- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

Will Hamilton Lane’s (HLNE) New Wealth Team Shape Its Competitive Edge With High-Net-Worth Clients?

Reviewed by Sasha Jovanovic

- Earlier this month, Hamilton Lane announced several high-profile hires to its North American client solutions team, including Beth Nardi as Head of U.S. Private Wealth and new Managing Directors for both institutional and private wealth outreach.

- This move underscores Hamilton Lane's intention to deepen its reach among high-net-worth and institutional clients in response to growing demand for private markets access and tailored investment solutions.

- We'll examine how the addition of Beth Nardi to lead private wealth may influence Hamilton Lane's positioning with high-net-worth investors.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hamilton Lane Investment Narrative Recap

For shareholders in Hamilton Lane, the key thesis centers on whether the firm can keep harnessing the appetite for private market investments and continue driving growth through its evergreen fund platform and expanded distribution. The recent wave of senior hires, particularly the appointment of Beth Nardi as Head of U.S. Private Wealth, reflects a clear response to growing demand among high-net-worth and institutional clients. In the near term, this news supports the primary catalyst of new asset inflows, but it does not materially offset the most pressing risk of rising compliance and operational costs as distribution widens. Among recent announcements, the partnership with Guardian Life Insurance stands out. This ten-year arrangement, where Hamilton Lane manages a US$5 billion portfolio and receives fresh annual allocations, provides substantial forward visibility into recurring fee revenue and supports the company’s ambition to scale up assets under management, echoing the opportunities presented by its new client team hires. Yet, what investors should not overlook is the increasing operational complexity and higher compliance requirements that sometimes follow such expansion, especially as...

Read the full narrative on Hamilton Lane (it's free!)

Hamilton Lane's narrative projects $1.0 billion in revenue and $426.8 million in earnings by 2028. This requires 13.2% yearly revenue growth and an earnings increase of about $214.6 million from the current $212.2 million.

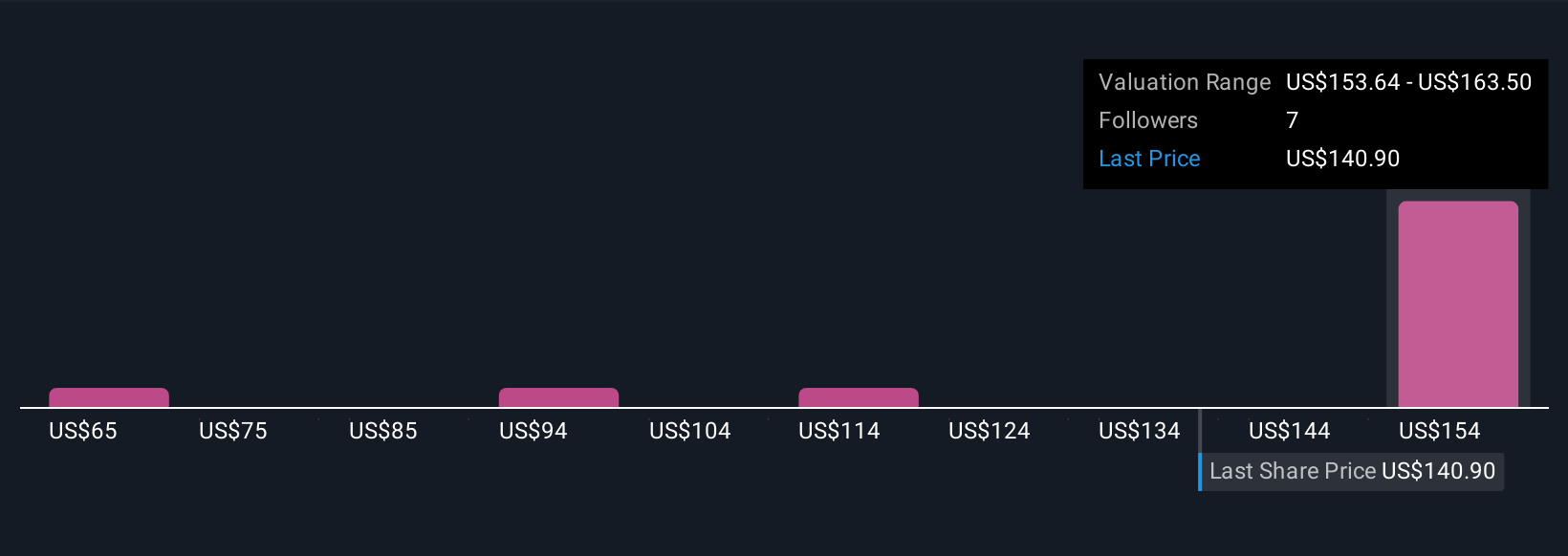

Uncover how Hamilton Lane's forecasts yield a $157.17 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span US$60.44 to US$164.82 per share, highlighting wide divergence in outlooks. While some expect Hamilton Lane to accelerate growth via new client wins and fresh fund launches, expanding distribution can also introduce considerable compliance costs, consider carefully before forming your view.

Explore 6 other fair value estimates on Hamilton Lane - why the stock might be worth as much as 35% more than the current price!

Build Your Own Hamilton Lane Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Lane research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Hamilton Lane research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Lane's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives