- United States

- /

- Consumer Finance

- /

- NasdaqGS:MFIN

Medallion Financial (MFIN): Profit Margin Decline Undermines Bullish Value Narratives Despite Low P/E

Reviewed by Simply Wall St

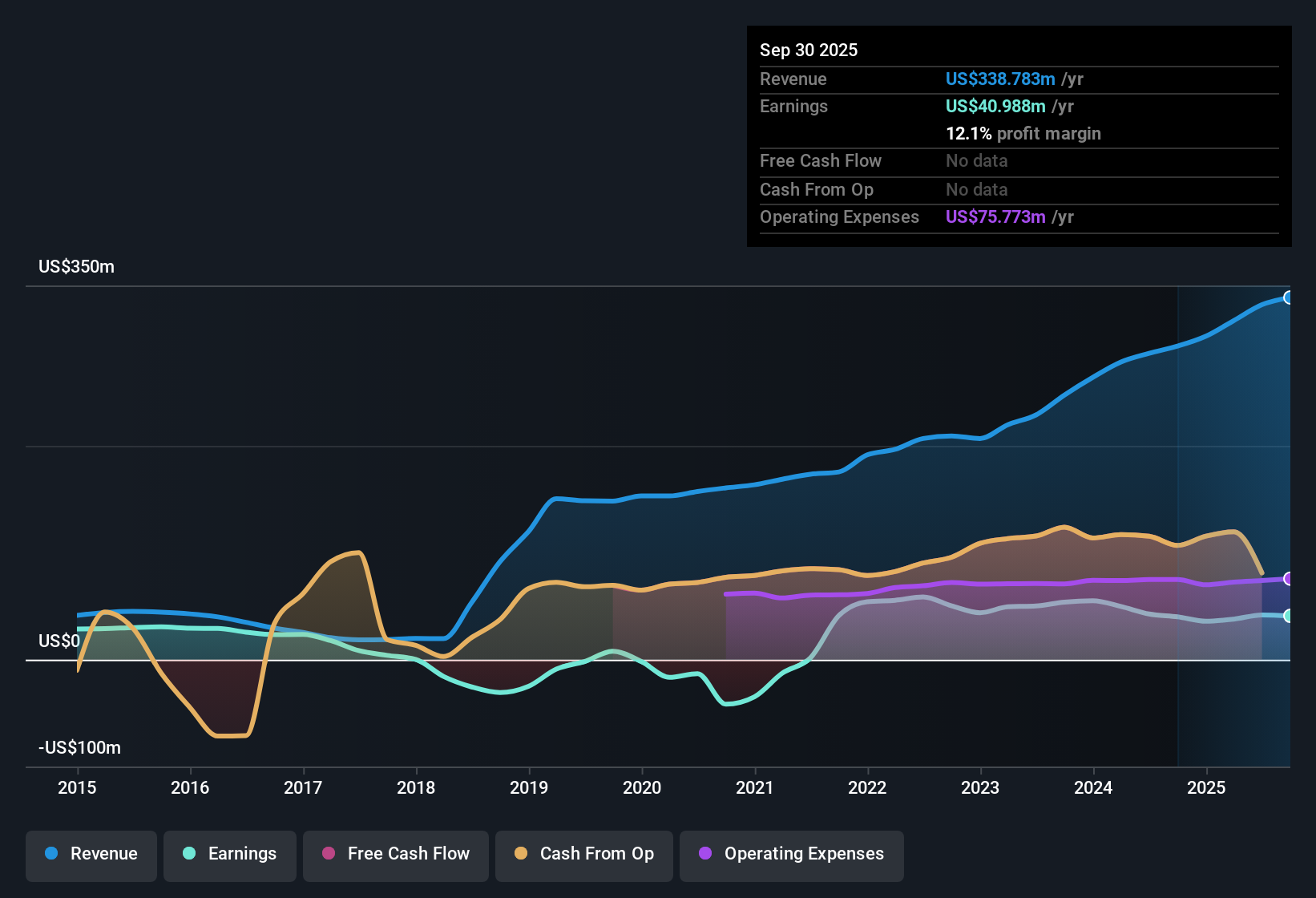

Medallion Financial (MFIN) closed the period with a net profit margin of 12.6%, down from last year's 15%, as the company reported negative earnings growth year over year. Despite this setback, over the past five years Medallion Financial has turned profitable, posting an average annual earnings growth rate of 28.3%. The stock is currently priced at $9.87, which trades well below its estimated fair value of $16.02. Its current Price-To-Earnings ratio of 5.3x stands out as notably lower than both peer and industry averages. Investors are considering whether the company’s attractive valuation and strong long-term growth can offset questions surrounding recent profitability momentum and the sustainability of its dividend.

See our full analysis for Medallion Financial.Next, we will see how these headline numbers stack up against the prevailing narratives in the community and which stories hold up under the latest results.

See what the community is saying about Medallion Financial

Margins Recover Expected in Analyst Models

- Analysts project that profit margins, currently at 12.6%, will rise to 22.3% over the next three years even as revenues are forecast to decline by 29.5% annually.

- The consensus narrative suggests Medallion’s investment in underwriting and servicing technology should help push margins upward, but there is tension here given slowing loan originations.

- While strategic fintech partnerships and digital expansion are expected to drive efficiency and higher margins, analysts acknowledge that shrinking top-line revenue tests the durability of profit improvement.

- Consensus notes continued focus on higher-quality borrowers and niche lending segments may offset some of the credit risk and support the push for better margins, but it hinges on borrower quality holding up.

- What is striking is that margin expansion is expected despite tougher competitive and regulatory conditions. This is a critical watchpoint for investors who rely on efficiency gains in the face of top-line pressure.

- Bulls and bears alike will want to see if margin gains can truly offset revenue declines or whether the core profitability story falters under industry headwinds.

- If the margin expansion materializes, it would heavily reinforce the bullish view of Medallion’s strategic pivot. Failure to achieve these gains would pressure consensus targets and re-frame the risk/reward profile.

- If the latest earnings results continue the trend of margin expansion, it could challenge skeptics and offer support to the consensus optimism around technology investments and operational strategy.

- For now, the consensus path for margin recovery is promising but requires close monitoring over the next several quarters.

- The market’s focus is squarely on whether Medallion’s operational changes deliver sustained profitability improvements as anticipated.

- Investors should watch upcoming reports for early confirmation of margin recovery and signs that costs remain contained.

- See how analysts think financial technology is shaping Medallion’s next chapter. Get the full consensus narrative and check how the margin story stacks up against historical averages. 📊 Read the full Medallion Financial Consensus Narrative.

Loan Book Quality Under the Microscope

- Credit loss allowances in recreational loans rose from 4.35% to 5.05% in the past year, and net charge-offs remain elevated at 3.25% of average portfolio value.

- Analysts’ consensus points to a balance between improved underwriting and heightened credit risks driven by rapid expansion into digital lending segments.

- On one hand, improved borrower quality and niche market focus are expected to reduce risk, supporting long-term sustainability.

- However, rising loss reserves and increased charge-offs flag greater credit exposure, confirming that economic shifts or weaker underwriting can still pressure returns.

Valuation Still Attractive Versus Peers and Targets

- Medallion trades at a 5.3x Price-To-Earnings ratio, well below the US Consumer Finance industry average of 10.1x and its direct peer average of 21.8x. Its share price of $9.87 is also under both the DCF fair value ($16.02) and the analyst price target of $12.00.

- Analysts’ consensus narrative highlights that this discount makes the stock look inexpensive if margin improvements and digital platform growth arrive as forecast, but warns that current market pricing also reflects very real concerns over profitability momentum and dividend sustainability.

- The current share price’s gap to both DCF fair value and analyst target gives value investors room for optimism, especially if Medallion meets or beats margin and risk-management targets.

- Meanwhile, cautious investors point to the need for stronger profit trends before such a valuation gap can close, making future earnings reports central to the investment case.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Medallion Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the figures that others might overlook? Put your insights to work and shape your own perspective in just a few minutes. Do it your way

A great starting point for your Medallion Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Medallion Financial faces pressure from shrinking revenues and credit losses, despite forecasts for margin recovery. Doubts remain about its ability to deliver consistent earnings growth.

If reliable performance is your priority, use stable growth stocks screener (2112 results) to find companies with a track record of stable revenues and profits through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MFIN

Medallion Financial

Operates as a specialty finance company in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives