- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

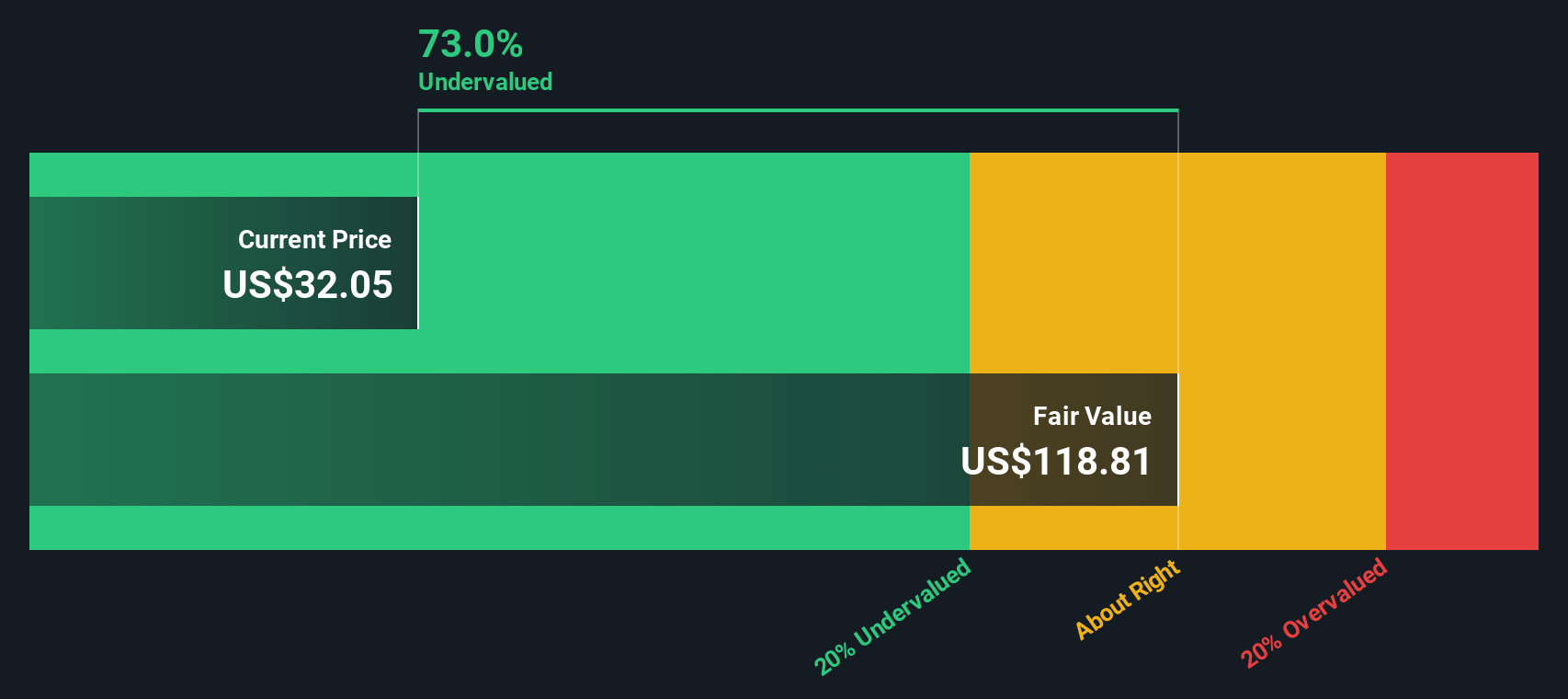

A Fresh Look at Merchants Bancorp (MBIN) Valuation Following Fed Rate Cut Optimism

Reviewed by Simply Wall St

Merchants Bancorp (MBIN) shares climbed 3.9% after remarks from a Federal Reserve official boosted expectations for lower interest rates. For regional banks, a drop in borrowing costs can have a significant impact on profits and drive activity.

See our latest analysis for Merchants Bancorp.

Merchants Bancorp’s share price saw a quick boost on the prospect of lower interest rates, but momentum has been hard to maintain this year. While healthy dividends and a solid track record have supported confidence, the 1-year total shareholder return is down 23.5%. This contrasts with a more robust 30.6% total return over three years, which suggests the market is reassessing growth prospects even as banks gear up for an interest rate shift.

If you’re on the hunt for what’s next after this rate-driven rally, now’s a smart time to branch out and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and strong dividends on offer, investors must weigh whether Merchants Bancorp remains undervalued, or if the market is already pricing in its next phase of growth.

Price-to-Earnings of 7.2x: Is it justified?

With Merchants Bancorp trading at a price-to-earnings (P/E) ratio of just 7.2x, the current share price stands well below both peer and industry averages. This establishes an undervalued narrative against recent market activity.

The price-to-earnings ratio gauges how much investors are willing to pay per dollar of earnings and offers a reliable benchmark when comparing profitability across banks and diversified financials. For a company like Merchants Bancorp, a low P/E often reflects market skepticism about future earnings potential or signals a potential bargain for long-term investors if underlying fundamentals are strong.

At 7.2x earnings, Merchants Bancorp trades significantly below the US Diversified Financial industry average of 13.2x and the broader peer group average of 11.3x. Compared to the estimated fair P/E ratio of 13.7x, this gap sets a realistic level the market could move toward as confidence returns.

Explore the SWS fair ratio for Merchants Bancorp

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, slowing revenue growth and continued negative year-to-date returns could challenge the view that Merchants Bancorp is currently undervalued.

Find out about the key risks to this Merchants Bancorp narrative.

Another View: Discounted Cash Flow Results

Looking beyond earnings multiples, our SWS DCF model values Merchants Bancorp shares at $64.28. This is more than double the current price of $31.34. This result suggests the market might be significantly undervaluing future cash flows. However, does the model capture all the risks ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Merchants Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Merchants Bancorp Narrative

If you see the data differently or want to test your own assumptions, you can build your own Merchants Bancorp story in under three minutes, and Do it your way.

A great starting point for your Merchants Bancorp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next great stock opportunity could be waiting. Don’t limit yourself to just one company. These handpicked screens can help you spot market standouts and unique trends before others catch on.

- Scoop up strong returns from companies sharing over 3% yields by checking out these 14 dividend stocks with yields > 3%, with proven financial resilience and income potential.

- Catch the surge in healthcare innovation by harnessing these 30 healthcare AI stocks, where artificial intelligence is transforming diagnosis, treatment, and patient outcomes.

- Seize opportunities in advanced computing by scanning these 26 quantum computing stocks, featuring pioneers driving quantum breakthroughs with extraordinary growth upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth