- United States

- /

- Capital Markets

- /

- NasdaqGS:GLXY

A Fresh Look at Galaxy Digital (NasdaqGS:GLXY) Valuation Following Recent Share Price Movement

Reviewed by Simply Wall St

See our latest analysis for Galaxy Digital.

Galaxy Digital’s share price has pulled back sharply in the past month, but it is still up 33.1% year-to-date. That said, the stock’s 1-year total return of 40.9% speaks to longer-term growth momentum, and its three-year total shareholder return of nearly 687% is tough to ignore. This serves as a reminder that although sentiment can shift quickly in the short term, long-term investors have been well rewarded by Galaxy’s performance so far.

If you’re wondering where else strong growth might be taking shape, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After significant gains and a recent pullback, the question now is whether Galaxy Digital is trading below its true worth, or if the market has already factored in the company’s future potential. Is there a buying opportunity, or is everything priced in?

Most Popular Narrative: 48.6% Undervalued

With Galaxy Digital’s fair value from the most popular narrative sitting at $46.73, almost double the last close of $24.03, market watchers are examining what drives this aggressive upside.

Expansion of proprietary trading capabilities and operational scale is allowing Galaxy to consistently outpace industry trading volume declines, while capturing outsized share from market dislocations. This suggests the potential for sustained trading revenue growth and structurally higher net margins as institutional crypto markets mature.

How can this stock’s future be so much brighter than the current share price suggests? The heart of this story is bold growth targets, accelerated by bets on explosive institutional demand, rapid revenue expansion, and a profit profile usually reserved for sector giants. Can the model really justify such a dramatic re-rating? Find out what turns this narrative into a sky-high price target.

Result: Fair Value of $46.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Galaxy’s heavy client concentration and capital-intensive data center expansion could undermine growth if market demand or financing conditions unexpectedly worsen.

Find out about the key risks to this Galaxy Digital narrative.

Another View: Market Ratios Paint a Different Picture

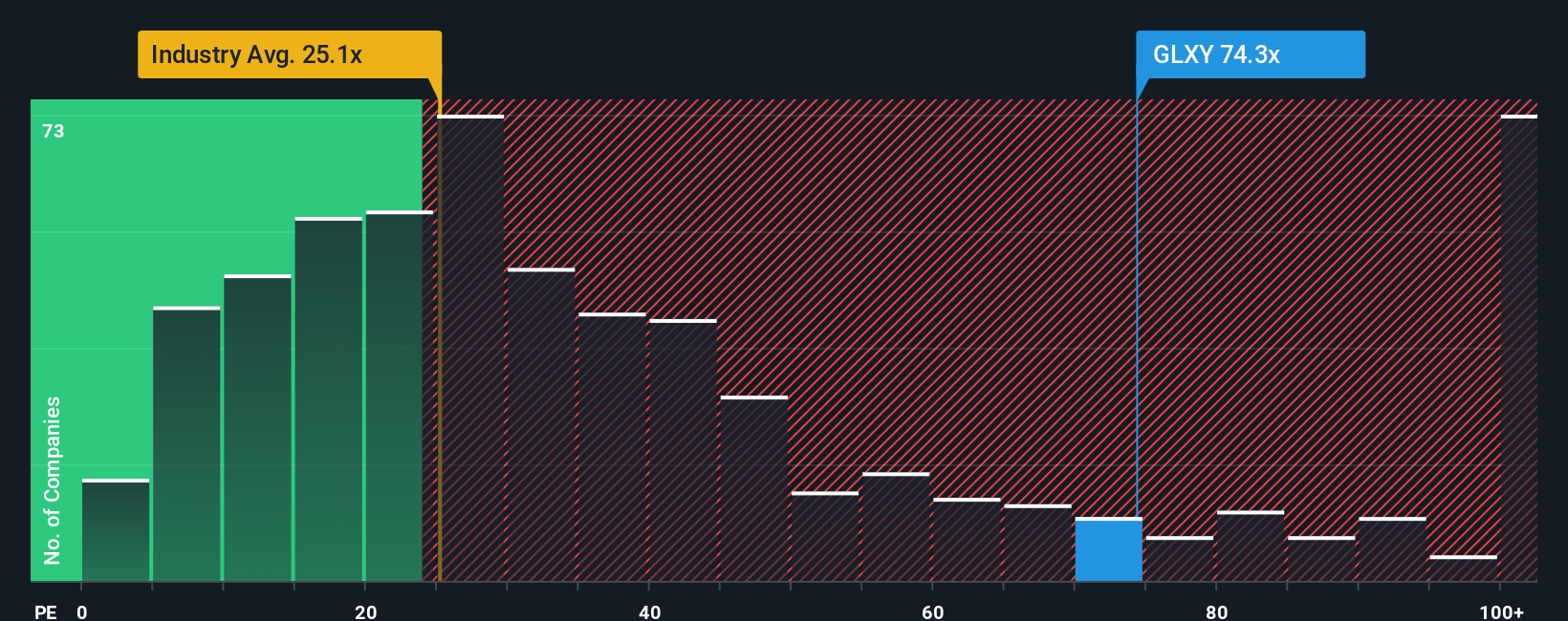

Looking through the lens of earnings ratios, Galaxy Digital's valuation appears far richer than its peers. Its price-to-earnings ratio stands at 38.8 times, which is well above the US Capital Markets industry average of 23.9 and the peer average of 18.9. The fair ratio suggests a level closer to 8.7. For investors, such a premium means there could be more downside if expectations do not play out as planned. Could these steep multiples signal caution rather than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If you feel differently about Galaxy Digital or would rather analyze the data yourself, creating a personalized narrative takes less than three minutes. Do it your way

A great starting point for your Galaxy Digital research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors move quickly when opportunities arise. Don’t let standout stocks in other market segments pass you by. Harness the power of the Simply Wall Street Screener today.

- Unlock high growth potential by targeting emerging artificial intelligence breakthroughs. Use these 26 AI penny stocks to pinpoint the innovators setting new standards.

- Start building a resilient income stream with these 16 dividend stocks with yields > 3% that consistently offer yields over 3% and stand out for their reliable cash flows.

- Step ahead of the crowd in digital finance by tapping into these 81 cryptocurrency and blockchain stocks shaping the evolving landscape of blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLXY

Galaxy Digital

Engages in the digital asset and data center infrastructure businesses.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives