- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

A Fresh Look at Hamilton Lane (HLNE) Valuation as Shares Trade Below Analyst Targets

Reviewed by Simply Wall St

See our latest analysis for Hamilton Lane.

Hamilton Lane’s share price has lost momentum in recent months, reflected in a 90-day share price return of -22.89%, and the 1-year total shareholder return sits at -38.15%. While short-term sentiment has dipped, long-term holders have still seen meaningful overall gains. The three-year total shareholder return is over 70%.

If the recent moves in financials have you curious about new opportunities, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

With the shares now trading well below recent highs and at a sizable discount to analyst targets, investors are left wondering if Hamilton Lane is undervalued or if the market is already factoring in all future growth prospects.

Most Popular Narrative: 23.1% Undervalued

With the narrative's fair value set at $157.17 and the last closing price at $120.87, there is a striking disconnect between what analysts see and where the market currently trades. This gap is fueling active debate among investors about whether the market is missing something major in Hamilton Lane's long-term story.

Healthy pipeline and backlog in customized separate accounts and perpetual fundraising strategies create forward visibility into recurring revenue streams and earnings growth. The high unrealized carry balance (about $1.3 billion) also points to potential for strong incentive fee income as more favorable macro conditions enable exits and crystallization of performance fees.

Want to know how recurring revenues and hidden incentive fee potential could re-rate Hamilton Lane? This widely followed narrative relies on a few aggressive assumptions and some surprising growth forecasts that most investors never see. Ready to uncover exactly what is driving such a large gap between fair value and the current price?

Result: Fair Value of $157.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory tightening and rising competition could dampen profit margins or slow asset growth. These factors may potentially limit the upside suggested by current forecasts.

Find out about the key risks to this Hamilton Lane narrative.

Another View: What Do the Multiples Suggest?

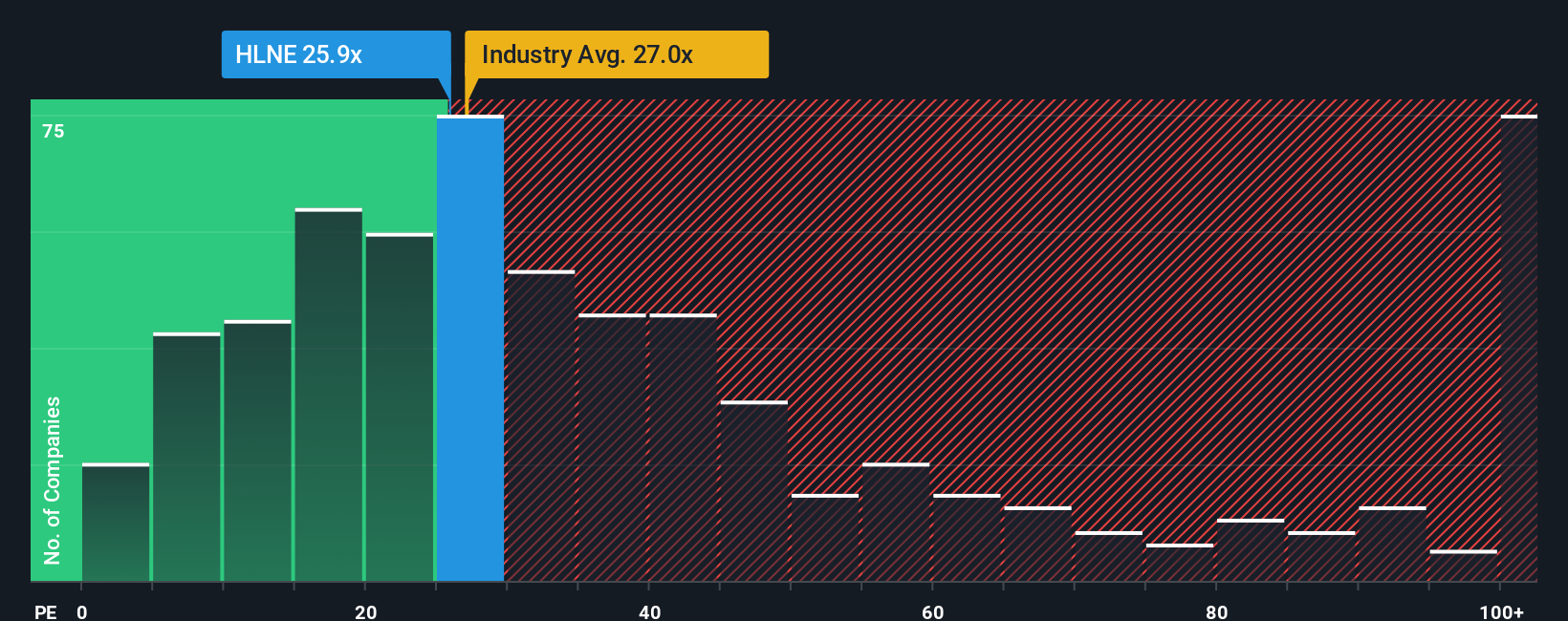

Looking at price-to-earnings ratios offers a different angle. Hamilton Lane trades at 23.3 times earnings, below the Capital Markets industry average of 23.9x but well above its close peers at just 12.2x. This relative premium presents both a potential risk if sentiment shifts and an opportunity if the company delivers. Could the market be overestimating HLNE’s strengths, or is there room to catch up to industry leaders?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hamilton Lane for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hamilton Lane Narrative

If you think the consensus narrative misses something or want to form your own perspective, you can build a customized view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hamilton Lane.

Looking for More Smart Investment Ideas?

The market moves fast and the best opportunities are easy to miss. Give yourself an edge by checking out these handpicked ideas for your watchlist:

- Capitalize on the future of digital assets when you browse these 81 cryptocurrency and blockchain stocks, which are paving the way for secure transactions and blockchain innovation.

- Boost your income strategy by targeting these 16 dividend stocks with yields > 3%, offering attractive yields and solid cash flows that can help your portfolio grow steadily.

- Get ahead in tech with these 25 AI penny stocks, which are creating the breakthroughs that will shape tomorrow’s industries and investor returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives