- United States

- /

- Capital Markets

- /

- NasdaqGS:GEG

Why Investors Shouldn't Be Surprised By Great Elm Group, Inc.'s (NASDAQ:GEG) 44% Share Price Surge

Great Elm Group, Inc. (NASDAQ:GEG) shareholders have had their patience rewarded with a 44% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 72% in the last year.

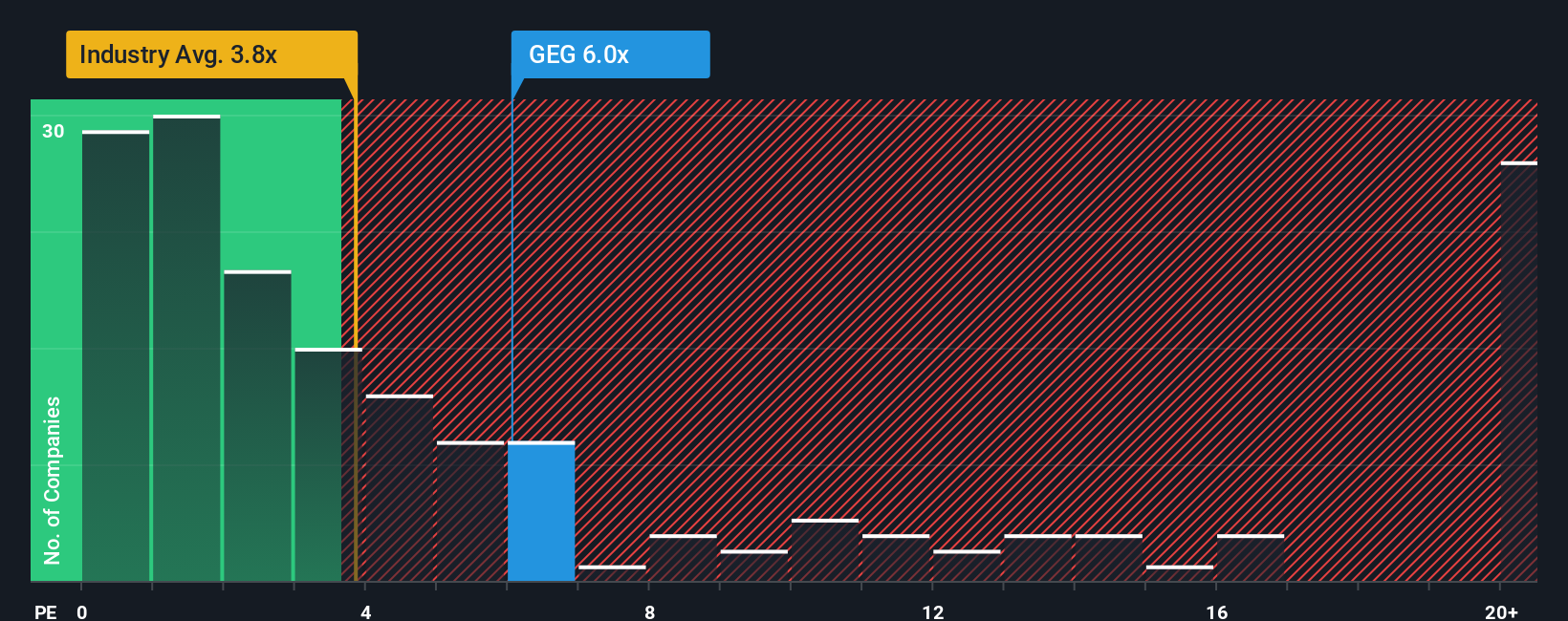

After such a large jump in price, you could be forgiven for thinking Great Elm Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6x, considering almost half the companies in the United States' Capital Markets industry have P/S ratios below 3.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Great Elm Group

What Does Great Elm Group's Recent Performance Look Like?

For example, consider that Great Elm Group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Great Elm Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Great Elm Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Great Elm Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.5%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 261% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 8.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Great Elm Group's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Great Elm Group's P/S

Shares in Great Elm Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Great Elm Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Great Elm Group that we have uncovered.

If you're unsure about the strength of Great Elm Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GEG

Great Elm Group

An asset management company, focuses on the credit, real estate, specialty finance, and other alternative strategies businesses.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives