- United States

- /

- Consumer Finance

- /

- NasdaqGS:JCAP

Is Jefferson Capital (JCAP) Still Undervalued? A Fresh Look at Recent Valuation Signals

Reviewed by Simply Wall St

See our latest analysis for Jefferson Capital.

After a quiet stretch earlier this year, Jefferson Capital’s momentum appears to be picking up steam. The stock’s 7.2% share price return over the past month, combined with sustained 16% gains over three months, suggests that investors are warming up to its long-term growth story and reassessing risks in a more positive light.

If steady momentum like this has you thinking bigger, now could be the perfect moment to discover fast growing stocks with high insider ownership

But with Jefferson Capital still trading nearly 27% below analyst targets and key growth metrics sending mixed signals, the question is whether the market is overlooking real value here or if future upside has already been accounted for.

Price-to-Earnings of 6.2x: Is it justified?

Jefferson Capital trades on a price-to-earnings ratio of just 6.2x, making its valuation appear attractively low compared to sector averages and peers.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of company earnings. For financials like Jefferson Capital, it signals market expectations of future growth and profitability.

With the P/E ratio at 6.2x, which is considerably lower than both the US Consumer Finance industry average of 10x and the peer group at 11.2x, the market seems to be discounting future prospects despite the company’s double-digit earnings growth over the past year. There is no fair value P/E ratio based on regression analysis provided, but the current discount is striking compared to industry norms and could indicate the stock is being overlooked by investors.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.2x (UNDERVALUED)

However, Jefferson Capital’s recent net income decline and mixed growth metrics may challenge the case for sustained undervaluation in the future.

Find out about the key risks to this Jefferson Capital narrative.

Another View: What Does the SWS DCF Model Say?

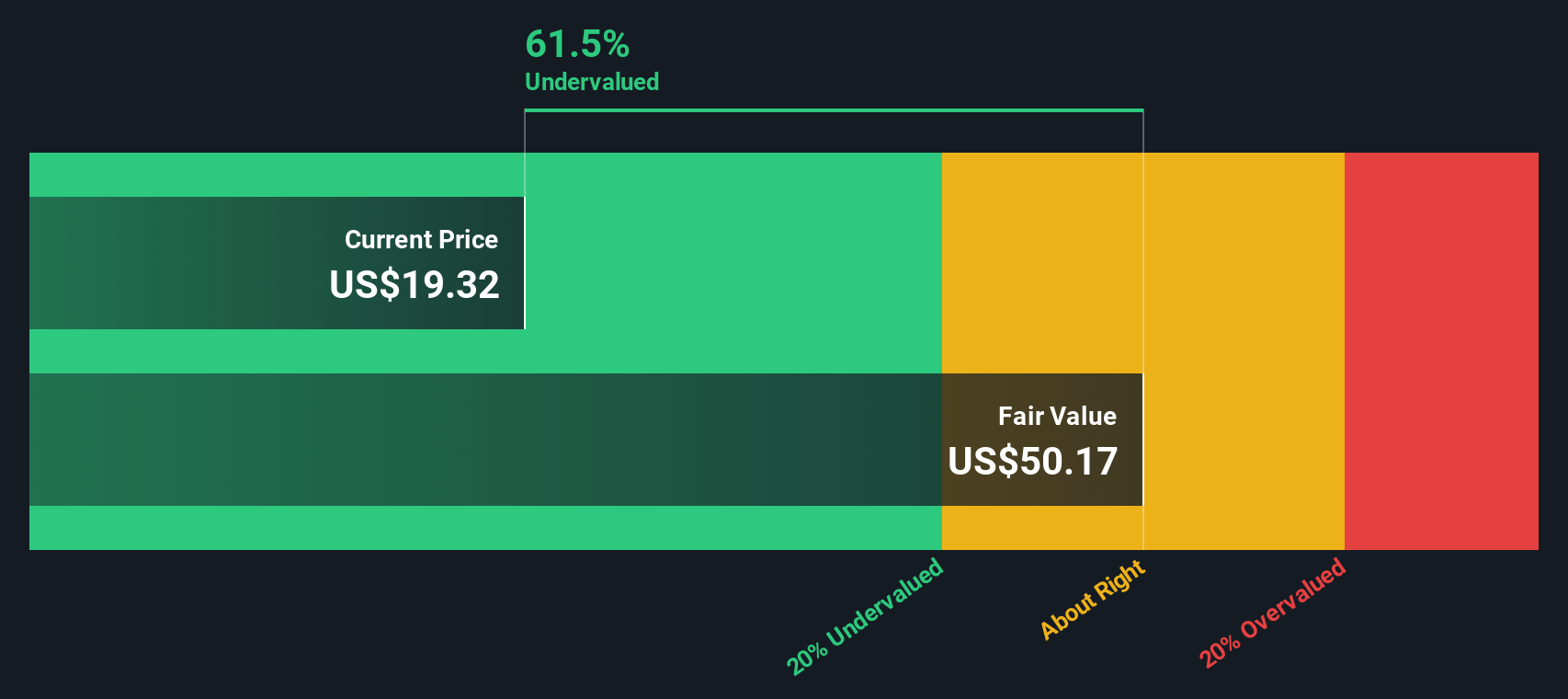

Looking at Jefferson Capital from a different angle, our DCF model suggests the shares are trading well below fair value, with the stock price nearly 60% lower than what this model estimates. This challenges the notion that the low price-to-earnings ratio tells the full story of value. Could the market be missing something substantial?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jefferson Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jefferson Capital Narrative

If you want to dig deeper or challenge these conclusions, you can explore the data and build your own story in just a few minutes. Do it your way

A great starting point for your Jefferson Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the momentum and put your money to work where it counts. Don’t let other smart investors get a head start while you wait. These opportunities could fit perfectly into your strategy.

- Capture higher yields and steady growth by tapping into these 22 dividend stocks with yields > 3% offering payouts above 3%.

- Unlock the power of next-generation technology with these 26 AI penny stocks driving AI innovation and future market leaders.

- Spot potential bargains before they take off by checking out these 831 undervalued stocks based on cash flows with strong fundamentals and attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JCAP

Jefferson Capital

Provides debt recovery solutions and other related services in the United States, the United Kingdom, Canada, and Latin America.

Undervalued with acceptable track record.

Market Insights

Community Narratives