting that could strengthen your portfolio and sharpen your edge. These smart strategies could be the difference between settling for average and capturing standout results.

- Tap into the potential for high growth with these 28 quantum computing stocks, which is set to redefine computing and unlock entirely new industries.

- Boost your passive income by checking out these 24 dividend stocks with yields > 3%, delivering attractive yields and proven payout resilience even in changing markets.

- Capitalize on the next generation of artificial intelligence by following these 26 AI penny stocks, poised for transformative impact across multiple sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives